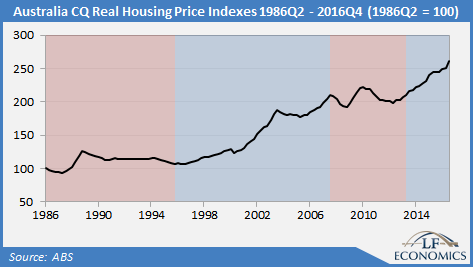

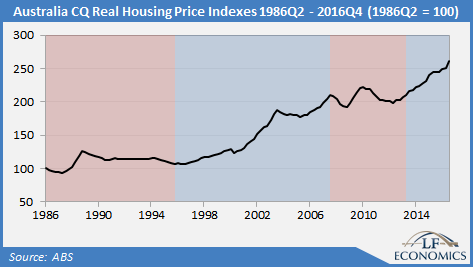

A new historical analysis has revealed Australian house prices have surged mostly when the Liberal National Party (LNP) was in power.

From Q2 1986 to Q1 1996 under the Australian Labor Party (ALP), housing prices –adjusted for inflation and quality – rose by 9.1%, wrote Philip Soos, cofounder of LF Economics and coauthor of Bubble Economics, in a recent blog post.

Once the Howard government was elected however, house prices rose by more than 121.4% between Q1 1996 and Q4 2007.

During the subsequent ALP government with Rudd and Gillard, housing prices dropped by 0.4% due to the global financial crisis (GFC). Values then increased by 31% during the Abbott/Turnbull years.

Despite the correlation between government and house price trends, neither party could be individually blamed for the rapid rise of property values, Soos told

Australian Broker.

“I don’t think that either the Liberal or the Labor government actually intentionally inflated prices. It’s only happened on the Liberal’s watch – especially under Howard – and that was mostly due to the financial deregulation which was implemented by Labor during the early to mid-1980s.”

Once the early-90s recession cleared the way, “the banks could lend to anyone who had a pulse,” Soos said, which helped generate the price growth experienced during Howard’s time in power.

However, Howard took two steps which also helped elevate prices, he added: the 1999 fixed percent discount on capital gains and the 2000 reinstitution of a federal first home owner’s grant (including a 2001 top up).

“This probably helps to explain why you see a huge increase from 1999 onwards.”

With the Abbott/Turnbull government, price growth was mainly due to a rebound after the global financial crisis years, Soos said.

“They’ve not actually done much of anything either way. They’ve engaged in a lot of dithering about affordability but they’ve actually not taken much action.”

The rise in prices has had nothing to do with policies increasing supply, he said, and has rather been attributable to interest rate cuts by the Reserve Bank of Australia (

RBA) which initiated another round of price growth and the current construction boom.

As for Labor, while prices did drop during the GFC they swung back up briefly due to Rudd’s bailout of the banking sector and an increase in the first home owner’s grant. Large RBA cuts also helped initiate another smaller round of price growth.

If Labor does win the next federal election, Soos said he saw a definite flow on effect onto house price trends, particularly the extreme rise in values currently seen in Sydney and Melbourne.

“If they implement their changes to negative gearing and capital gains tax, we definitely should see prices moderate off if not fall slightly.”

Related stories:

NSW housing completions at 46 year high

Property prices must drop by half, says expert

Mortgage arrears trending upwards nationally