The number of mortgages originating from brokers at

ANZ has been on a steady increase since FY14, according to the bank’s yearly financial results.

The bank’s portfolio consisted of 47% broker-originated loans in FY14 – a figure which has increased by 1% every financial year since. This put the total number of mortgages secured through brokers at ANZ at 49% for FY16.

ANZ’s total loan book grew 7% from $231 billion to $246 billion from FY15 to FY16.

Breaking this down, 37% of all mortgages were interest-only, holding steady from last year. Looking at the type of loan, 62% were owner-occupied while 34% were investment loans – down from 58% and 37% respectively in FY15.

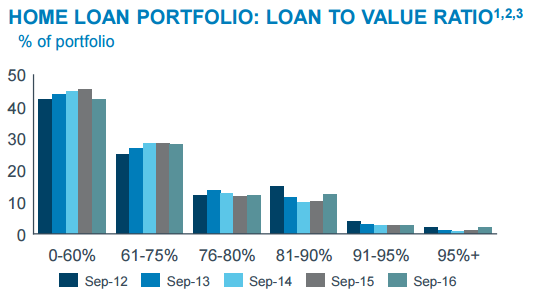

The vast majority of loans have an LVR of lower than 75%. While the average LVR at origination remained steady at 71% the average dynamic LVR increased from 50% to 52% from FY15 to FY16.

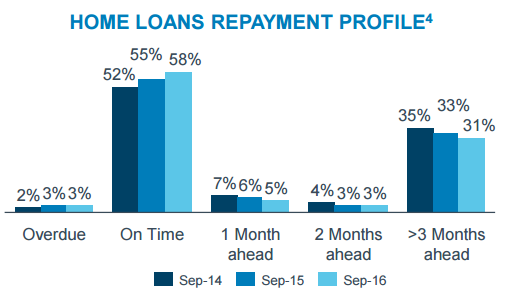

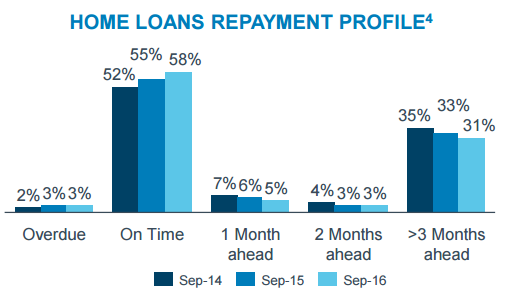

Thirty-nine per cent of borrowers were ahead of their payments, which was down from the 42% last year.

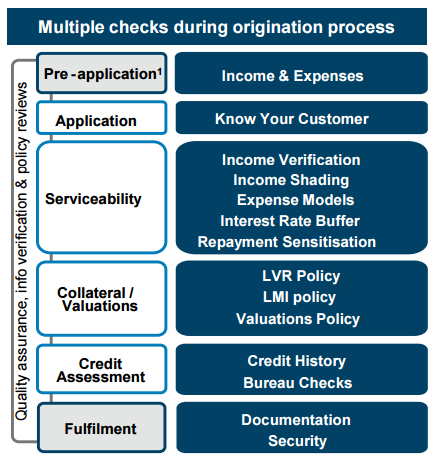

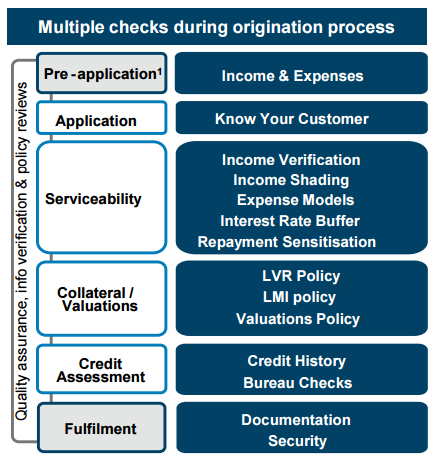

ANZ has also made changes to its lending standards, applying an interest rate floor to new and existing mortgage lending introduced at 7.25%. Additionally, the bank has brought in an income adjusted living expense floor (HEM) and a 20% haircut for overtime and commission income. There is also an increased income discount factor for residential rental income from 20% to 25%.

The bank has also reduced its LVR cap to 90% for investment loans and 70% for mortgages in high risk mining towns. The maximum interest-only term of owner occupied interest-only loans has also been decreased to five years.

Finally, the annual report also went over the individual steps in ANZ’s origination process:

Related stories:

YBR grows loan book by $39b

National Australia Bank continues to snap up brokers

Australia & NZ Banking Group CEO says banks face diminishing returns

Related stories:

YBR grows loan book by $39b

National Australia Bank continues to snap up brokers

Australia & NZ Banking Group CEO says banks face diminishing returns