Overall mortgage default rates are predicted to rise over the next 12 to 18 months, according to the latest analysis by Digital Finance Analytics (DFA).

In a new blog post, founder and principal of DFA Martin North said that low wage growth, employment changes and a number of other changes would drive the number of mortgage arrears higher despite record low interest rates from the

RBA.

“Households with units in the CBD and surrounds will also be under pressure. This will likely put some downward pressure on home prices in these areas,” North said.

This echoes

statements made by credit agency Moody’s last week in which the percentage of Australian residential mortgages more than 30 days in arrears was at a three-year high.

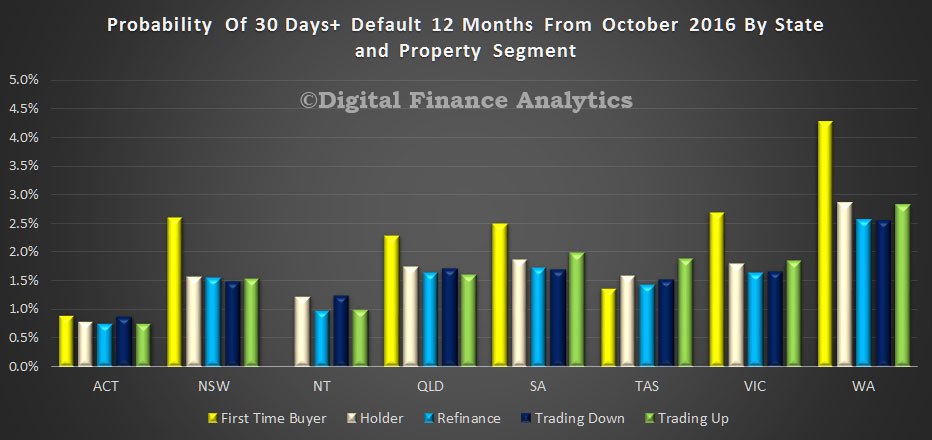

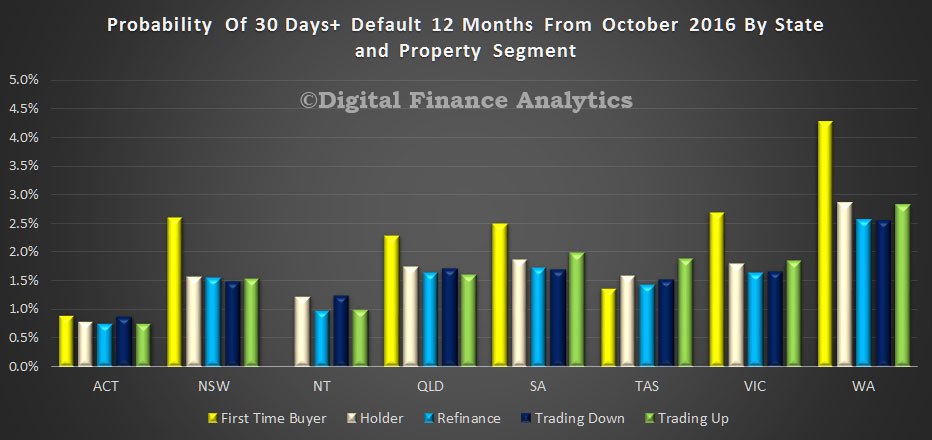

DFA modelling found that mining areas in Western Australia and Queensland will experience a significant portion of defaults while New South Wales, Victoria and the ACT will be the safest regions. Breaking the probabilities by state as below, DFA found that first time home buyers in WA will be most at risk:

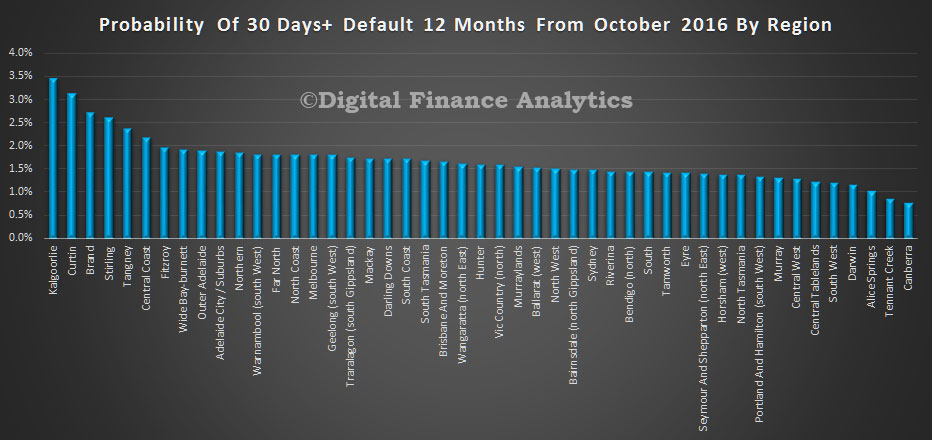

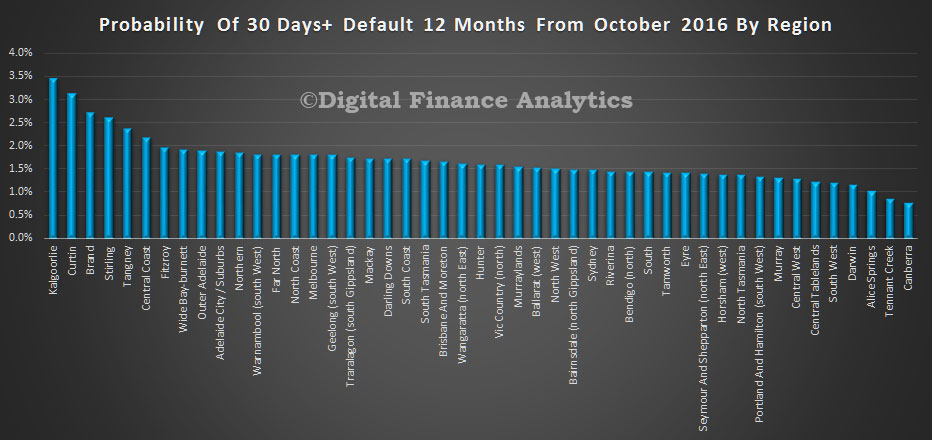

Breaking downing the risk of mortgage default by region, DFA found that Kalgoorlie, Curtin and Brand had the highest potential while Canberra, Tennant Creek and Alice Springs were relatively safe.

“We haven’t seen the same run up in house prices and we haven’t seen the same run up in debt in those areas,” North told

Australian Broker. “So a lot of people who are borrowing are borrowing more easily within their means compared with some other areas, for example the rest of WA.”

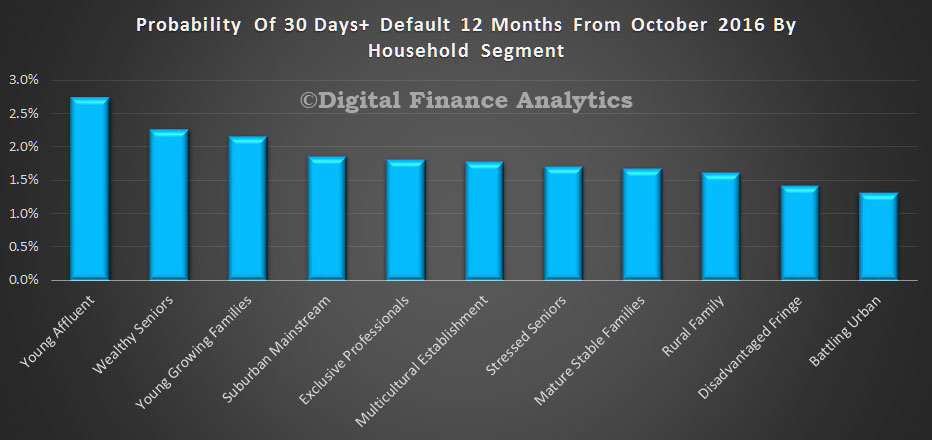

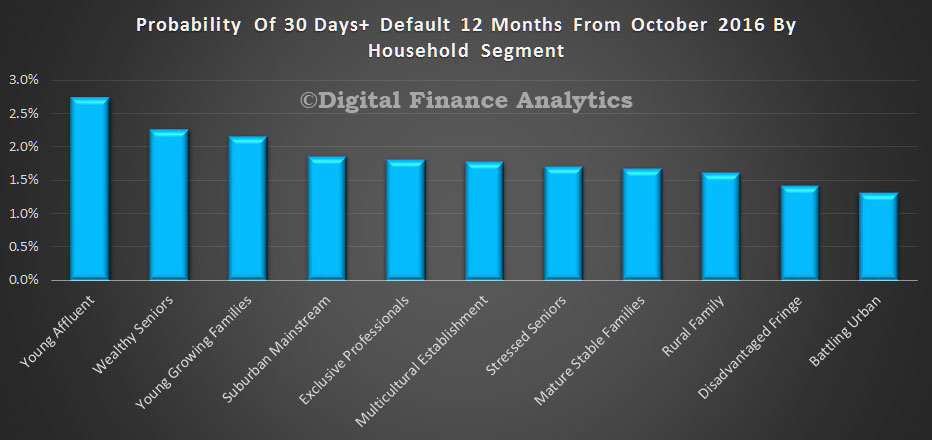

The analysis found that affluent younger and senior buyers were most at risk. Surprisingly disadvantaged households on the edge of cities and battling urban households were less likely to default.

“This is because they have not been able to gear up as much as other household groups as lending standards have tightened,” North said. “However, as expect many young growing families are finding it difficult to make their mortgage repayments, and with incomes static, this will only get worse.”

Lastly, the probability of default varied from lender to lender depending on their underwriting criteria for serviceability as well as their mix of business.

“It depends on where they’re writing and what types of business they’re writing. Some of them are writing a great proportion of what I call ‘jumbo loans’ – loans of over $1 million – while some are writing much smaller loans,” North told

Australian Broker.

“The other thing is they have different channels of originations. Those writing via brokers have slightly higher risk setting than those writing via the branch networks.”

This was partly because there were particular types of customers who preferred to seek the best deal through brokers, he said, including those who may not find it easy to get a loan from the banks. Secondly, brokers help applicants to position on the application form improving the likelihood of success. This can sometimes translate to slightly higher forms of risk.

“I also noticed that there’s a slightly higher LVR on average via the broker channel compared with through the branch channel so by definition, higher LVR means slightly higher risk.”

Related stories:

Mortgage arrears at three year high: Moody’s

Mortgage arrears go against seasonal trends

Mortgage arrears increase over June quarter