.jpg)

By

With three broker partnerships now in the bag, HSBC's Alice Del Vecchio, reveals the bank's third party strategy

HSBC has a long history of balancing local and international operations and, while the GFC saw it drop the “world’s local bank” tagline, it remains one of the largest global financial institutions, with 3,800 offices in 66 countries and territories.

In Australia – where the bank has operated since 1965 – HSBC offers services in retail and commercial banking, financial planning, trade finance, cash management and securities custody, to name a few. Its niche balance of global and local reach has seen it become a primary choice for expatriate and foreign citizens, along with well-travelled Australians at home and away.

Last year, a renewed focus on mortgages saw HSBC Australia re-enter the broker distribution channel in partnership with Aussie Home Loans. The bank has employed a strategy of measured growth, and January 2018 saw the announcement of a second partnership with Mortgage Choice.

“We identified pretty early on that our brand really does resonate in the Australian market,” says HSBC’s head of mortgages and third party distribution, Alice Del Vecchio.

“We have really great products, great rates, strong brand awareness, and we just thought there was so much more opportunity. We have constantly punched above our weight when we look at results from previous years, so it was a natural move to begin thinking about how we can get the brand out to more Australian consumers. Broker distribution is just the natural channel.”

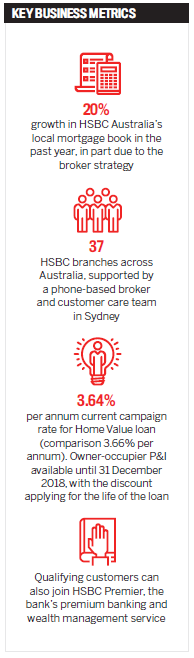

In September, a third partnership was announced with REA Group’s Smartline, which in July appointed former CBA broker head Sam Boer as CEO. The group now offers Home Value (see boxout), and qualifying Smartline customers can also enjoy access to HSBC Premier, the bank’s premium banking and wealth management service, which Del Vecchio describes as “the no-brainer solution” for those with lives and ties beyond a single country.

Combined, the three partnerships mean that HSBC’s products are now available through more than 2,200 brokers across Australia.

“We have looked for partners who have a very similar value and culture to us, and I don’t say that lightly. With the current focus on governance and controls within broking, and financial services in general, this is a really nice fit for us,” Del Vecchio explains.

Reporting that things are going “really well”, she says the broker channel now complements HSBC’s branch network, offering comprehensive reach for customers and brokers.

Although focused on growth, the pace is deliberately measured, and HSBC has clear boundaries that underpin a sustainable and long- term outlook for its role in the broker space. For example, the criteria for new partners covers governance, professional development and CSR, with a heavy emphasis on regulatory compliance.

Partners are required to have a strong reputation in the marketplace; comprehensive training programs that support brokers’ continued professional development; a culture of connectivity and leadership within the network; and support for causes and initiatives beyond the world of broking.

Del Vecchio explains, “For both parties there is a lot of investment up front, and we go through the process quite genuinely. It’s about asking, how do we get the best out of the relationship? Then, once the onboarding is done, it’s about making sure there is value in the ongoing relationship management.

“We have regular meetings and engagement with our partners, and we are always sharing information from each side on the results and options for growth. It’s a long-term view.”

This high-touch approach is extended to the brokers themselves, who can take advantage of a range of benefits, including a dedicated broker care team and credit hotline, manned onshore by experienced underwriters.

Located at HSBC’s broker branch – aka broker branch 101 in Sydney’s Parramatta – underwriters are available to talk through scenarios and even give brokers a direct phone number for follow-ups.

“The underwriters in Sydney are used to dealing with complex situations. There is nothing that can surprise us, and I think that truly surprises brokers,” says Del Vecchio, who describes the contact with underwriters as “a real point of difference”.

It’s also a necessary measure, given the variety of policies offered by the bank and the complexity that can emerge when working with offshore and international customers. For example, how can a broker arrange finance for a visa holder? How can offshore rental income contribute towards onshore income?

“We have always had a very strong relationship focus in our branch network, so we did take a lot of time to talk to brokers before we launched with Aussie to try to replicate this, and they helped us to devise these strategies. We didn’t just speak to top brokers, but ones who write various levels of volume and different types of deals,” Del Vecchio says.

Relationship managers are also on hand and, unlike BDMs, they work without sales targets to ensure the focus remains fully on supporting brokers.

These elements dovetail with an extensive training and accreditation program, which mandates face-to-face attendance where possible and a 100% pass rate, to ensure brokers are well versed in HSBC’s products.

“We have a lot of discussion at the end of each accreditation session, where we really bring the policy and the brand to life, and everybody learns from that,” Del Vecchio explains.

The final rule is that, despite the competitive rates offered, the bank doesn’t do introductory promotions, instead favouring long-term competitive rates rather than honeymoon periods.

“We pride ourselves on building strong relationships with brokers and their customers, so that means we are very transparent in all our product offerings – and customers at the end of the day must be very clear about what we have offered them,” Del Vecchio says.

“We give them a good product, we support them with good service, we are really clear on our policy, and we can show customers the value for their money. Not all customers will shop on rate; rather they want to know there is true value here for them.”

.jpg)

A point of difference

Although gaining pace for more than a year, in branding terms HSBC’s market re-entry couldn’t have come at a better time. Public trust in corporate ethics has declined across the board, but trust in the country’s banking, finance and insurance firms is at its lowest point in three years, according to the Government Institute of Australia.

“We have been extremely consistent in our offerings and service, and that means we are now a tangible alternative in the market,” Del Vecchio says.

“We are strong and stable, we have a branch network and customers appreciate that, along with the range and quality of our products. That differentiates us. Price is important, but it’s also how the broker can genuinely talk about us.”

Looking ahead, HSBC is focused on applying the lessons it learns on the international stage to the local market. That includes drawing on its experience of open banking and comprehensive credit reporting beyond Australia, building on global compliance standards and, of course, adding more broker partnerships.

Del Vecchio concludes, “We do the niche stuff, and that’s what we are known for. But the local customer who goes to a broker and wants a better rate, or just a better package that includes relationship management, fully functional transactional banking and the choice of a branch network, whether they use it or not – all those types of things mean that we have now become quite popular, and we are writing some lovely business as a result.”