Across Australia, 311,000 (or 6.8% of) mortgage holders have been found to have little or no real equity in their home, according to a recent report from Roy Morgan.

The report,

State of the Nation: Spotlight on Finance Risk, highlighted that this group of property owners is at particular risk if they have to sell or prices decline.

Broken down by state, mortgage customers in Western Australia were most at risk with 9.2% of homes valued less than or equal to the amount owed. NSW was the safest with only 5.1% of mortgage holders in the same situation.

Overall figures for each state found in the report are listed below:

- NSW (5.1%)

- TAS (6.1%)

- VIC (6.3%)

- SA (6.7%)

- QLD (7.5%)

- WA (9.2%)

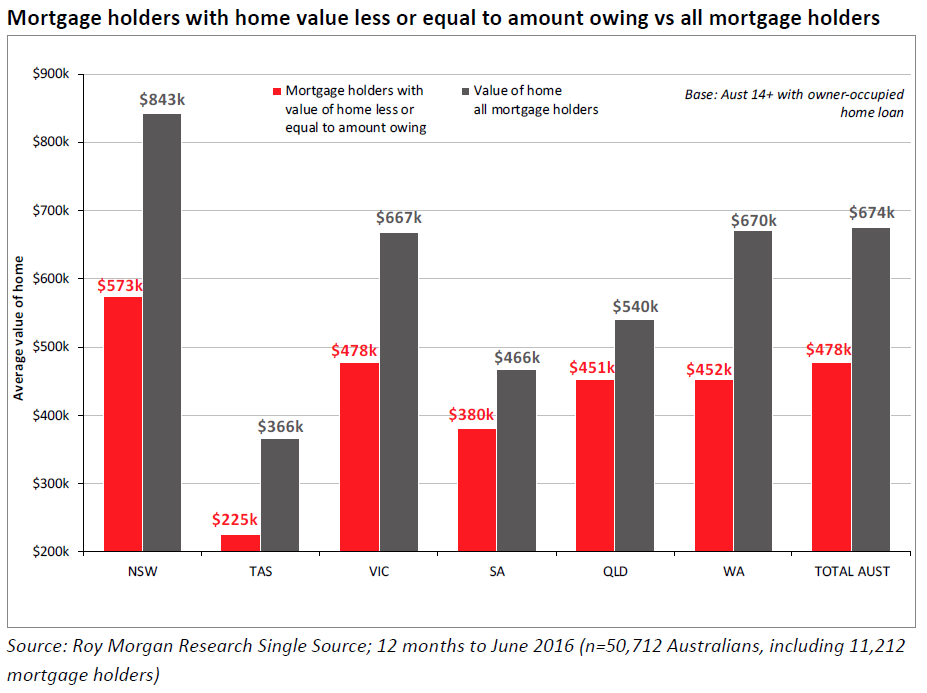

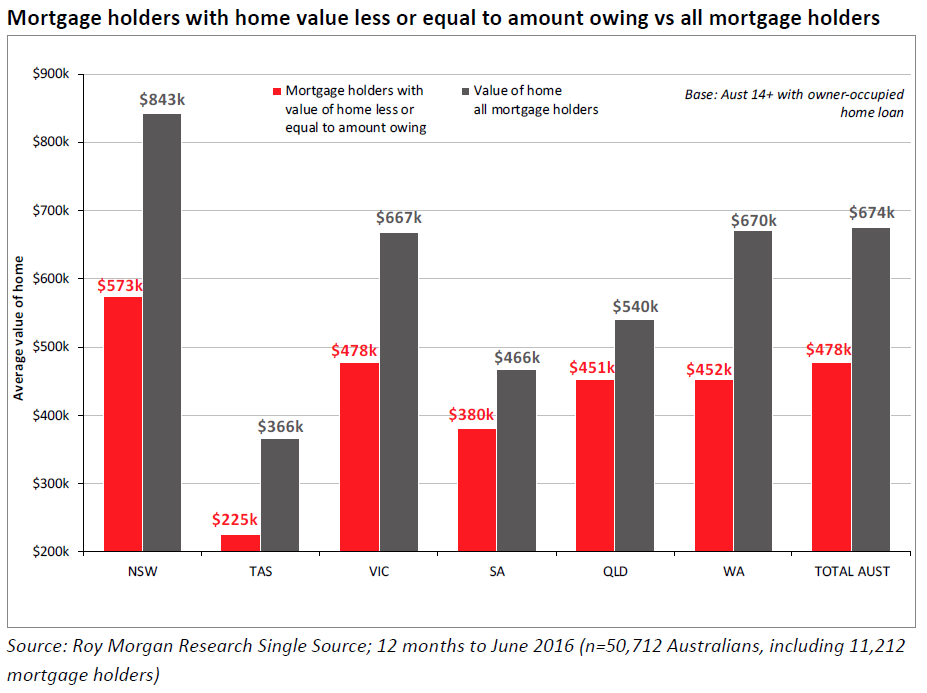

One of the key trends revealed by the research was that lower value homes tended to face more equity risk. The value of homes owned by mortgage holders with little or no equity was $487,000 across Australia – compared to a nationwide average of $674,000 for all mortgage holders.

This trend was found across all states with figures found in the following graph:

“It tends to be at the lower end which seems to indicate maybe it’s the newer borrowers,” Norman Morris, industry communications director from Roy Morgan Research, told

Australian Broker. “These sorts of numbers indicate there are people borrowing right up to the limit.”

While this could reflect on the duty of care that brokers had to customers, Morris said that these trends would present more of a problem if prices go down.

Compared with 2012 however, the figures have improved in the past four years.

“In 2012, the figure was 7.7%. Now it’s 6.8%. I would say that the main reason for that is housing and dwelling prices that they’ve been borrowing on have been going up fast.”