ASIC’s Michael Saadat tells Australian Broker about the regulator’s latest deep dive into interest-only loans and its upcoming shadow shopping exercise.

For those who see ASIC as the ‘bad guy’, consider this: one of its senior executives working in the broker space has gone to brokers on two occasions for help in finding a suitable loan for his own home. Not only that, but one broker he visited came highly recommended by another colleague at ASIC.

Apparently the broker was not trembling in his dress shoes when the ASIC man arrived at his door.

“I don’t think that broker was terrified,” says Michael Saadat, ASIC’s senior executive leader of deposit takers, insurers and credit services. “It was a very pleasant experience for me, and I think it was a pleasant experience for the broker as well.”

Saadat says he already had a positive view of brokers and this interaction was further confirmation of that. “If I didn’t have a positive view about brokers I probably wouldn’t have used a broker.”

That Saadat, as a borrower, visited a broker personally is an interesting anecdote, but it doesn’t mean that ASIC, the regulator, is about to back off on its oversight and scrutiny of brokers. ASIC’s job is to continuously monitor all of the sectors it is responsible for, including brokers, to understand the industry’s evolution and identify and recommend areas for improvement.

So, while the

Review of Mortgage Broker Remuneration has been the hot-button issue this year, ASIC has been busy at work on a number of other reviews of the industry, including a deep dive into interest-only loans, an upcoming shadow shopping exercise, and what all this means for brokers.

“We’re not just there to audit licensees and make sure they’re meeting every single legal obligation they’ve got. We have to prioritise the areas where there is the greatest risk to consumers, so that’s a key part of our approach and the thinking we do around the kinds of reviews we do,” Saadat says.

Promoting responsible lending is a priority for the regulator because a home loan is one of the most critical financial decisions a consumer will make, he adds.

“Making sure the industry is operating appropriately is really important for the financial wellbeing of Australians, and that’s something that we take seriously and we’re prioritising.”

Interest-only review

ASIC’s investigation into interest-only lending is still underway, and depending on what the regulator finds, it could result in enforcement action.

The aim of the review is to determine whether lenders and brokers have recently been recommending unsuitable and more expensive interest-only loans to customers, particularly owner-occupiers. The review will assess the volume of interest-only loans being provided, in order to understand the different trends and identify any outliers, Saadat says.

He says ASIC expects to see a reduction in the number of interest-only loans, reflecting APRA’s tighter lending standards and also lenders’ more robust approach to ensuring interest-only loans are the right product for consumers.

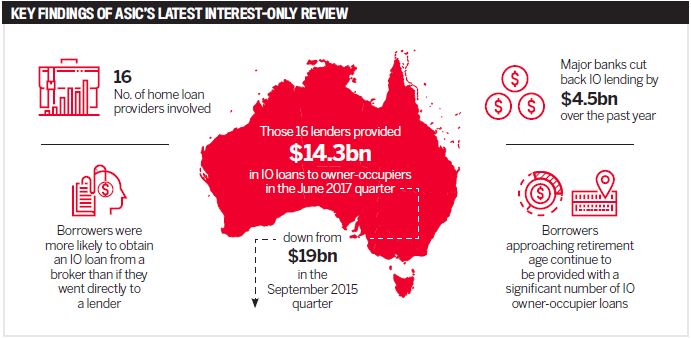

The first phase of the review involved the collection of interest-only loan data from 16 lenders, spanning a two-year period up to June 2017. So far, ASIC has concluded that, while Australia’s major banks have cut back their interest-only lending by $4.5bn over the past year, other lenders have partially offset this decline by increasing their share.

The first phase also found that borrowers who used a broker were more likely to obtain an interest-only loan, compared to those who went directly to a lender, something Saadat says is consistent with the findings in the remuneration review.

“We know that a lot of work has been done by the industry over the last couple of years to improve standards and improve record-keeping, so we’re really interested to look at the current conduct out there and we’re hoping to see those improvements reflected in the files that we’re reviewing,” he says.

ASIC has now progressed to the second stage of the review, which involves looking at hundreds of recent interest-only owner-occupier loan files from a subset of those 16 lenders and from brokers directly. ASIC has already contacted those brokers.

ASIC will review those files to see how the consumer’s situation was described, why the interest-only loan was offered, and if it was appropriate for that consumer’s circumstances.

“We’re looking at both the lender’s conduct and the broker’s conduct in that case to determine how they have gone about making sure that the consumer was given the product that met their requirements and objectives,” Saadat says.

This review will also provide ASIC with an update on whether the recommendations of its September 2016 REP 493 review into interest-only loans and brokers’ inquiries into consumers’ requirements and objectives have been met.

“Certainly all of the lenders and the brokers committed to implementing the improvements that we observed were necessary, and we are confident that things have been heading in the right direction, but this is something we can check as part of this second stage of the review.”

If lenders and brokers are found to be doing a good job in determining and recording how a customer is approved for an interest-only loan and ensuring it is a suitable fit, then the review will be finished and ASIC won’t take any further action.

“But if we do find things that we are concerned about, then we will look at what other options are available to us, including enforcement action,” Saadat says.

Shadow shopping

While ASIC dug into vast amounts of data to prepare the remuneration review, Saadat concedes that data doesn’t always explain everything.

Following what was observed through the remuneration review, and noting its limitations, the shadow shopping exercise was considered a “natural next step” to achieve a clear understanding of how the industry operates and to help inform ASIC’s regulatory approach.

“Having used a mortgage broker myself very recently, I expect that the interactions that consumers are having with brokers are generally very positive, and we hear that from a range of sources,” Saadat says.

“This is not about going into the review thinking that there are significant problems that need to be uncovered; in fact this is about really trying to understand how the interactions between the broker and the consumer are playing out, given that we don’t get any sense of that really from the loan files.”

The point of the shadow shopping exercise, which is slated to occur within this financial year, is to understand how those interactions work in practice, and to determine whether there are any issues that ASIC should be aware of.

“Anything that we find through shadow shopping will be more about understanding to what extent brokers are potentially not meeting their legal obligations, and whether ASIC, for example, needs to produce more guidance around what they can or can’t say to consumers or whether some other action is required,” he explains.

In the past, ASIC has pointed to record-keeping as something brokers need to improve on, but that doesn’t mean brokers aren’t trying to make sure that customers are getting the right loan product; just that the loan file doesn’t adequately explain the process that has occurred, he says.

This operation will hopefully shed some light on that. But it will be a significant undertaking involving real consumers.

“We will probably need to use a research firm to assist us with this, because this isn’t something that we do every day, so we need to get some expertise around how we manage that and ensure the sample is robust, that we’ve gone through all the right processes.”

Michael Saadat, ASIC

Michael Saadat, ASIC“It’s in the nature of being a regulator that you will have areas where there are disagreements or where people think a different approach should have been taken, but that’s to be expected” - Michael Saadat, ASIC

Ongoing communication

One positive outcome of the remuneration review from Saadat’s perspective is that it has increased interactions and engagement between ASIC and the sector.

“We were conducting this major review and the sector was obviously very keen to understand what we were doing and to be part of the process,” he says.

“Brokers don’t always necessarily have a full appreciation of what ASIC is trying to do, and what our expectations are, and so we’re constantly trying to make sure we’re communicating with industry to make sure the industry does know what we expect. What we want to avoid is a situation where people don’t understand what the regulator expects of them.”

While it’s impossible to engage with every single broker directly, Saadat says ASIC does have constructive relationships with industry bodies and is in regular contact with the

MFAA and

FBAA.

The parties might not always agree on everything, but ASIC does try to take their feedback on board, something that it did during the structuring of its cost recovery scheme. As a result of those discussions, ASIC made significant changes to the model to reflect the industry’s concerns, Saadat says.

“It’s in the nature of being a regulator that you will have areas where there are disagreements or where people think a different approach should have been taken, but that’s to be expected, and I think it’s making sure that there’s good communication at all times and we’re keen to foster that.”