Peter Marshall (pictured above), Mozo finance expert, voiced a widespread agreement on RBA’s decision to maintain the cash rate at 4.35% in February, suggesting that previous increases have begun to curb inflation effectively.

“There’s general agreement that not moving in February was the right thing to do... the rate hikes they’ve already delivered may well be enough to do the job of getting inflation down,” Marshall said in a Mozo release.

With the RBA meeting on March 19 approaching, experts, including those at CBA, ANZ, NAB, and Westpac, predict the cash rate will remain unchanged for the fourth consecutive time.

“There’s plenty of information coming through that suggests key indicators, such as spending, borrowing, and employment, are all showing that the rate hikes are making a difference,” Marshall said.

The consensus among the big four banks is clear, with each predicting the cash rate will stay at 4.35% in March. This agreement reflects a cautious optimism that the current rate is sufficient to continue influencing the economy towards the RBA's targets without necessitating further hikes or premature cuts.

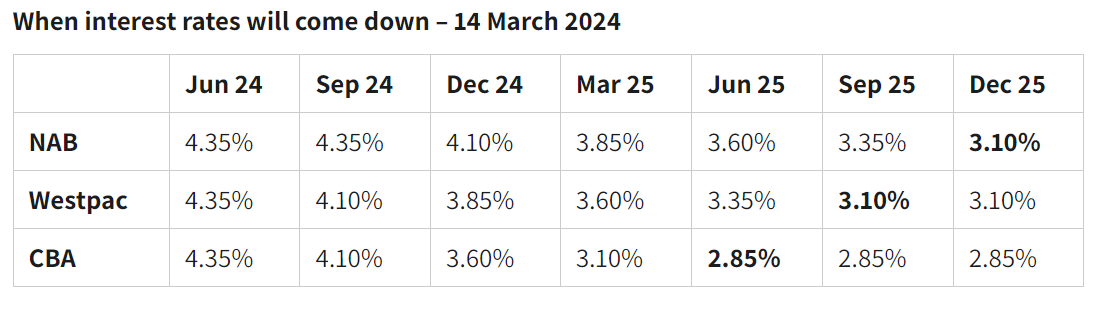

While official interest rates are tied to inflation targets, current predictions from the big four banks vary, with most eyeing the latter part of the year for potential rate cuts.

“The latest annual CPI figure suggests headline inflation is at 4.1%... Predictions ... typically point to September/December this year for the first cash rate cuts,” Marshall said, suggesting a possible reduction to 2-3% sometime in 2025.

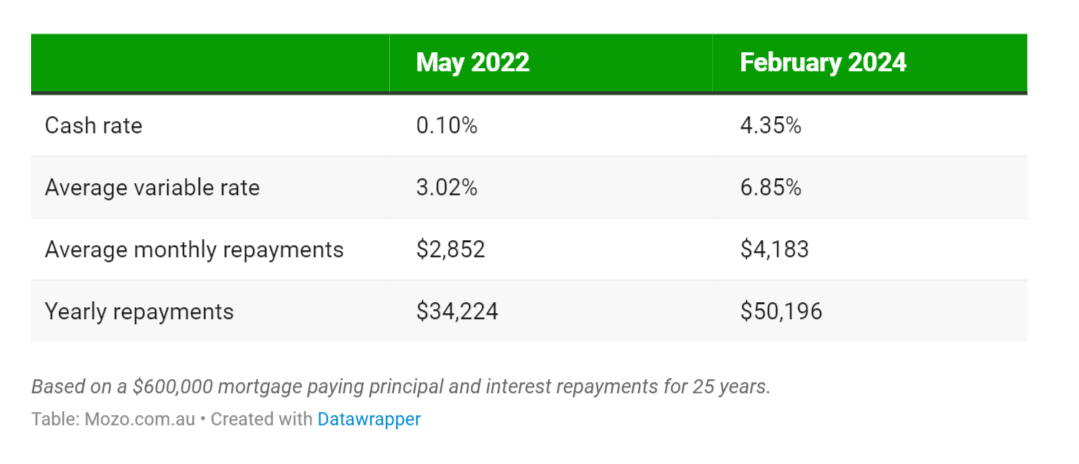

With home prices escalating, the surge in interest rates intensifies affordability concerns. See how these rate changes have significantly increased average mortgage repayments:

For home loan borrowers facing the stress of rising repayments, Marshall recommended considering refinancing or utilising offset accounts as viable strategies to mitigate interest burdens.

“Have a look at what other rates might be available to you ... and see how much you could save by switching,” Marshall said.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.