A third of all mortgage applications across direct and third party channels were neither factual nor accurate with misrepresented loans more common amongst brokers, new research by UBS has found.

The Australian Banking Sector Update, entitled

$500 billion in ‘Liar Loans’?, was compiled by UBS Evidence Lab analysts

Jonathan Mott and

Rachel Bentvelzen and economist George Tharenou. It surveyed 907 Australians who took out a mortgage over the previous 12 months.

The main crux of the research was that only 67% of respondents said their mortgage application was “completely factual and accurate” – far fewer than the 72% who gave the same response in the 2016 survey.

Of the remainder of those surveyed, 25% said their application was “mostly factual and accurate,” 8% said it was “partially factual and accurate” and 1% declined to answer.

Broker concerns

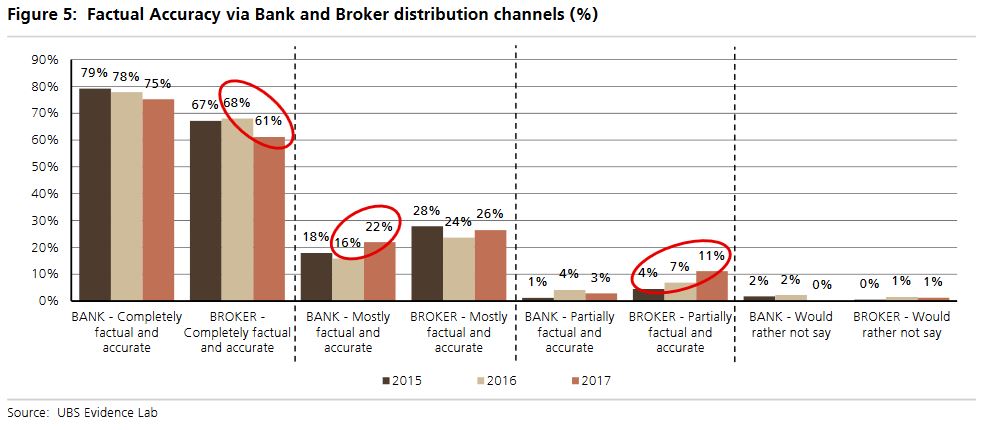

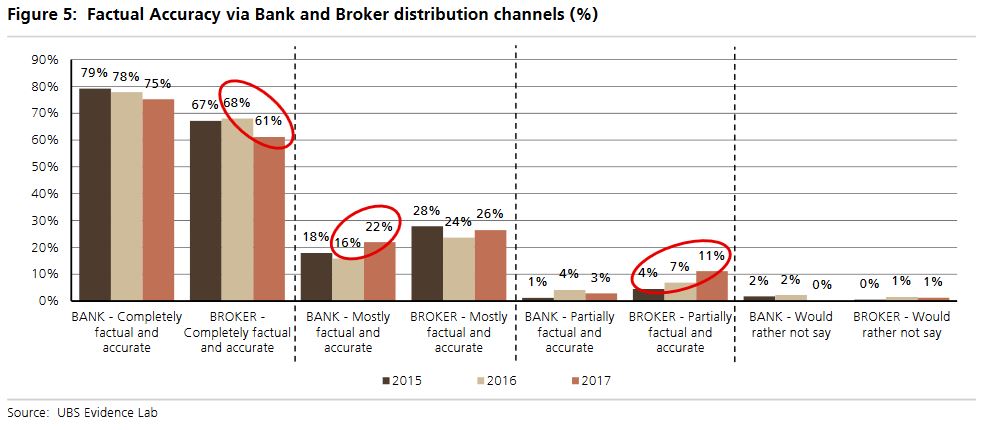

These levels varied across the broker and direct channels however, with discrepancies higher amongst brokers than banks, analysts said. Between 2016 and 2017, the level of accurate mortgages fell from 68% to 61% for brokers and from 78% to 75% for branches.

“Of concern, 11% of participants who took out a mortgage via the broker channel in 2017 stated their application was only ‘partially factual and accurate’. This is a statistically significant increase from both the 2015 Vintage (4%) and 2016 Vintage (7%).”

Analysts also raised another potential issue, saying that 37% of respondents who used the broker channel (and who acknowledged that their applications were not factual) said that they were urged to misrepresent the application by their broker. This was slightly down from the 41% recorded last year.

“This also implies that 14% of all mortgage applications via the broker channel were factually inaccurate following the suggestion of their broker, a similar level to 2016 (13%).

“It is possible that customers who have knowingly misrepresented their loans would prefer to point the blame at someone else, even in an anonymous survey.”

In comparison, UBS analysts said that only 8% of participants approved for a loan through the banks who confirmed inaccuracies within the application claimed they were pushed to misrepresent their loan by the banker.

“This implies only around 2% of bank originated mortgage applications are inaccurate as a result of the suggestion of the banker.”

Because of these figures, UBS analysts estimate that there are approximately $500bn of factually inaccurate mortgages on the banks’ books within Australia.

Looser underwriting

The results also showed applicants were finding it easier to get approved for a mortgage despite the stricter regulatory measures imposed by the

Australian Prudential Regulation Authority (APRA).

When comparing the current process against previous experience, 46% of respondents said it was easier to get a mortgage approved now while 17% said it was harder. These ratios were consistent across both brokers and branch channels.

Participants were also asked about the amount of supporting documents required, with those polled saying there had been no significant increase.

“Despite recent macroprudential policies, the findings of this survey and the fact that mortgage approvals remain at record levels implies that there is little evidence mortgage underwriting standards have been tightened through the eyes of the consumer.”

Related stories:

Research firm calls for FOFA-like broker reforms

ASIC claims “contradict” industry data: FBAA

“Not everyone is built to be a broker”: MFAA