Australia’s incredibly tight rental market constricted even further last month, with new rental listings on realestate.com.au nationally down 18.9% month-on-month in April, according to PropTrack Market Insight.

“There was little relief for hopeful renters in April, with new listings recording the largest monthly decline since 2017,” said Cameron Kusher (pictured above), PropTrack director of economic research.

“The larger capital cities are seeing supply tighten, creating incredibly difficult conditions. However, pressures are starting to ease in regional areas and smaller capital cities as pandemic-induced trends begin to reverse.”

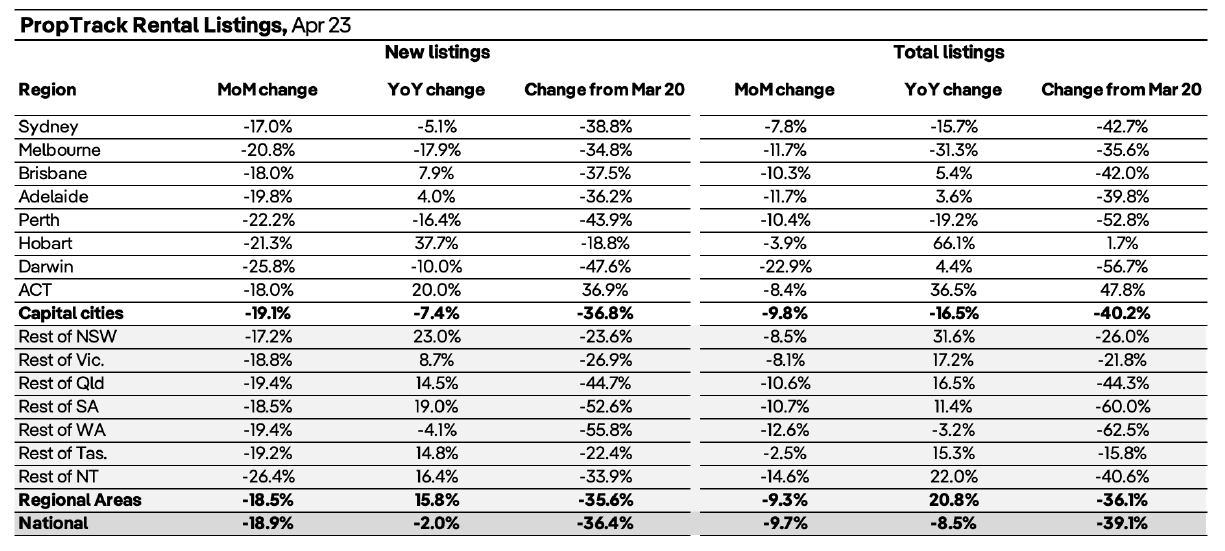

In capital cities, new rental listings fell 7.4% year-on-year in April but increased 15.8% in regional areas over the same month.

Given the decline in new rental listings over the month, total rental listings were also lower nationally, down 9.7% month-on-month in April. But while regional markets saw a 20.8% rise in the total number of properties for rent, the figure was 16.5% lower in capital cities.

“Sydney (-5.1%), Melbourne (-17.9%), Perth (-16.4%), regional WA (-4.1%), and Darwin (-10%) all recorded a decrease in new listings over the year,” Kusher said. “Excluding Darwin, these areas also recorded declines in total listings over the year, led by Melbourne (-31.3%), Perth (-19.2%), Sydney (-15.7%), and regional WA (-3.2%).”

Although rental supply increased in some markets, total stock for rent remained significantly lower compared to the start of the COVID-19 pandemic in both capital cities and regional areas, which were down -40.2% and -36.1% respectively, with Hobart and Canberra the only regions that had more stock for rent than at the start of the pandemic.

“Without an imminent increase in supply, the stock of rental properties will remain low, exacerbating the competitive conditions renters currently face,” Kusher said.

Use the comment section below to tell us how you felt about this.