The market share of new residential home loans originated by brokers and aggregators increased to 53.7% in the first quarter this year, according to a new report by the Mortgage & Finance Association of Australia (

MFAA).

This was an increase of 1.9% from the previous quarter and represented an average growth rate of 21.5% over the prior three years.

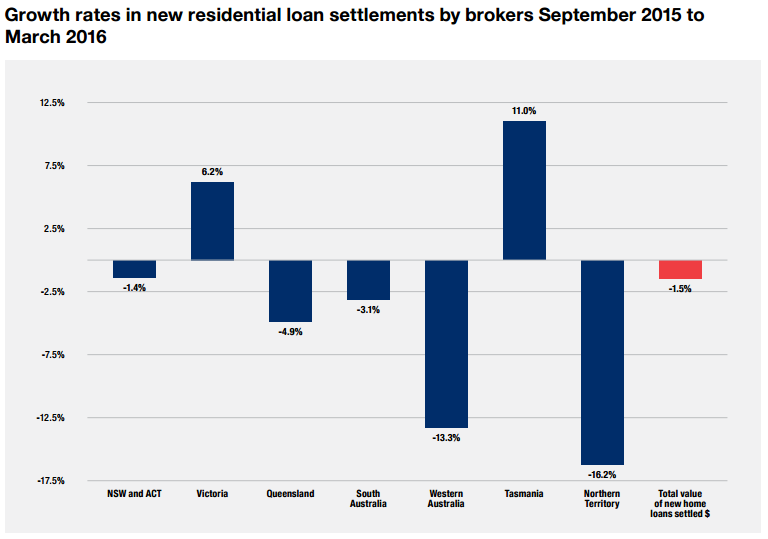

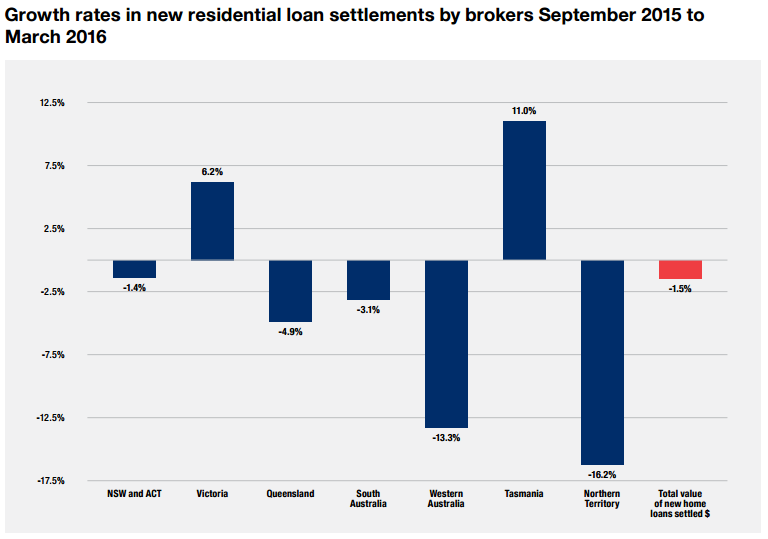

However, despite this upward trend, the total value of broker-originated loans across the country dropped by 1.5% from just over $92 billion in the six months prior to the end of March 2016 to $93.4 billion in the six months prior to the end of September.

Growth rates over the same six month time period across the different states and territories can be found below:

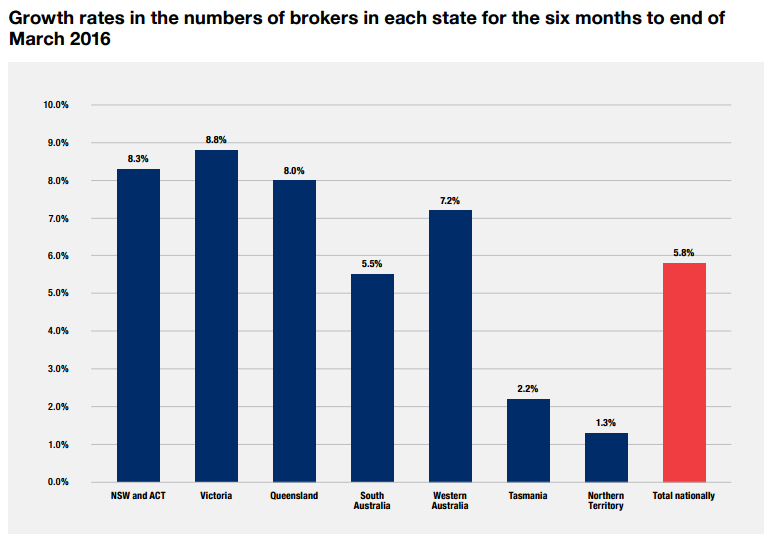

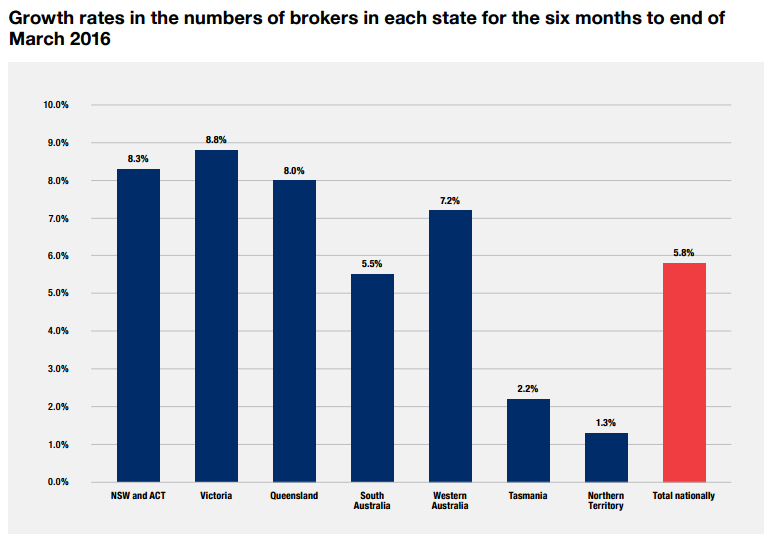

The size of the broker community also grew by 6% to 14,379 from September 2015 to March 2016. This data is based on information gained by the MFAA from Australia’s 13 biggest aggregators which cover 16 mortgage broking businesses.

With the MFAA estimating that these 13 aggregator groups make up 95% of the industry, this means there are approximately 15,000 brokers in Australia.

In the September to March period, 750 new brokers entered the industry while 1,044 left or moved between businesses.

NSW was the best state for brokers: accounting for 42% of all new lending originating from brokers despite only having 35% of the total national broker population. Victoria was in more of an equilibrium: accounting for 28% of all new lending as well as 28% of the total broker population.

More women are now entering the broker community as well, the MFAA has found. While 28% of the broker community from September 2015 to March 2016 was female, women made up 32% of new brokers recruited in the same time period.

Lastly, the MFAA split brokers up according to productivity and found that 21% settled more than $10 million worth of loans in the six months prior to March 2016. This included 4.6% of brokers who settled more than $25 million.

At the lower end of the scale, 22% settled less than $1 million worth of new loans in this same time period. The MFAA also found that 17% of brokers were ‘passive’ in that they failed to settle any loans during the stated six month period.

Related stories:

Big four market share on the decline

Broker market share underestimated: NAB

Non-bank market share surges