The World’s worst-kept secret is that Sydney is going through a once-in-a-lifetime property boom, but how long can this trend keep going for? There are some aspects of this property boom that just don’t add up.

Throughout the calendar year, the number of properties going to auction have been consistently low. On average, month after month we have seen stock levels down approximately 25%.

However, according to the monthly stock on market report by SQM Research, the number of listings as at 30 September had risen quite sharply. The Sydney metro had 27,103 properties on the market compared to 23,533 at the same time last year – an increase of 13.2%.

And yet according to the Real Estate Institute of New South Wales, the NSW government is facing a budget shortfall as land-related transactions and total stamp duty collected are below current budget forecasts for the 2016/17 financial year. In the first three months of FY17, the NSW government collected $138m less in land transfer duty compared with the $2.157bn in transfer duty it collected in the first three months of FY16.

The total budget for FY17 for all transfer duty is $8.777bn, and at the current rate NSW is facing a budget shortfall.

Filling in the gaps

So, what are we missing? Let’s be honest here and admit the fact that the data surveys, polls and predictions have been more unreliable than they’ve ever been. We can start with Brexit.

Every poll and bookie was forecasting a very clear win for the UK to remain in the EU after the referendum – in fact, the odds the bookies were giving were not worth betting on.

Then we had the Australian federal election. The LNP at one point were $1.11 to win and the ALP were over $4, but as we know, it took over a week to find out the outcome of the election as it was so close.

And of course there was the victory of Donald Trump over Hillary Clinton just last month. Trump had always been seen as a long shot in the media’s polls, and yet he won with an overwhelming majority. The point is that something is very wrong with the information we are receiving, and it might suggest that people are becoming reluctant to hand over information or even their opinion for the sake of predicting poll outcomes. Does this mean that the outcomes suggested by data and statistics overall are becoming questionable?

The

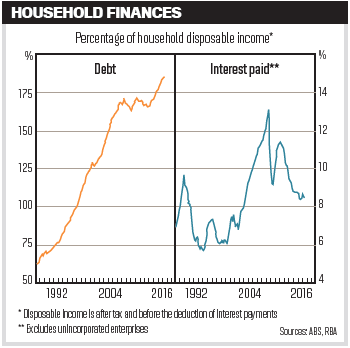

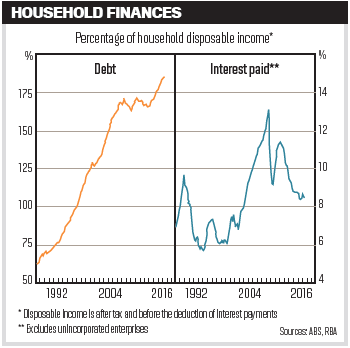

RBA, for example, finally expressed concern recently over the level of household debt, but data from the ABS shows that loan approvals are actually on the decline – so why the concern now, and not before?

Misinformed?

I believe that we are not seeing a true indication of how the Sydney property market is performing, and that there is too much focus on auction clearance rates in the media.

Let’s be generous and suggest that there are 3,500 properties to go under the hammer next weekend. If we take the 3,500 properties from the total number of properties listed for the month (27,103), this only represents 15% of all property transactions.

The pockets of Sydney that typically have properties that sell via auction campaigns are generally affluent areas. So I ask, is this really a true snapshot of the overall market?

It is not uncommon in the industry to hear about ‘off market’ sales. In fact, over the past 24 months there have been plenty of off-market transactions, which do not get registered via the Office of State Revenue until settlement day.

The need for new analysis

The need for new analysis

When we look at all the data, we have a 13.2% increase in stock levels across the metropolis but a 25% decline in auctioned stock levels, with household debt increasing rapidly and housing loan approvals on the decline!

Something tells me we need the methodology of all this data to be revisited. Should the property market no longer be self-regulated, and should we make the reporting of sales, withdrawn properties and unsold properties compulsory? Should an industry as big as the property industry – the country’s biggest industry, making up over 11% of GDP – be self regulated? If it is not compulsory to report the outcome of a marketing campaign for a property, then how could we possibly have an accurate snapshot?

Property is not deemed to be an investment class, which is why the industry is not governed by ASIC. However, if I were to purchase the same property through my

SMSF, it would come under the derestriction of ASIC.

The Reserve Bank takes into account all of the property data that is provided to them, but they’ve recently questioned the methodology of a certain research house. Surely the data provided to the RBA should be as accurate as possible given that they make monetary policy decisions based on this information? Shouldn’t the consumer be able to access the same information given the fact that purchasing a home is typically the biggest investment a family will ever make?

One thing’s for certain: the figures are not adding up, and it’s hard for people to make confident, informed decisions about property without accurate information at their disposal.

Rob Ward is the CEO of Di Jones Real Estate

.jpg)

The need for new analysis

The need for new analysis