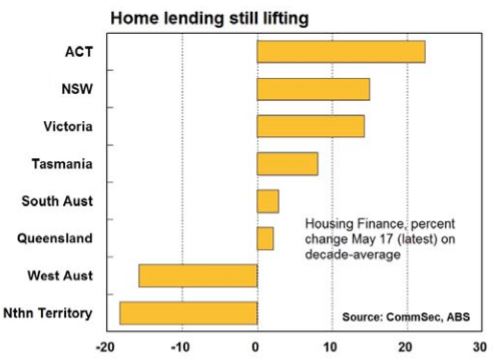

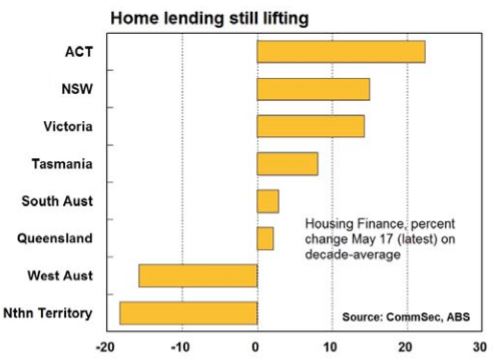

The Australian Capital Territory (ACT) is leaps and bounds ahead of all other states and territories in terms of housing finance commitments compared to the decade average.

The

CommSec State of the States report found that housing finance commitments are above decade level trends in the ACT, NSW, Victoria, Tasmania, South Australia and Queensland.

However, only Tasmania featured levels above those recorded a year ago (+7.0%) with a decrease in loan commitments found in all other states and territories.

Levels of housing finance commitments for the states and territories compared to the decade average are as follows:

- ACT (+22.4%)

- NSW (+15.0%)

- Victoria (+14.3%)

- Tasmania (+8.1%)

- South Australia (+2.8%)

- Queensland (+2.2%)

- Western Australia (-15.8%)

- Northern Territory (-18.3%)

“Housing finance is not just a leading indicator for real estate activity and housing construction but it is also a useful indicator of activity in the financial sector. It would be useful to compare figures on commercial, personal and lease finance, but unfortunately trend data is not available for states and territories,” the report said.

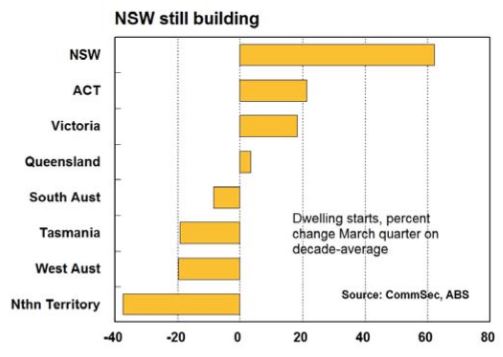

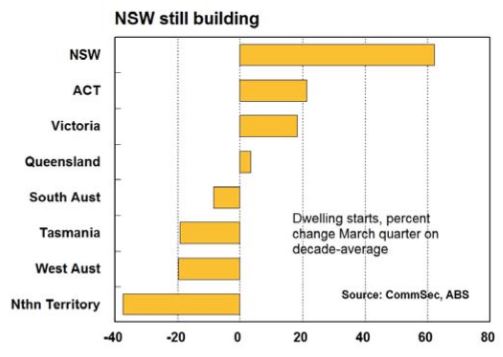

CommSec also looked at the trend number of dwelling commencements compared to the decade long average with home building outlook mixed across the country.

Dwelling commencements were higher in NSW, ACT, Victoria, and Queensland while they dropped in SA, Tasmania, WA and NT. Percentages compared to the decade average can be found below:

• NSW (+62%)

• ACT (+21.4%)

• Victoria (+18.2%)

• Queensland (+3.4%)

• South Australia (-8.5%)

• Tasmania (-19.3%)

• Western Australia (-19.8%)

• Northern Territory (-37.0%)

Looking at annual growth, only the ACT had building levels higher than those recorded a year before (+3.5%).

“Starts are driven in part by population growth and housing finance and can affect retail trade, unemployment and overall economic growth. However, any over-building or under-building in previous years can affect the current level of starts,” CommSec researchers said.

Related stories:

Median house price at record $818k

Home loan arrears level now stable

June quarter sees drop in mortgage applications

Related stories:

Median house price at record $818k

Home loan arrears level now stable

June quarter sees drop in mortgage applications

.jpg)