By

A UNSW economics professor has sounded the alarm on Australia’s $1.7trn mortgage market, warning that banks, regulators and borrowers aren’t taking the signs of its unravelling seriously enough. Are brokers part of the problem?

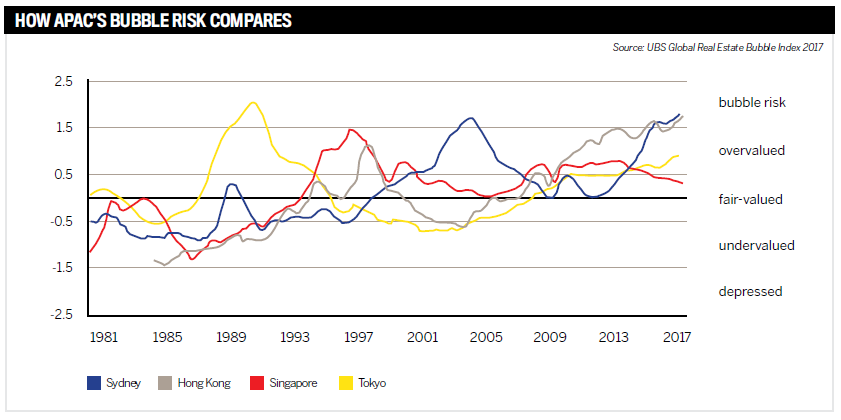

There's been much debate among experts over the years about a bubble in Australia’s property market and whether it’s about to burst. It’s not always clear who’s right. What is clear, however, is that the voracity of local and overseas buyers of Australian property is insatiable despite attempts to quell it.

Last November, home loan financing reached a record high of $24bn, with nearly 62,000 loans settled, according to ABS data analysed by Finder.com.au.

So while there is some evidence that macroprudential measures are starting to take effect, banks are still in the business of lending, and whether borrowers will be able to bear the financial burden in the future is something that has occupied UNSW economics professor Richard Holden.

Holden recently sounded the alarm on the Australian property market, warning that it is heading in a similar direction to the US market prior to the subprime mortgage crisis, something he doesn’t think banks, regulators and borrowers are taking seriously enough. And he suggests brokers are part of the problem.

“I was a professor at the University of Chicago during the crisis. I watched the mortgage meltdown, the collapse of credit markets, and what was nearly a repeat of the Great Depression,” Holden told Australian Broker.

What are the signs?

In an opinion piece in the Australian Financial Review, Holden wrote that there were several signs indicating that the Australian housing market is on the same trajectory as the US market prior to the 2007-08 financial crisis.

According to Holden, those markers include Australian banks’ propensity for high-LVR loans and interest-only loans, borrowers fudging details about their household expenses and incomes, and borrowers paying very little towards their housing deposit or using funds from unsecured personal loans.

While interest-only loans have declined lately, reflecting APRA’s move last March to cap investor loan growth to 10% and interest-only loans to less than 30% of new mortgages, they still account for a large portion of mortgage lending.

In the latest AFG Mortgage Index to December 2017, which takes into account loans originated by the aggregator’s near 3,000 brokers, interest-only loans across Australia accounted for 33% of the mortgages lodged in the last quarter of FY17.

“Interest-only loans in Australia typically have a five-year horizon, and to date have often been refinanced. If this stops then repayments will soar, adding to mortgage stress, delinquencies, and eventually foreclosures,” Holden wrote.

Holden says the issues he’s identified in the Australian market are compounded by brokers because of their commission structure.

“Their incentives are thoroughly misaligned with both borrowers and lenders – just as was the case in the US a decade ago. There are also high-powered incentives for those originating loans with banks, creating more moral hazard,” he wrote in the AFR.

In a follow-up interview with Australian Broker, Holden said he thought “brokers should get something close to no commissions, or have the commissions deferred and depend on repayment rates over several years”.

Holden is not the only one who’s raised these issues. In UBS’s controversial ‘Liar Loans’ report published last year, the bank’s analysts said a third of the 907 mortgage holders surveyed had provided some inaccurate information on their loan applications, with more discrepancies appearing through the broker channel. UBS estimated that $500bn in mortgages were based on inaccurate information.

But brokers, broker associations and other academics have different views on the risks in the housing market and the role that brokers play in it.

Jeffrey Sheen, an economics professor at Macquarie University, says there are very few similarities between Australia’s market now and that of the US prior to the 2008 financial crisis. That was a problem of subprime lending, much of which came from the shadow banking system and resulted in a significant rise in home ownership among households with low credit scores, he explains. Once interest rates rose, it led to an increase in delinquencies and foreclosures.

“Risk assessment of the mortgage portfolios was incredibly bad, leading to underwriting failures,” Sheen says.

“We see little of all that in Australia now. Much of the new growth in lending for property in Australia has instead been from investors who typically have lower price-to-income ratios than the average household. Funds largely come from the main banks.”

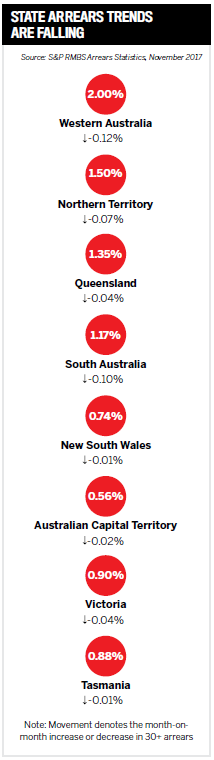

While brokers could be in a position to encourage borrowers to apply for larger loans than they need, Sheen doesn’t think this is a significant issue in Australia, given the low delinquency and foreclosure rates here.

“Large financial institutions dominate Australian lending for housing, and they have sophisticated practices in place to assure good lending. Failures exist, but are not significant now,” he says.

While he couldn’t comment on brokers’ remuneration structure, he says in his personal experience brokers can and do provide “an invaluable link between the borrower and lender”.

MFAA CEO Mike Felton refutes Holden’s arguments about brokers, pointing to the ASIC remuneration review and the Sedgwick report, which found no evidence of systemic harm to consumers.

“A broker’s model is based on strong relationships and referral business and positive outcomes,” he says. “If they found wrongdoing, [brokers] face consumer protection legislation, clawback and the potential loss of their business. There is a significant incentive for them to behave appropriately.”

According to data from the Credit and Investments Ombudsman, it appears brokers are doing just that. Only 6% of consumer complaints received by the office relate to brokers and aggregators, compared to 46% related to residential lenders.

That, along with brokers’ growing market share, which is now at nearly 56%, is a “strong affirmation of the broker value proposition and the incredible service that they’re providing”, Felton says.

“A broker has a responsibility to ensure they are asking the appropriate questions to establish the needs and to match product to needs and to collect the appropriate information for the application and consideration. But at the end of the day, it is the lender who is making the credit decision as to whether or not to lend.”

In the broker’s corner

In September last year, PJ Patterson experienced a career highlight as a broker. A young first home buyer family approached him after being declined by their bank. He helped them get a $630,000 loan through NAB, and they went ahead and purchased their dream home in country NSW. But this was not just any house: its contents and construction had been entirely donated, and all the funds raised in the sale would go towards the Children’s Cancer Institute.

“Most brokers put their heart and soul into arranging the most appropriate loan for their clients and do not get paid extra for the tremendous value-add service provided,” says Patterson, CEO of Keystone Financial.

Patterson took issue with Holden’s interpretation of brokers and their work, saying if the professor were to learn more about the industry and the service that brokers provide, “I dare say he would retract and revise his comments”.

“I would argue that brokers provide more of a handbrake to lending than we are given credit for,” he says.

As the first finance professional many clients speak to, a broker often has to lower their clients’ expectations about their borrowing capacity, Patterson says.

“There is a huge disconnect right now in the market where consumers think they can borrow a certain amount but in reality they cannot.”

What more could be done?

Borrowers may not always be accurate on their loan applications, but that doesn’t mean they are intentionally lying or that brokers are complicit in it. Most people likely can’t accurately calculate their household expenses.

Therefore APRA recommends ADIs use the greater of a borrower’s declared living expenses and apply an income and other serviceability buffers.

According to research cited in an article on ‘liar loans’ in The Conversation, banks estimate on average $1,637 more for monthly expenses than applicants report.

“Based on the bank’s calculations, housing investors underestimate their monthly expenses by $1,932 on average, while owner-occupiers underestimate by $1,560 on average,” the article said.

The Australian Bankers’ Association told Australian Broker that “banks have strict obligations to lend responsibly and determine whether a customer can afford to repay loans. When it comes to home loans, banks are now typically requiring larger deposits from Australians”.

An ABA spokesperson added that, over the past eight years, new loans where customers borrow 80% or more than the value of the property have declined significantly while new loans, where customers borrow 90% or more, have fallen to a record low.

“Banks are working with representatives from the mortgage broking industry to change remuneration structures to promote better outcomes for customers. This includes changing the standard commission model to avoid financial incentives that encourage consumers to borrow more than they need or will use, for example, by basing commissions on facility draw-down net of offset,” the spokesperson said.

Holden says he was aware of the reforms proposed by the Combined Industry Forum.

“They are going in the right direction but it may be too little too late. Tighter macroprudential regulation by ASIC is important, including more action, in addition to what they are doing on interest only loans,” he says.

Sheen, on the other hand, believes the regulators’ macroprudential measures to deal with systemic risks are sufficient and may soon be due for marginal relaxation.

“It is time to watch and see how well recently implemented measures work, and be prepared to fine-tune them, which may even mean easing some of the interventions,” he says. Patterson supports APRA’s measures to tighten lending standards to ensure the health of the market.

“We currently have a serious debt problem, and I am glad the regulators are finally doing more about it. However, we must ensure the regulation pendulum does not swing so far towards tightening as to destabilise or harm the industry. For now I think everyone is doing a good job of getting this right,” he says.

The only downside is for the consumer who is caught in the middle, Patterson says.

“It is now incumbent on every broker to educate their clients about what is happening and why lending has changed.”

It’s this complexity that many argue actually reaffirms the role of the broker, making them instead part of the solution.