The Australian mortgage market has shown a diverse range of interest rate adjustments over the past week, reflecting the ongoing adjustments by financial institutions in response to economic signals, Canstar has reported.

Canstar’s latest weekly interest rate movements wrap-up highlighted several key changes in the home loan interest rate space.

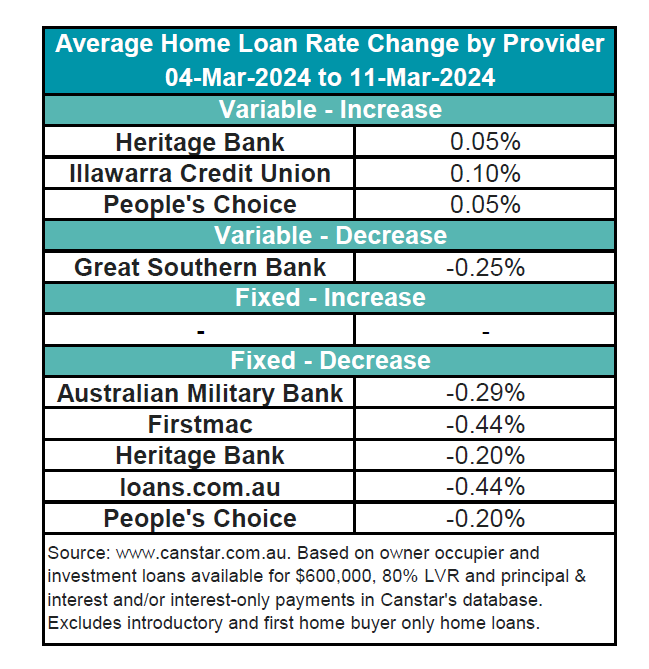

A minor increase was noted as three lenders upped 15 owner-occupier and investor variable rates by an average of 0.06%. Conversely, a more substantial decrease was observed with Great Southern Bank cutting two owner-occupier and investor variable rates by an average of 0.25%.

In terms of fixed rates, five lenders reduced 78 owner-occupier and investor fixed rates by an average of 0.33%.

See table below for a snapshot of last week’s rate adjustments.

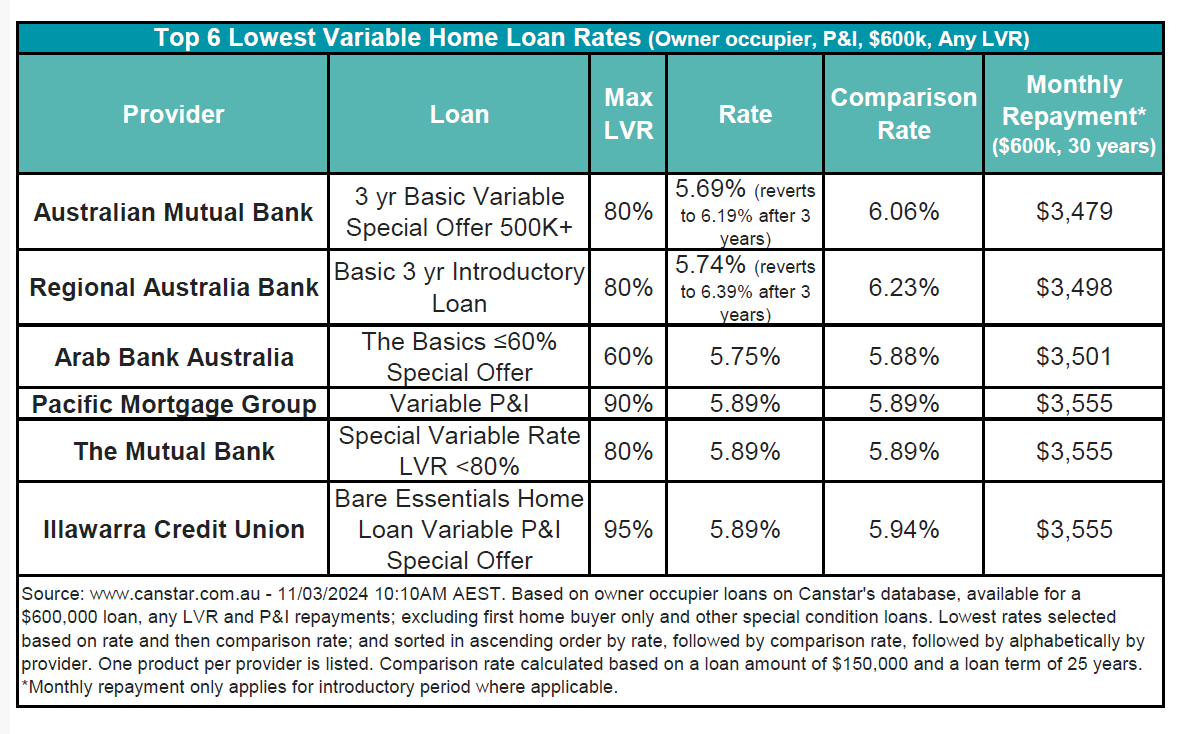

The current average variable interest rate for owner-occupiers paying principal and interest stands at 6.90% for an 80% LVR, with the lowest variable rate at 5.69%, an introductory offer by Australian Mutual Bank.

Canstar’s database now boasts 20 rates below 5.75%, an increase from the previous week’s count of 19. These rates are available at Australian Mutual Bank, HSBC, LCU, People’s Choice, Police Credit Union, RACQ Bank, and Regional Australia Bank.

See table below for the lowest variable rates available on the Canstar database.

Steve Mickenbecker (pictured above), Canstar’s finance expert, commented on the notable actions within the last week, particularly highlighting the significant cut to fixed home loan rates by five lenders.

Mickenbecker suggested that “the spread of fixed-rate cuts across all terms suggests building confidence that we are now just in a waiting game for an inevitable Reserve Bank rate cut.”

Reflecting on the broader economic context, he noted the recent 0.2% GDP growth for the December quarter, a decline from the June quarter’s 0.3%. He interpreted this as a sign that the RBA might reconsider its previous rate hikes, offering a glimmer of hope for borrowers.

“At least borrowers can take comfort that there will be no more rate hikes for this cycle,” he said.

Furthermore, Mickenbecker pointed out the reopening of borders to migrants and the resultant impact on GDP per capita, which has seen a decline for the third consecutive quarter.

“Maybe we’re not technically in recession but to a lot of people, it will feel like it,” he said, suggesting that the economic indicators may not fully capture the lived experiences of Australians.

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.