Canstar has observed minimal changes in home loan rates over the past week while also addressing the increasing number of Australians turning to the government's Home Equity Access Scheme to finance their lifestyle and contend with rising living costs.

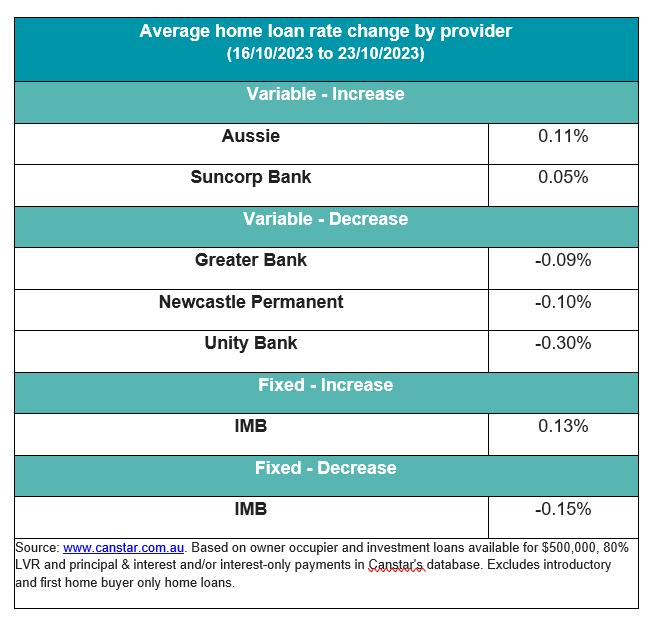

Between Oct. 16 and 23, only two lenders – Aussie and Suncorp Bank – raised their variable rates while three – Greater Bank, Newcastle Permanent, and Unity Bank – cut theirs.

IMB Bank was the only lender last week to make fixed rate changes, lifting its investment principal and interest and interest-only one-year fixed rates by 0.1% and 0.15%, respectively, and cutting six owner-occupier and investor fixed rates by an average 0.15%.

See a summary of rate changes in the table below.

Effie Zahos (pictured above), Canstar’s editor-at-large and money expert, said there is still ample competition in the market, with Canstar’s database showing 576 rates below 6%.

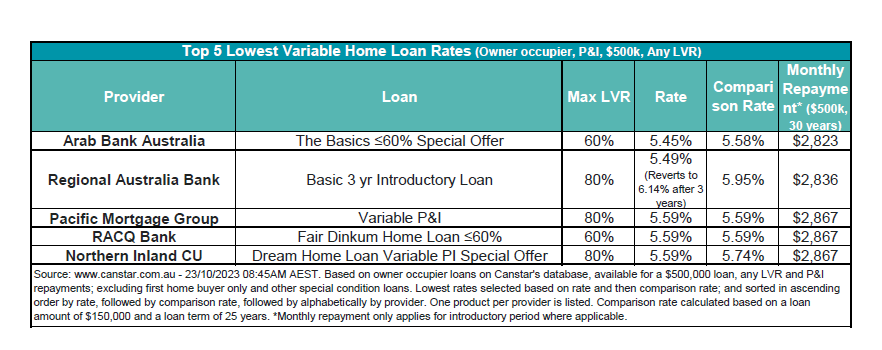

The same database showed that the average variable interest rate for owner-occupiers making principal and interest payments stands at 6.68% with an 80% LVR, while the lowest variable rate for any LVR is 5.45%, available through Arab Bank.

Eight rates below 5.5% are currently listed on Canstar's database, which has remained unchanged since last week. These rates were from Arab Bank Australia, Australian Mutual Bank, LCU, RACQ Bank, and Regional Australia Bank.

For the top-five lowest variable home loan rates, see the table below.

Meanwhile, the latest data from the Department of Social Services showed a 73% jump in the number of Australians who have utilised the government’s Home Equity Access Scheme between June 2022 and September.

Previously referred to as the Pension Loans Scheme, the Home Equity Access Scheme is open to eligible Australians who have reached Age Pension age or are older who own a home that can serve as collateral for the loan. They must also receive or qualify for the age pension, carer payment, or disability support pension.

“With interest compounding fortnightly at 3.95% per annum, the government’s offering is a far cheaper product than a traditional reverse mortgage,” Zahos said.

“According to Canstar, the lenders offering the cheapest reverse mortgages are Express Reverse Mortgage at 7.85% with a comparison rate of 7.87%, Australian Seniors Advisory Group at 8.14% with a comparison rate of 8.56%, and Gateway Bank at 8.55% with a comparison rate of 8.63%.”

She cautioned, however, that while these loans are somewhat more flexible than the government's Home Equity Access Scheme, conditions still apply. To be eligible for the Express Reverse Mortgage, for instance, a homeowner’s property needs to be worth $400,000 or more.

“While these types of products allow retirees to free up cash there are pros and cons,” Zahos said. “Most importantly, it’s important to understand that the interest is compounded and there could be less equity in your home to help pay for aged care when that time comes. It’s best to get independent expert advice.”

The Canstar money expert also made her prediction on the Reserve Bank’s next move.

“With the latest job numbers continuing to show a tight labour market, the Reserve Bank will no doubt focus its attention on the quarterly CPI data due for release on Oct. 25,” Zahos said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.