The resilience of Australia’s property market is tested as Lismore struggles to recover from the 2022 floods, with land values halving and creating challenges in saleability and financial stability, according to a new report from PointData.

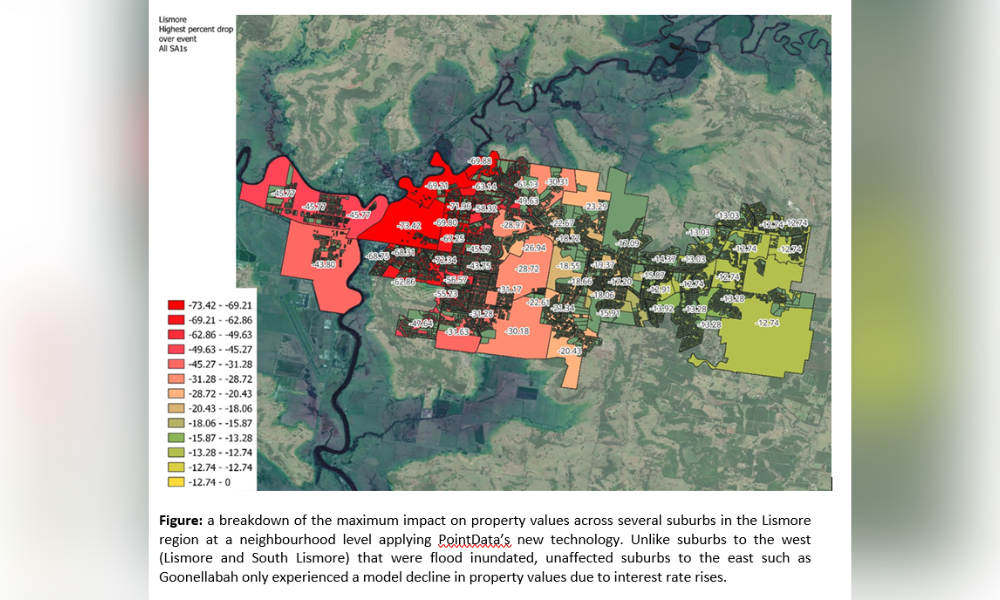

PointData’s climate risk modelling uncovered the long-term devaluation of properties in Lismore, employing AI and machine learning to differentiate between immediate and extended impacts on property values.

George Giannakodakis (pictured above), founder of PointData, discussed the compounded devastation caused by climate events and market fluctuations, particularly highlighting the drastic value drop in Lismore’s flood-affected areas and the subsequent risks to the financial sector.

Despite recovery initiatives like the NSW government’s Lismore Flood Recovery Planning Package, property values in North and South Lismore remain significantly reduced.

“The flow-on impact is that entire postcodes or suburbs are often then classified as ‘no go’ zones by banks and insurers, as the risk of further flooding, or climate-related events remains,” Giannakodakis said.

In a media release, PointData said its granular technology now identifies locations within suburbs less vulnerable to flood risk, separating them from higher-risk areas.

The company has developed two solutions accessible to both consumers and financial institutions:

“As an industry, we need to find solutions that spread the risk of climate-related events to mitigate the potential for ‘climate ghettos,’” Giannakodakis said. “Innovation and technology should be at the centre of the solution to enable protections for homeowners, while mitigating the risk for banks and insurers.”

Get the hottest and freshest mortgage news delivered right into your inbox. Subscribe now to our FREE daily newsletter.