By

The first ABS building approvals update for 2013 indicates that new home building activity will this year fall short of both RBA expectations and the Australian economy's requirements, according to Housing Industry Association (HIA) chief economist, Harley Dale.

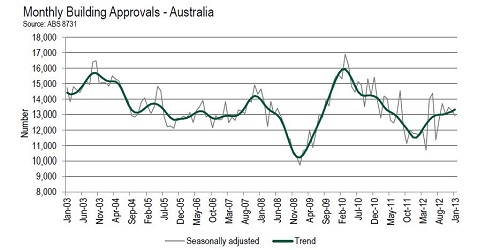

Dale says building approvals in January, 2013 fell for a second consecutive month, falling back below the 13,000 mark – and would have been worse if not for one market segment stepping up.

"The headline January decline of 2.4% would have been weaker if there hadn't been a 3.3% rise in detached house approvals, a component that continues to miss the mark overall. Even with that monthly rise, approvals for detached houses were still down by 1% over the three months to January.”

He says the signal from leading housing indicators is that if, if the country does see a recovery in new housing starts in 2013, that recovery will fall ‘well short’ of what the RBA is looking for.

“We would hope our central bank is very cognisant of that situation ahead of a decision on interest rates due [today]. Interest rate reductions are part of the equation, but federal and state governments also have to provide policy solutions to a lack-lustre new home building outlook. If policy makers haven't woken up by now to the fact that interest rate cuts can't do all the heavy lifting then they need a louder alarm.”