From today,

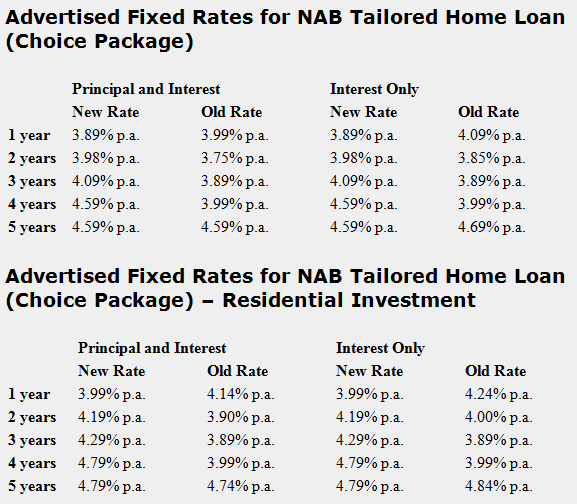

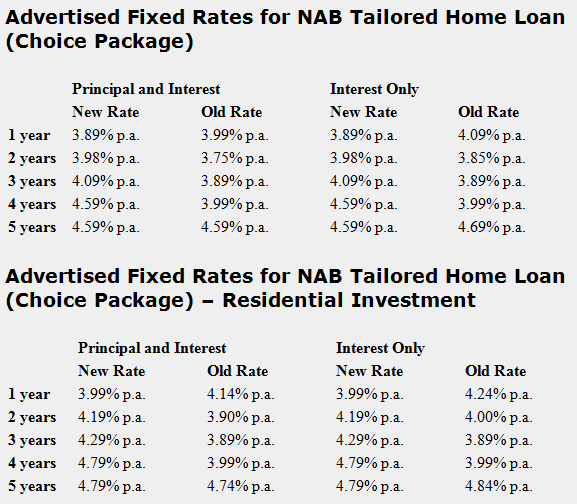

NAB will decrease its 1 year Package Fixed Rate for Home Loans to a highly competitive rate of 3.89% per annum for owner occupiers.

NAB will also decrease its 1 year Package Fixed Rate for Residential Investment Home Loans to 3.99% per annum.

Meanwhile, NAB’s 2, 3 and 4 year Package Fixed Rate for Home Loans will increase effective today, to 3.98%, 4.09%, and 4.59% per annum respectively; and 2, 3, 4 and 5 year Package Fixed Rate for Residential Investment Home Loans will change to 4.19%, 4.29%, 4.79%, and 4.79% per annum respectively.

“There are a range of factors that influence the funding that NAB – and all Australian banks – source, so we can provide home loans to our customers,” NAB Chief Operating Officer, Antony Cahill, said.

“The cost of providing our fixed rate home loans has increased over recent months.”

“We continue to watch market and economic conditions to ensure we continue to lend and manage our business responsibly, so we remain strong and stable for the benefit of our customers, shareholders, and the broader economy,” Mr Cahill said.

Today’s decision applies to new fixed rate home loans only. NAB continues to closely monitor the various factors that influence its Variable Rate for Home Loans (Standard Variable Rate) for owner occupier customers, which remains at 5.25% per annum at this time.

Mr Cahill said NAB’s fixed rate home loans remain highly competitive – especially with today’s new one year rates.

“We know that fixed rate home loans have become increasingly popular with our customers. We saw these applications more than double as a share of total applications in December, compared to in September last year,” Mr Cahill said.

Customers who want to have certainty about their monthly repayments should speak with their banker or broker to find out more about what’s available, and if a fixed rate home loan might be right for their circumstances. Conditions, fees and eligibility criteria apply to NAB’s products.