Want to know how to settle a deal when a council office containing critical files burns down and your clients go on vacation during the approval process? Just ask this broker

THE SCENARIO

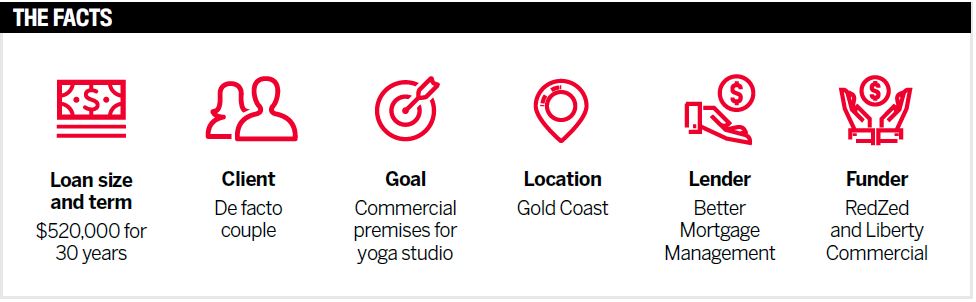

A referral from one of our lead sources, the clients approached me needing a low-doc loan so they could purchase a commercial building to host their yoga studio. They had bank statements and an accountant verification/declaration. Both applicants were separately self-employed and had a relatively low LVR on their current home, with some other minor debts.

The plan, given the equity in the home, was to refinance their

ANZ home loan, consolidate their debts, and provide sufficient cash to purchase the commercial dwelling and fit it out on a low-doc basis. So, Loan A for personal and Loan B for commercial were secured against their principal place of residence to keep the loan at residential rates.

After lengthy discussions with the clients, the accountant and the mortgage manager, and in conjunction with the verifiable income available, we provided a solution with a low-doc refinance and cash-out against their PPOR with two loan splits (private and business/Loan A and B).

There were many complications, including that the male applicant was extremely time-poor and the female applicant had little financial understanding, so it was very time-consuming to explain things in a way that ensured she knew what we were doing and what it meant for her. The clients also went overseas during the approval process.

Once we got conditional approval, the clients moved to valuation of their residential property (at their cost), and as they were overseas we had to wait for the bank transfer to hit the lender’s account as they didn’t want to pay on credit card.

The valuation went ahead; however, it indicated that there were renovations that were not yet council approved, causing a reduction in the valuation amount as the non-approved renovations were excluded.

Once the clients returned from overseas and tried to source copies of the approvals, unbelievably, they couldn’t because the council office had burnt down, destroying the plans and records. (This was apparently done pre-electronic copies.) The new problem was that without the council-approved plans the valuation was short and the finance deadline on the commercial purchase was fast looming!

THE SOLUTION

Thankfully we were dealing with a mortgage manager with multiple funders, so we were now able to add the commercial property to the mix on a ‘no doc’ basis via

Liberty Commercial. The only downside was that there were only 10 days left to go from lodgement to approval with a commercial valuation.

We ended up doing two separate loans with three separate loan splits: one loan split against the commercial purchase and two loan splits against the couple’s home (one split for the refinance of the owner-occupier loan and one split for the shortfall of the commercial purchase).

When the first two loans were finally approved, they were posted to the clients by the respective lenders. Unbeknownst to us, the clients didn’t have a mailbox at their home so the loan documents were ‘parked’ at the local post office. Only when we checked with the clients to ask if they had received the documents did they think to verify at the post office. Once the documents were in the clients’ hands, we were able to certify and witness the documents to be returned for settlement.

THE TAKEAWAY

The big advantage with this transaction was the combination of our experience as brokers and the mortgage manager’s, along with the relationship that we had with them and the clients.

We were able to reassure the clients that, although there were some challenges, we were able to provide a solution and largely with the same lender, in this case Better Mortgage Management.

Once the clients returned from overseas and tried to source copies of the approvals, unbelievably, they couldn’t because the council office had burnt down

Ultimately, the clients got the solution – their private and business debt was separated, the commercial property was purchased, and they were able to open their yoga studio at their new premises.

The absolute takeaway is to communicate with your clients, keep them reassured, and ensure that you keep up to date with lender training so you ensure the best possible outcome for your clients.

Scott Beattie

Broker at Cube Home Loans in

Queensland