.png)

By

Many industry figures have embraced CBA's recently unveiled changes to broker accreditation, but some question the bank's decision not to work with new entrants and how that might affect the future of the industry

After a fractious year between brokers and the CBA, the major bank did not go about ingratiating itself with the third party channel before the summer break.

Instead it announced on 14 December that it would be freezing accreditation for the remainder of 2017 to implement new benchmarks designed to lift standards, emphasise education and “ensure the bank is working with high-quality brokers” in the new year.

Starting in early 2018, the bank said mortgage brokers wishing to write CBA loans would need to hold at least a Diploma of Finance and Mortgage Broking Management; be a current member of either the MFAA or the FBAA; and be a direct credit representative or an employee of an approved aggregator/head group or an Australian credit licence holder.

But the point that raised the most contention and debate among industry members was the CBA’s firm stance on only doing business with brokers who have at least two years’ experience writing residential loans.

.png)

While many industry figures said they were supportive of CBA’s attempt to lift standards and consumer outcomes, they disagreed with the bank’s decision not to work with new entrants, saying it could prove damaging to the bank’s business and the future of the industry.

Where does this leave new brokers?

The mortgage broking industry has been steadily growing over the last couple of years, with hundreds of new brokers joining the sector every six months.

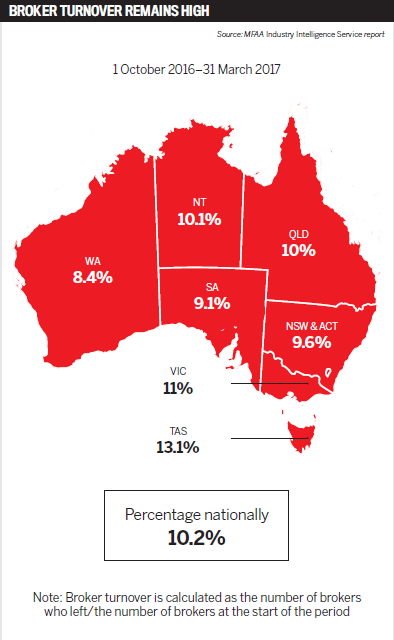

According to the MFAA’s latest Industry Intelligence Service report, for 1 October 2016 to 31 March 2017, the broker population reached 16,009 brokers during this period, 500 more than in the previous six months.

Broking is not an easy job and attrition rates are high. Of all those who joined the industry during those six months, 10.2% left, a trend that’s expected to continue.

Barring new entrants from accessing the largest lender in the country could prove to be another hurdle for those who already face steep challenges. It will likely force brokers to establish their skills elsewhere and take their loans elsewhere, leaving them with “no need for CBA in the future”, says FBAA executive director Peter White.

Not everyone sees CBA’s accreditation changes as being that significant, however. Most lenders have similar criteria in place, and the MFAA and the FBAA also have their own education standards.

.PNG)

Brokers who have less than two years of loan-writing experience must obtain their mortgage broking diploma within the first 12 months of becoming an MFAA member. FBAA members are required to have their Cert IV, but White says the vast majority have also received the diploma or have pursued higher education degrees of their own volition.

White is of the opinion that effective learning and education should not be foisted upon people. “Undertake learnings because you want to and you believe it will be beneficial to you in your business or personal knowledge. Do it in your own time and pace, and in line with what is legally required by law,” he says.

Where CBA has upped the ante compared to other lenders, however, is in making it mandatory to have a diploma, and specifying the amount of experience required.

Sam Boer, CBA’s general manager of third party banking, explained in an earlier interview with Australian Broker that the two-year rule has always been part of CBA’s accreditation policy; it’s just that now the bank has decided to take a firmer position on it.

“Two years has actually always been the policy, but what we noticed was that there were a lot of different mentoring standards being applied, and we felt that this really needed to be improved upon,” he said.

“You wouldn’t expect to see too many exceptions to that rule, but what we’re seeing in recent

times is that basically every accreditation has been an exception.”

CBA said brokers would also be put under additional questioning during the accreditation process, with more scrutiny on the individual, the company they work for, the head group they’re partnered with, the quality of their business, and how they have been operating.

Rebecca Barbe, broker and owner of Finance Solutions Queensland, says she doesn’t take issue with CBA’s accreditation changes because they underscore the importance of getting sufficient on-the-job training.

“There are more people who enter this industry and think it’s an easy way to make money, and it’s not. If you have that mindset, that’s when things like compliance aren’t important to you, and compliance is such a huge part of this industry.”

It’s not so much getting a formal education that matters but gaining experience working with clients, writing loans and reading financials, something new brokers should do by working as loan writers and getting a mentor early on, Barbe says.

Overall, she doesn’t see CBA’s move itself as having a major impact on new brokers. It will only pose challenges for them if the other majors and some of the second-tier lenders follow suit.

“You can’t become a broker without the big four on your panel, so it depends on what the others do. Time will tell.”

Lifting the bar

Mark Vilo, head of bank intermediaries at Suncorp, says it’s understandable that the largest Qldlender in the country is tightening its policies around the accreditation process, and he generally doesn’t consider the changes to be hugely significant.

It’s more about the message behind it: it’s a flag to the market that education standards need to be raised across the board to ensure brokers and other industry players are suitably educated and are in an environment of constant learning, Vilo says.

“It will impact the industry and it will create dialogue and it will create some action,” he says. “In terms of consumer outcomes, having a better-educated individual that’s been in the industry longer can help, but it doesn’t automatically translate to a better broker.”

“You can’t become a broker without the big four on your panel, so it depends on what the [other lenders] do. Time will tell” - Rebecca Barbe, Finance Solutions Qldlender

Clive Kirkpatrick, general manager of Vow Financial, echoes these sentiments. He says the YBR group is broadly in agreement with what the CBA has put forward.

“From our perspective, we’ve already read the tea leaves and we want to move this from an industry to a profession, and to do that we need to improve education levels,” he says.

It’s not so much the level of qualification that’s an issue, he adds, but the ongoing and continuous education needed to help people improve. He says it’s about encouraging people who are better educated and can understand financials, who are good at building relationships with customers and can deliver better advice, to join the industry.

“CBA can’t go at it alone. I would have thought it would have been better that the Combined Industry Forum (CIF) made this statement and the agreement and the action to move forward with education. But I’m glad that the CBA has put a line in the sand,” Kirkpatrick says.

So far, it does seem that the CBA is going at it alone. The CIF actually made little mention of brokers’ expected education standards or requirements. It instead provided recommendations around educational content at conferences and professional development days and looked at whether there were any conflicts of interest if lenders and aggregators provided financial support for education and training.

As brokers get older and start retiring from the industry, it’s important for the future of the profession that companies foster the growth and education of new entrants, Kirkpatrick says.

“I just completely disagree with having a freeze on bringing new people into the industry. I just think it’s the wrong thing to do. CBA has taken a unilateral stance on that at the moment,” he says.

With new brokers diverted away from CBA, it could actually benefit the other majors and non-majors.

Suncorp will continue to support and educate new-to-market brokers, something Vilo says they often remember later when their careers have kicked off.

“The challenge will be, for lenders like the CBA, ensuring that they get some currency from brokers who have been in the market for two years and have never done business with them,” he says.

He also says Suncorp is satisfied with its current accreditation criteria. “Between now and the foreseeable future, we’ve got no plans to say to any broker that you need to have a minimum of two years of experience to be able to do business with us – not at all.”

Two sides to every opinion

Most people seem to be split on the changes and what their outcome will be.

On the one hand, the more time and energy that’s invested in helping people understand a bank’s products, processes and policies, the better the broker will be at advising a customer, Kirkpatrick points out.

“In the longer term, if CBA holds firm on that particular [two-year rule], then it would be detrimental to their business,” he says.

But on the other hand, brokers shouldn’t be resistant or offended by CBA’s attempts to raise the bar.

“We all owe it to our customers to provide better quality, so if [brokers have] got an issue around providing better-quality advice and delivering better-quality submissions to a bank, then that’s probably not a profession they want to be in for the long term.”

This article appeared in the January 2018 issue of Australian Broker magazine.