On what happened when his tenants became a client of his brokerage, and how working with an experienced accountant was a game changer

Matt Punter

Matt Punter

Managing director, The Savings Centre in Queensland

THE SCENARIO

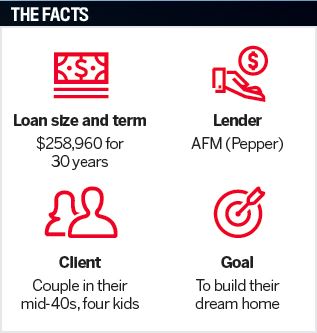

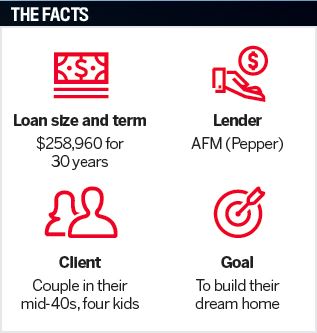

The client was a self-employed couple with four children who had recently relocated to Australia from New Zealand with the dream of building their own home. They had purchased a block of land on the Sunshine Coast at 50% LVR with funds brought across from NZ. Upon arrival in Australia, the family moved into a rental property. Unfortunately, despite a clear credit history, several banks and two mortgage brokers declined their construction loan applications.

As fate would have it, they were actually renting a property that my wife and I own, so we got to know their story and understand their struggles. We knew them to be good tenants who always paid their rent on time, and we knew that they had a strong cash position in business. It was evident to me that they were generating sufficient income to service the proposed construction loan, so I decided to help them, and I looked a little deeper into why they weren’t having any financial success.

When I began working with the couple they didn’t believe that they would ever be able to access finance, and they were even contemplating selling their land. After some initial investigation I found that their bookkeeper was quite behind with their BAS, and that their ATO returns were a bit of a mess. This made it somewhat tricky to verify income. After much discussion and some frustration, I made a recommendation that they enlist the help of an experienced accountant for some sound advice. As it turned out, this expert advice was an absolute game changer for their application.

Location: Sunshine Coast

Location: Sunshine Coast THE SOLUTION

THE SOLUTION

The accountant immediately advised our client to replace their bookkeeper, which they quickly took on board. Within two weeks of this change, their BAS was brought up to date, which demonstrated increasing revenue and substantiated surplus funds. The ATO returns were also completed, and they revealed that the business’s latest financial year was far superior to the prior period, which put them in a visibly strong financial position.

Once the paperwork was tidy and the client’s financials were clear, I contacted Rachel Walsh, a BDM at

Australian First Mortgage, to identify an appropriate lender for the proposed loan amount. I believed that the couple deserved to obtain finance, but because they were self-employed they needed some additional support to help them demonstrate that they could meet the lender’s serviceability criteria. Walsh offered us some case study examples of other similar successful applicants so that we could guide our client through the process. The lender subsequently approved their application and we were able to deliver an extremely positive outcome for all parties.

THE TAKEAWAY

This deal was a great example of how looking beneath the surface of a client’s situation can completely turn things around. Second opinions can be highly valuable, and the guidance of a good accountant was crucial to this deal. I also recognised the value of BAS statements for verifying income. This is something that I hadn’t previously harnessed but now find particularly useful as a source for businesses that are in the growth phase.

While this case wasn’t a huge moneymaker in terms of loan size, I gained the respect of the accountant, who observed my problem-solving skills and clientcaring approach and subsequently referred more than $2m worth of new business to The Savings Centre.

For me, the real reward is seeing my clients move on to the next stage in their lives. Construction is nearing completion on this client’s property and in a few months the whole family will enjoy their first Christmas in their dream home.

This has become one of my favourite ‘feel-good’ client stories, and it is the perfect example of why we, as brokers, shouldn’t be afraid of coaching our clients if there is something holding them back from reaching their personal or financial goals.

Matt Punter

Matt Punter

THE SOLUTION

THE SOLUTION