.jpg)

La Trobe Financial’s chief lending officer, Cory Bannister explains recent developments in the SMSF sector

Q: In the five years to 2017, SMSF-lending-based property assets (as a proportion of total assets) increased from 3.51% to 21.17%. According to your observations, what is driving this trend?

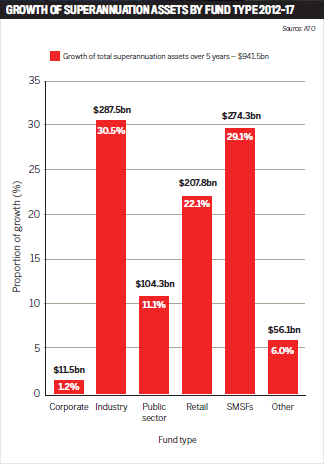

A: With more than one million Australians having turned to taking more control of their own super, the SMSF sector continues to grow. SMSFs continue to have a significant influence on the overall growth of the $2.7trn Australian superannuation industry, with SMSF assets increasing by $274.3bn or 65% in the five years to 2017. So with this in mind we can expect this sector to continue to be important in asset allocation debates in the retirement industry.

The majority of SMSFs are formed by self-employed business people who are astute and understand investment risk, having run their own businesses.

They have a bias towards asset classes with low volatility and assets that have longer-term investment horizons of 10 or more years. To this end, property is imminently recognisable and understandable for SMSF investors..

Q: How do you believe the trend will play out over the next five years?

A: Looking at growth in the number of SMSFs, it is on an upward trajectory, growing on average 5% year-on-year (over the five years to 2017), from 473,000 SMSFs to 597,000.

With a notable increase in the younger entrants, particularly in the 35 to 50 age bracket, and a gender shift in the SMSF landscape, combined with Australia’s penchant for DIY, we expect the numbers will continue to rise but at a lower annual rate than previously

Q: Has the withdrawal of major banks from SMSF lending caused any reputational damage among consumers?

A: We believe that the reason why the banks may be withdrawing from SMSF lending is simply to streamline their product range and concentrate more on the individual home loan type product. This will also assist the banks in the processing of simpler prime-type home loans, where automation is the key for them.

The SMSF loan product is a bit more complex in structure and more difficult to fit into their automated credit model. We also believe that the banks may be required to hold higher capital levels for these types of loans compared to a prime standard home loan for individuals.

A: We have been offering SMSF commercial and residential security mortgages since 2009, and our SMSF portfolio has demonstrated stellar performance outcomes with these high-quality super prime borrowers, who are saving and investing for long-term retirement purposes, proving to be low risk – contrary to some press reporting.

Our SMSF lending continues to be strong, and we expect it to get even stronger now that the majors have pulled out of the market.

Competition in the market will of course become more limited, and we believe that a number of non-bank lenders will continue to support this type of specialist lending. La Trobe Financial’s broader product range continues to support brokers in the SMSF and other underserved markets.

Q: In terms of the residential and commercial SMSF products on offer from La Trobe Financial, what are the pros and cons that brokers need to outline to their clients?

A: We would suggest that clients have an SMSF in place already, unless they are coming to a broker with advice from an adviser and are in the process of establishing their SMSF. Clients should not be encouraged to establish SMSFs unless they receive independent advice from an appropriate adviser first.

An example of when it may be appropriate to recommend that your client seek advice about setting up an SMSF is where they are self-employed and currently leasing their place of business. If they hold adequate funds in their superannuation to allow them to borrow funds to purchase a business premises through an SMSF, it might make commercial sense for them to purchase their business premises, as they can use cash flows from their business to pay their mortgage, as opposed to paying someone else’s by way of rent.

It is a discussion your client might wish to have with their financial adviser