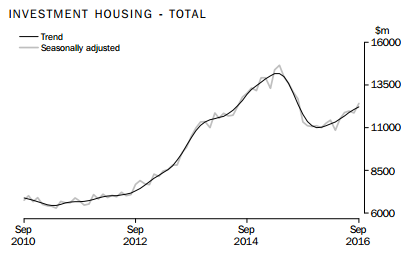

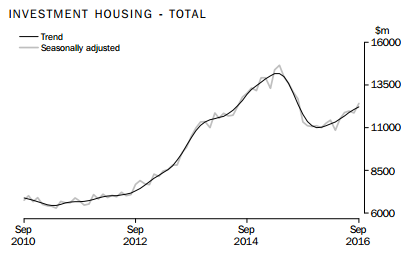

The total value of dwelling finance commitments for investor lending has risen by 4.6% from August to September this year, according to the latest seasonally adjusted figures from the Australian Bureau of Statistics (ABS).

Out of a total dwelling value of just over $32 billion, the ABS found that $12.2 billion (approximately 38.1%) was for investment purposes.

Geordan Murray, economist at the Housing Industry Association (HIA), expected this increase in investor lending to continue.

“We can expect some further uplift in this part of the market over the year ahead as an increasing number of the new homes currently under construction reach completion and off-the-plan purchases by investors reach settlement,” he said.

This upward trend was seen in the value of housing commitments for rent or resale which increased by 2.4%. A decrease of 8.7% was seen in the value of commitments for the construction of dwellings for rent or resale.

In contrast, the value of owner-occupied loans fell by 0.5% to $19.8 billion from August to September.

Looking at the total number of dwelling commitments, owner occupied housing fell by 1%. The hardest hit segment was the purchase of established dwellings which dropped by 1.1% while the purchase of new dwellings decreased by only 0.4%.

Amongst owner-occupiers, the number of first home buyers fell from 13.2% to 13.1% of total owner-occupied housing commitments between August and September. The average loan size for first home buyers during this time increased by $6,000 to $324,000.

In comparison, the average loan size for owner-occupiers in general increased by $4,000 to $367,700 in the same monthly time period.

Broken down by state, the change in the number of housing commitments for owner-occupied lenders between August and September can be seen below:

| State |

Vic |

NSW |

WA |

ACT |

Qld |

SA |

NT |

Tas |

| Change |

-1.4% |

-0.9% |

-0.7% |

-3.9% |

-0.1% |

-0.2% |

-2.1% |

+0.6% |

Looking at home loan demand in general,

Mortgage Choice chief executive officer John Flavell, predicted a slight rise over the new few months.

“Data from

CoreLogic shows property prices across the combined capital cities rose a further 0.5% in October – proving that the property market remains alive and well,” he said.

“Furthermore, interest rates continue to sit at all-time lows, which is not only helping to keep the cost of borrowing low, but it is helping to keep property demand high.”

Related stories:

Gen Y heads up investment property pack

Investors warned off Sydney property market

Australia fading for Chinese property investors