By

While the big banks escaped largely unscathed, commissioner Hayne’s final report raised huge questions about the future of broking. Australian Broker reports

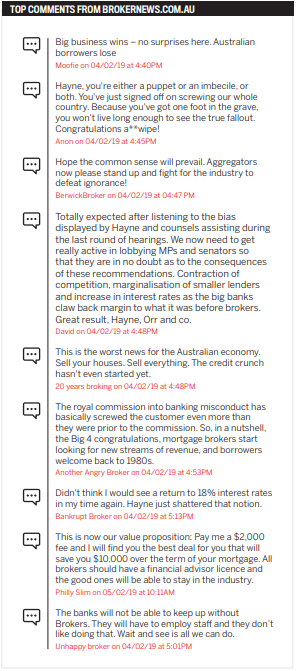

OF the 76 recommendations set out in Commissioner Hayne’s final report, the proposal that brokers should take a 50% pay cut from next year was the one that sparked outrage.

While many were braced for change, few fully expected the sweeping recommendations Hayne included in his three-part report. Nonetheless, the industry was ready to stand up for itself.

In the hours following the news, associations, aggregators and brokers alike were out in force, defending the third party channel and reminding Australia of its worth.

"I thought I was reading a CBA submission to the royal commission to be honest,” says Loan Market executive chairman Sam White.

“I was disappointed that the commission made such sweeping recommendations and apparently they didn’t even talk with a mortgage broker.

.jpg)

Shore Financial CEO Theo Chambers says, “These changes could wipe out the broking industry. Brokers are the voice of many second-tier lenders and smaller financial institutions, so the consumer has probably lost out in all this. It isn’t a recommendation that helps consumer choice.

“In my opinion the whole royal commission has been more in favour of the banks,” he adds.

They aren’t alone in their observations. MFAA CEO Mike Felton labelled the ban on trail a “tax on borrowing”.

In a statement released shortly after the announcement, he said, “These policy recommendations are effectively a new multi-thousand-dollar tax on borrowing. They will put the broker channel at severe risk, damaging competition and access to credit, and [they will] entrench bank power."

Talk soon turned to exactly how broker businesses would survive and the various outcomes that could occur.

“Trail is approximately 50% of income, so if the trail in itself goes and there are no other changes to upfront, that’s a 50% drop in income,” says Trail Homes head and founder Nick Young.

While he says an increase in upfront could compensate for this loss, he also warns that changes to broker remuneration threaten to create an uneven playing field.

“This is not a little bit of tinkering at the edges. What we are talking about here is a destruction of the way that 60% of people today get a home loan. It’s undemocratic and it’s un-Australian. I’m still scratching my head as to the systemic issue this is trying to address,” Young says.

His view is one that extends well beyond the broking community.

“This is what the broker industry was fearing,” says Heather Baister, partner at Deloitte’s assurance and advisory financial services practice.

“You now have brokers being held to a different standard than bank branch staff. A broker, much like a financial planner, will now be held to a best interest standard. However, if you went into a major bank, that lender is only obligated to ensure that a loan is not unsuitable.”

The road ahead

Australia isn’t the first to implement a ban on trail commission.

During the GFC New Zealand also adjusted its remuneration structures to remove trail; however, there the move was compensated for with an increase to upfront commissions, and today there is talk of reverting to the upfront plus trail model once again.

Young says, “To me, the return to trail in New Zealand is a sign that a natural market will want to settle on an upfront and trail model. That is also true in the mortgage broking industry in a democratic country like Australia.”

For Baister, however, an assessment of international models could still hold the key. During the commission’s 68 days of public hearings the fee-for-service models employed in the UK and the Netherlands were regularly referenced. Yet Baister says neither model provides a “perfect working scenario”.

“The UK has a fee-for-service model, but there are concerns there about the extent of churn. The products there are more vanilla and more comparable lender to lender. In the Netherlands, the fee is tax deductible, so although it is paid by the borrower there is a financial offset,” she says.

In Australia trail was introduced almost 20 years ago as a way for the banks to lower the burden of upfront commission payments and, ultimately, defer the cost of origination.

“In Australia the model changed because the banks wanted to defer the outlay and match it up with their own revenue stream. Now, for the banks to decide they have collective memory loss and throw brokers under the bus is the biggest disappointment,” says Ray Hair, executive director of The Local Loan Company.

“Trail was nothing to do with ongoing customer service.

For many, trail covers essential overheads such as staff, and huge questions remain around how such essentials will be covered in future.

Mortgage Choice owner-manager Deslie Taylor employs six staff, with one specifically dedicated to client relationships.

She says, “Mortgage brokers help the economy in so many ways through hiring staff, giving back to the community. Without the trail, how do we stay in business and what will the future commission structure look like? It’s a world of unknowns.”

New revenue streams

Despite the unknowns, many are already looking ahead to what the next 15 months, and indeed subsequent three years, will bring – and it may not all be bad.

“Our argument is that, as long as the net present value of the commission remains the same, brokers can continue to invest in their business and service levels. If that is cut then the concern we have is that broker income drops, which means service drops, compliance drops, and that’s a real concern,” says White.

With net income still hanging in the balance, multiple revenue streams are becoming even more important.

“Take care of your business today. Look after your customer. If you get that right, the rest of your business will be solid. The second thing is to diversify: asset finance, commercial – there is a new urgency around that now,” says White.

“The third thing is to make sure your tech platform is awesome. Keep in touch with customers today to make sure that, as things change and move, we can prove the contact points we have with customers.”

For its part, Loan Market is preparing to launch a weekly training program for brokers who are ready to make the leap into new areas of lending.

Supporting such measures could become commonplace for aggregators as they evolve to take on a new role in the industry – one that involves a greater focus on understanding the challenges brokers face and adopting a stronger business coach role, says White.

“Our role as an aggregator will be helping our brokers to adapt and grow in this environment.

For Hair, the focus moving forward will fall on efficiency, technology optimisation and many viability assessments. The most drastic outcome, he says, will be a complete repositioning of the business.

“As the borrower-fee model, as it’s being called, is fleshed out and we get a better idea of what it will look like, we then have to make an objective assessment of whether or not we will have a viable business. If it is viable, what does it look like? Diversification will be key to that.

“We are already looking at how we provide a range of services to our customers, both existing and prospective,” he says.

There are plenty of areas to diversify into.

From asset finance to commercial, specialist, auto, business and personal lending, the opportunities are there for those who want to leverage them.

MFAA data shows that brokers have started to diversify already. In the six months to March 2018 there was a 125% spike in the number of mortgage brokers also writing commercial loans, taking the total number of brokers to just under 3,700.

Combined, they wrote close to $9bn in commercial loans during that period.

“There is going to be a lot of change, and those who aren’t in a position to be nimble enough to adopt, evolve and embrace the change will struggle,” Chambers says.

And while the brokers go back to school, players from across the industry will continue to fight their corner.

FBAA executive director Peter White says the association has a “significant and unique initiative” planned with key influencers and senior ministers on both sides of government.

“We know the Liberals well, but there will be a strong focus on Labor, and it’s something that in my time in the industry I haven’t seen done in the past. It’s a significant initiative with regard to those interactions and to make sure our message is clearly understood,” he says.

Meanwhile, the MFAA is extending its ‘Your Broker Behind You’ drive through a new multimedia campaign launched in the days following Hayne’s final report.

However, the focus for now should be business as usual.

As Hair says, “There is still an opportunity. It’s not over; we have to fight this, we have to be vocal, and we have to step up and produce the evidence to demonstrate that some form of workable remuneration model that maintains viability of a very important small business sector is critical.”