The number of fixed rate mortgages offering rates of less than 4% is trending downwards thanks to recent rate hikes by a large number of major and non-major banks.

The recent

Rates of the Nation report by RateCity.com.au found there were now 525 fixed home loan products offering an interest rate of less than 4%. This was down by 98 throughout the December quarter.

“The ‘Under 4 Club’ for fixed rates contracted by 15% over the quarter; that’s around 100 fewer sub-4 per cent fixed rates on offer now compared to three months ago,” Peter Arnold, data insights director for RateCity.com.au, said.

This shift saw an increase in the demand for fixed mortgages by close to 30% at the end of 2016, he added.

This means that for brokers, conversations with borrowers around fixed rates will be quite different, Arnold told

Australian Broker.

“Now there’s a higher chance than at any point in the last five years that the great rate that you’ve got will disappear before the loan gets funded so managing borrower expectations around that and considering rate locks is appropriate.”

He also suggested reassuring borrowers that although rates have increased by 10 or 20 basis points, levels still are at historic lows.

“If you look at the changes, we hope that won’t be enough to change whether someone will actually get a loan. Most brokers will probably be pretty comfortable with that but for a lot of borrowers that’s probably a big factor on their mind.”

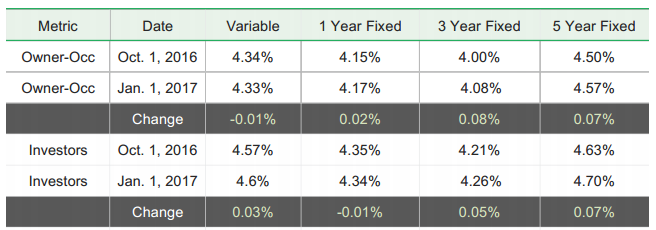

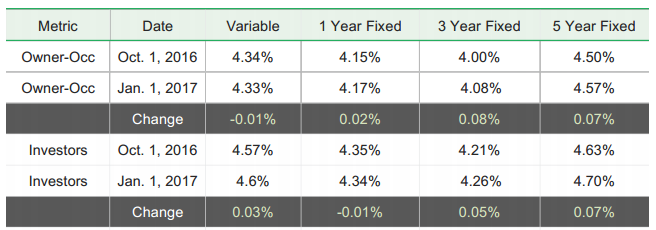

At present, the majority of fixed rates lie between 3.8% and 4.6% while for variables, this is slightly higher between 3.8% and 4.8%.

The average rates for longer-term fixed mortgages are now higher than variable rates. This shows that the banks expect further rate rises in the foreseeable future.

For owner-occupiers, the gap between the average home loan rate and the lowest home loan rate has remained steady at 0.98% since September last year.

This was one of the more surprising results of the report, Arnold told

Australian Broker, given the level of activity in the second half of last quarter.

“From mid-November onwards, out of the 105 lenders that we track, we’ve seen at least two thirds of those lenders increase at least some of those fixed rates.”

While it was unusual to see this much movement without an

RBA cash rate change, Arnold said that the current state of play was a massive decoupling of home loan rates and the

RBA.

“We’re seeing lenders raise and also decrease their offers whenever they see fit from a competitive or funding point of view, and we’re seeing a lot of good deals released daily and ending daily as well.”

For investors, the gap between average and lowest rates increased from 0.88% to 0.91% from September 2016 to January 2017.

LVR pricing has also shifted over the past 24 months. The largest movement was for loans available to borrowers with a 5% deposit which dropped from 61% of all mortgage products to 50%.

Looking ahead to the rest of the year, Arnold said consumers should expect even more rate rises on the horizon.

“It’s unlikely that we’ll see rates return to the long term average of around 7% just yet, but competition at the low-rate end of the market is slowing.”

He also predicted that lenders will undergo a full repricing to bring fixed rates more in line with variables. One reason behind this was since fixed rates have been significantly below variable rates for a while.

“I’d expect it would be more of a levelling out of fixed and variable rather than the shorter-term fixed ones sitting much higher than variables.”

Related stories:

Fixed rate demand surges for four months running

Non-major market share surges amid refinancing trend

Lenders to “turn the screws” in 2017