Suncorp Bank has announced lower variable rates for both its Better Together Back to Basics and Home Package Plus offers.

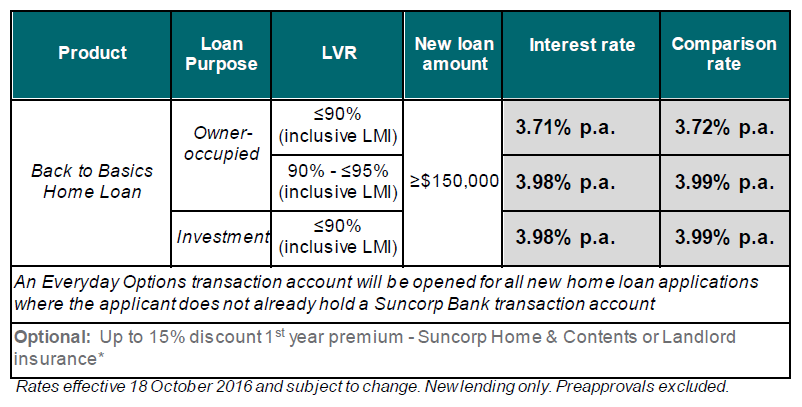

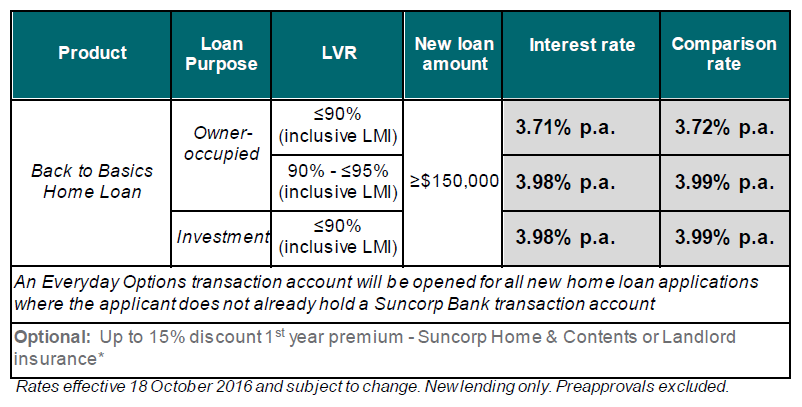

This means new customers can get variable rates from 3.71% per annum for new owner-occupied Back to Basics home loans of $150,000 or more (with a maximum LVR of 90%). Equivalent new investor loans come with a variable rate of 3.98% per annum.

“The Better Together specials provide customers with some of the most competitive variable interest rates in the market, supported by great service, product features and access to benefits from across Suncorp,” said Steve Degetto, head of Suncorp Bank Intermediaries.

Furthermore, the Better Together package also includes transactional banking, lower fees, and home and contents insurance.

“We have waived the upfront loan establishment fee and there are no ongoing account keeping fees on the new Back to Basics home loan and transaction account (an essential requirement of the offers),” Degetto said.

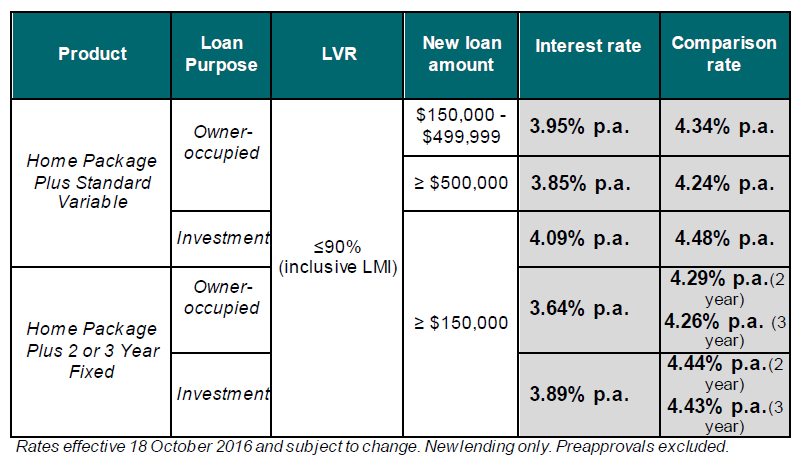

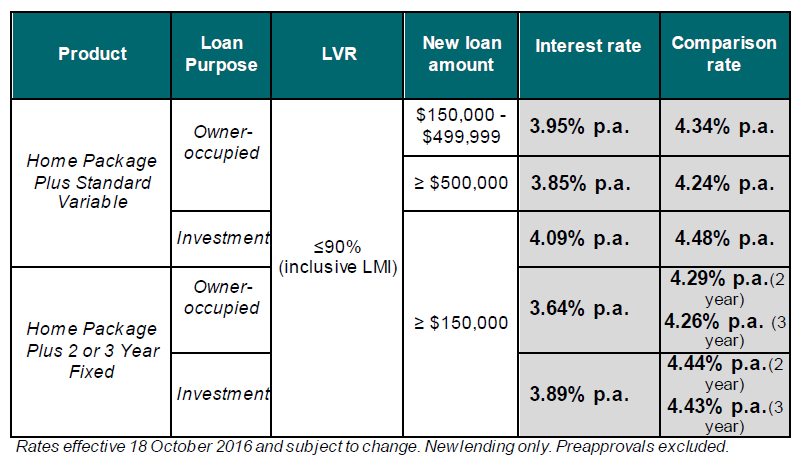

The bank is also offering standard variable discounts on Home Package Plus as well as both two and three-year fixed rates. These start from 3.64% p.a for owner-occupiers and 3.89% for investors.

“This offers greater choice for new customers and will support them in making their next property move. We’re committed to delivering an exceptional service proposition to our broker partners by providing flexible products and features, consistent service and assistance when brokers need it most.”

Both Back to Basics and Home Package Plus are effective from today (18 October) and can be found below: