Property investors will be more vulnerable than owner occupiers if a national economic downturn occurs in the future, analysts from Moody’s Investors Service have found.

In a new

Sector Comment released yesterday, analysts looked at investor trends in Western Australia and concluded that a similar scenario could occur across the country in the event of poorer economic trends.

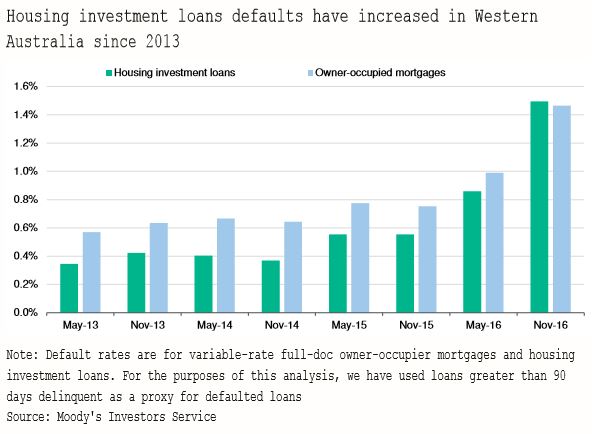

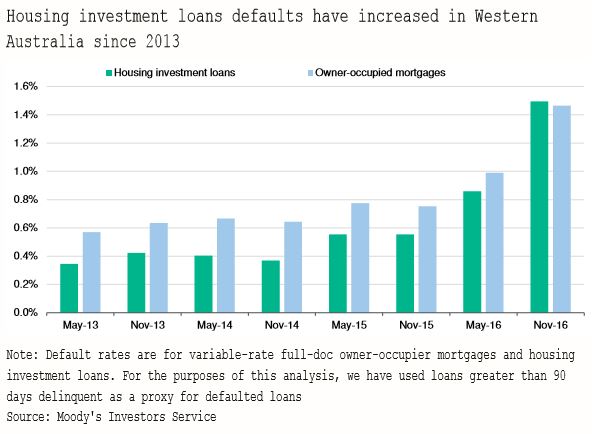

“A significant increase in housing investment loan defaults in Western Australia over the past four years demonstrates what we believe would happen to the performance of such loans in other Australian states in the event of an economic downturn,” they said.

Currently, levels of investment default are higher than those for owner occupiers which reverses the trend found before WA started deteriorating economically in 2013.

“In the event of an economic downturn in other Australian states, we expect that housing investment loans will incur higher defaults and losses than owner-occupiers mortgages, in a reversal of the current trend.”

Investors are particularly vulnerable to a change in economic conditions due to a reliance on rental income and house price appreciation to generate a return on income, Moody’s analysts said.

“Moreover, loan repayment and property management costs exceed the rental revenue generated by many Australian residential property investments, meaning that investors incur ‘cashflow losses’.

“Such investors rely on property price appreciation to offset their cashflow losses and provide a return on their investment, which increases their exposure to house price volatility.”

In contrast, owner occupiers do not rely on rental income to meet loan repayment and will not be exposed to a downturn in the rental market. They are also less reliant on house price appreciation since the property is seen as a residence first and an investment second.

“As a result, owner-occupiers are more likely to see out a housing market downturn than housing investors and are less likely to default on loans or have to sell their properties at a loss.”

Related stories:

Indebted property investors less risk averse

Australians too scared to invest in property

RBA hikes could trigger crash: UBS