The amount of equipment and plant leasing occurring amongst Australian businesses is set to grow in what has been seen as a multi-billion dollar market.

According to the Australian Bureau of Statistics (ABS), $52bn will be spent on commercial assets by the end of this financial year. Of this, $40bn worth of equipment will be purchased outright while $12bn will be leased.

This is compounded with an increased positive focus by business with the latest

Alleasing Equipment Demand Index predicting large numbers of commercial enterprises seeking to increase their asset base.

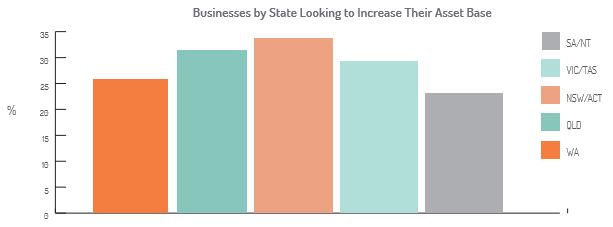

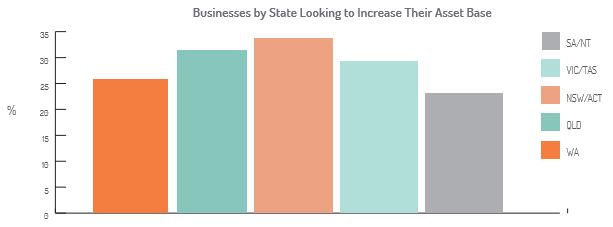

Nationally, 30.6% of businesses plan on increasing their asset base during the June quarter. This has gone up from 25.6% from Alleasing’s previous index. On a state-by-state basis, the percentage of businesses looking to purchase more equipment is as follows:

Within the mining sector, 26.4% of firms indicated they wanted to expand their asset base in the June 2017 quarter, which was up significantly from the 17.6% measured in the last index.

“We are clearly seeing businesses in the mining services industry regaining confidence. Although the number of firms intending to increase their asset base is below the national average, it has jumped 7% from the previous quarter,” said Daniel Blizzard, chief executive of Alleasing.

Cost of capital seems to be an issue for 60.2% of small and medium enterprises (SMEs), 50.3% of lower corporates and 43.5% of upper corporates however. This means cost cutting is a continuous exercise which can take precedence over growing a business, Alleasing found.

While the steady increase of firms seeking to purchase more assets shows renewed confidence, impediments to growth mean that firms have to rely more on their own funds especially with the tighter credit policies of some lenders.

“Not all of the $40bn [that] businesses will spend on buying assets this year could be financed, but if a portion of these funds were freed up for growth via the use of alternative capital, we could see a significant impact on individual businesses and the broader economy,” Blizzard said.

Related stories:

Annual mortgage lending increases by 7.5%

New tools released targeting SME lending

Industry association to hold commercial lending masterclass