Australians spend an average $803 to refinance an owner-occupied home, but just how much rate discount will they need to secure to make sense of switching?

Costs associated with refinancing a home loan include fees such as the discharge, application, valuation, documentation, legal and settlement costs.

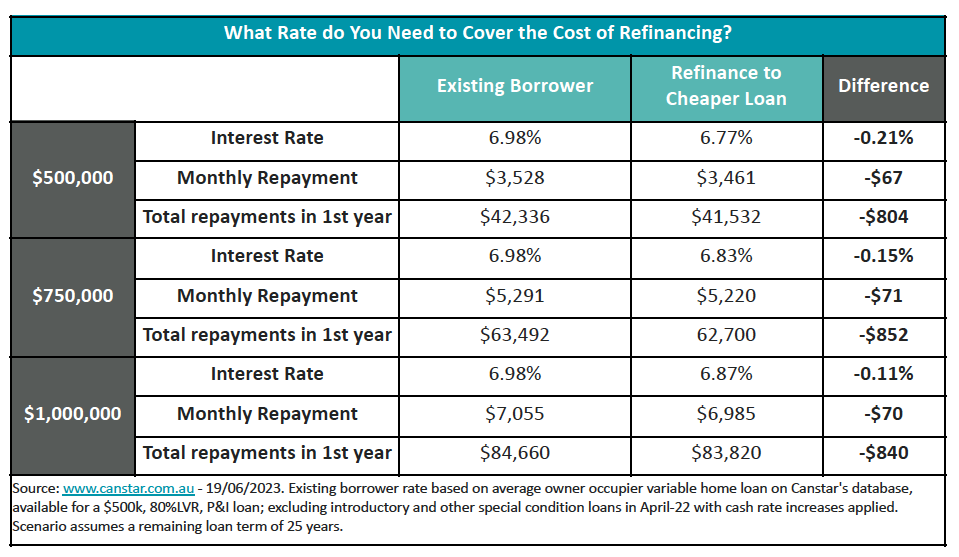

According to a Canstar analysis, a borrower with a $500,000 loan with an existing average variable rate of 6.98% will need to secure a rate discount of 0.21%, to recoup their refinancing cost within the first 12 months of making the switch.

This would take their interest rate to 6.77%, slashing $67 off their repayments per month or a total of $804 in the first year, which is enough to cover the cost of refinancing.

“The number of home loans refinanced has reached record highs recently,” said Effie Zahos (pictured above), Canstar editor-at-large and money expert. “In the 12 months to April, 433,453 loans were refinanced to a new lender, according to the latest figures from the Australian Bureau of Statistics.

“If borrowers are spending on average just over $800 per refinance, this means that collectively they could have spent more than $348 million in refinancing fees in one year… If you don’t secure a discount of at least 0.21 percentage points, it’s not worth the hassle and paperwork.”

The aim, of course, Zahos said, was to try and always secure the lowest possible rate, as there’s no guarantee that the lender the borrower will make the switch to will always maintain that interest rate discount in a rising interest rate market.

Zahos warned borrowers against extending their loan to a full-30-year term when refinancing, because although this will lower repayments even further, they’ll not only have to pay for longer, they’ll also need to pay more interest in the long run.

Homeowners whose loan is more than 80% of their property’s value may find it more challenging to recoup the cost of refinancing in the first year.

A borrower with $500,000 home loan and an LVR that was 90% of the property’s value, for instance, would need to secure a rate discount of 3.24%, in order to recoup the cost of refinancing and lenders mortgage insurance. That would take their interest rate from 6.98% down to 3.74%, which according to Canstar “doesn’t exist in today’s market.”

“Unfortunately, a breakeven analysis for homeowners whose loan is over 80% of the value of their property would more than likely show that the costs outweigh the benefits of refinancing,” Zahos said, adding that those unable to avoid paying LMI when refinancing are better off negotiating a better rate with their existing lender.

Use the comment section below to tell us how you felt about this.