.jpg)

By

Greg Pennells, of subaggregator Purple Circle, encourages brokers to speak up, stand out and become shareholders

There are very few companies in the broking industry that would be likened to “a movement”, but that’s how one broker describes being part of Purple Circle Financial Services, one of the youngest subaggregators in the business.

“What a lot of [brokers] are feeling is that they’re just a number in some of the big aggregators’ books … they get told what’s happening with them,” says Purple Circle’s founder and managing director, Greg Pennells.

“What they’re getting with us is they’re actually not pawns at all, they’re right at the top.”

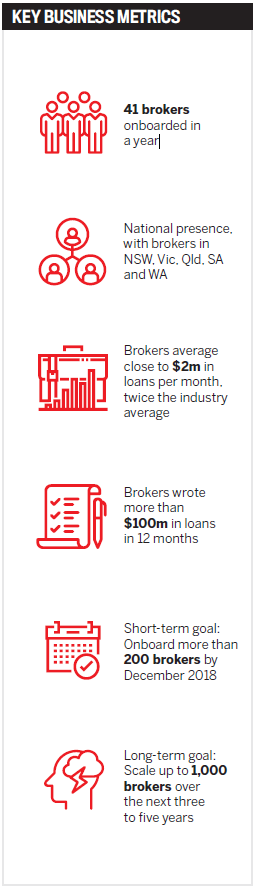

About a year and a half since opening its doors in August 2016, Purple Circle now has 41 brokers on board across the country, nine staff members and three BDMs. Its brokers, the majority of whom are established brokers who decided to switch aggregators, as well as some new-to-industry members, are averaging around $2m a month in new loan settlements, about double the industry average.

Pennells’ goal for 2018 is to welcome more brokers into the Purple Circle fold, a subaggregator that’s anything but average.

Not only is the company’s name unusual; so is its business proposition. Its brokers are its clients, and also its owners. For entrepreneurially minded brokers, this has proved to be an attractive offer.

Purple Circle’s intention is to make brokers feel part of “an invitation-only meeting of like-minded people”, which is actually the meaning behind its colourful name.

In the Purple Circle world, brokers can earn shares in the company based on the volume of loans they write. Brokers get to decide on the split. For example, the lower the commission, the more shares they can earn and vice versa. Brokers receive the same services and tools that Purple Circle’s parent aggregator, Finsure, offers its members, such as use of its CRM, commission accounting services and ACL.

“Once the shares have been earned by the broker they come without encumbrances. You can sit back and enjoy company dividends, will them to your kids, sell them to other brokers, or anyone for that matter. And if the company is sold or floated in its entirety, you can enjoy the capital benefits that come from the sale. These are benefits that have never been passed through to brokers themselves,” he says.

Allowing brokers to earn a stake in the company and have their voices heard has resulted in “a complete paradigm and cultural shift”.

“What a lot of [brokers] are feeling is that they’re just a number in some of the big aggregators’ books … what they’re getting with us is they’re actually not pawns at all, they’re right at the top”

“We won’t make any major decisions without consulting our brokers and asking them what they think … and if they don’t like it, we won’t do it, because they’re also owners, they’re also shareholders, and they have skin in the game.

“They really enjoy having that voice and having a bit of control over their destiny, rather than just being in this ocean of change,” Pennells says.

All brokers who are shareholders are entitled to see the company’s financials, such as its profit and loss statements, and they get to take a hands-on role in the decision-making.

Shareholder brokers get to join a steering committee that represents the interests of the broking group as a whole, Pennells says. An elected broker from the committee sits on board meetings to tell the company heads what brokers want and need. In the last few months, four of Purple Circle’s first broker members have become shareholders.

“They speak to the other brokers and ask, ‘What do you need, what have you seen in the marketplace, what have you seen in other industries, what have you seen overseas?’ And then we sit down and brainstorm,” he says.

Instead of dumping decisions onto brokers that have been concocted by executives in an ivory tower, the Purple Circle approach is to come up with strategies collaboratively that help the group grow collectively.

“It’s completely transparent and our brokers really appreciate that. There’s no cloak and dagger, and there’s no, ‘We’re in it for us and they’re in it for themselves’. We’re just an open book,” Pennells says.

Benefits for brokers

Paul Lewis, director of South Australian-based Lighthouse Financial Services, joined Purple Circle from the very beginning and is now a shareholder. He said the decision to switch to a group that was developed and driven by one of the most respected and passionate industry pioneers was a “no-brainer”.

While he’s been with three other aggregators in the past, none were like Purple Circle, which he says is “an aggregation group built by brokers for brokers and for brokers alone”.

Purple Circle has fostered a working environment that encourages brokers to share their input, knowledge and experience to drive change, Lewis says.

In a time of flux for the industry, having an aggregator that supports and stands alongside brokers is important

.

“I believe that our industry is under attack, and we are in danger of losing our identity as finance professionals and even our relevance in the market. Purple Circle has the potential to be far more than just an aggregator; it provides the potential to have a voice in our industry,” he says.

“Purple Circle is very different – it’s a movement. … Stay tuned. I believe we will make a real difference in our industry.”

Leading together

As an early adopter of mortgage broking in the 1990s and co-founder of Choice Home Loans and Choice Aggregation Services, Pennells is no stranger to the challenges that come with starting up a business. Despite the challenges and the waves of change the industry is undergoing, he’s still managed to blaze a new trail with Purple Circle.

“The setting up of the appropriate corporate structures to accommodate issuing shares to brokers was by far the biggest challenge so far,” he says.

“Apparently, what we are doing with our brokers is unprecedented not only in the finance world but also in corporate Australia. Countless hours were spent with lawyers and accountants to create a structure that makes it all work, and as essential as this was, it really pushed the grey matter to its limits.”

Pennells is eager to keep pushing the boundaries, something he believes was more common in the industry’s early years when companies were driven by innovation, imagination and entrepreneurship.

Lately he’s found that aggregators have shifted their attention to compliance and regulation, sometimes losing sight of brokers’ needs.

“[That] is fair enough, but the problem is it’s created a bit of a sea of sameness where one aggregator looks exactly the same as the other. … Nobody is innovating.”

Purple Circle is looking to shift the status quo. “We consider ourselves less of a broking business but more of a platform for ideas and innovation from our brokers,” he says.

As a subaggregator it can rely on Finsure’s expertise and vast resources in the compliance and regulatory department and instead focus on its brokers’ business strategy, development and idea generation.

Over the next few years, Purple Circle’s plan is to continue growing while still giving brokers a voice.

Pennells is not shy about his ambition. He wants to end 2018 with 200 brokers on board.

So how will he expand the company to ensure it retains its collaborative, transparent feel?

Pennells says the company’s model is designed to grow to scale so that the feeling of connectedness that makes Purple Circle unique is maintained. The steering committee will add new members as the company does so that brokers continue to feel valued and fairly represented.

“We’re going to start doing some things that no one’s ever seen before, and that’s going to attract more people to us, and it’s actually going to raise the support that all brokers with all aggregators will come to expect as a new standard,” he says.

If you want to know what Purple has in store, Pennells says, “you’re going to have to watch this space”.