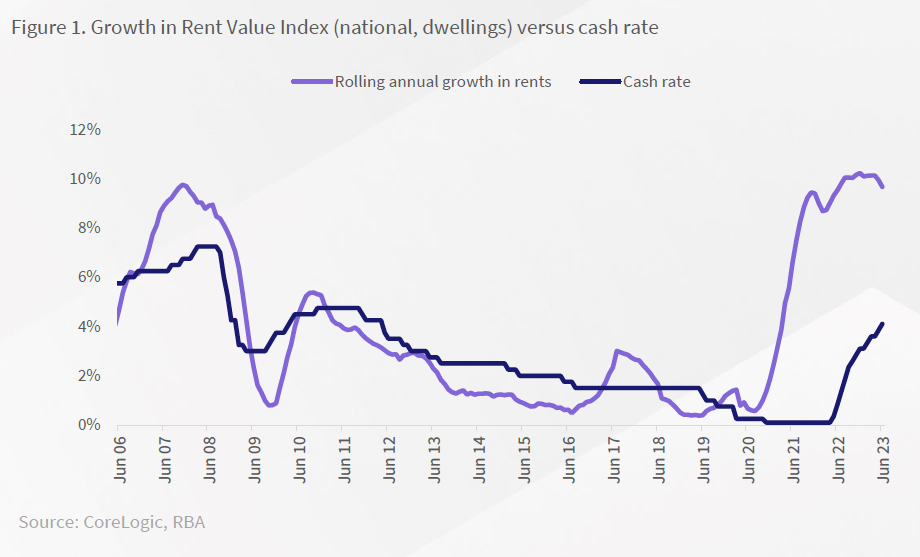

New analysis from CoreLogic has suggested that high rental growth will likely ease in the next year, as the Reserve Bank gets closer to the end of rate hikes and as inflation moves past its peak.

In looking into the correlation between rents and interest rates, Eliza Owen (pictured above), head of research at CoreLogic, noted that rents and interest rates move together over time, so a peak in the cash rate might indicate that a growth in rent values has also peaked, or nearing it.

Major banks were now expecting the cash rate to peak this year, followed by cash rate cuts through 2024. Meanwhile, annual rent growth, while still high, had been on a downward trend since a peak in December 2022.

“There are multiple reasons these two series might move together,” Owen said. “For one, rents are an input in measuring inflation. When rents rise, inflation can rise, and this prompts the RBA to lift interest rates. “Secondly, interest rates can impact rent. Higher interest rates mean investment property becomes less attractive, which could slow the delivery of new rental stock coming to market, and this could push rents higher.”

She noted that the rental market could also be impacted by other factors affecting investment activity. An uptick in annual rents in September 2017, for instance, might have been due to temporary restrictions on investment lending by APRA. Owen also noted that the fall in rental supply in 2019 was due to the broad-based decline in the housing market, and waning interest from investors.

What causes rent increases

Although higher interest rates might have partly driven rent increases so investors could fund higher mortgage costs, Owen said it was unlikely that rents have been increased to the full extent of interest cost rises.

Analysis of ATO tax data from the 2020-21 financial year showed that 47% of Australian property investors were negatively geared, meaning rents were not covering interest payments on investment properties in the years before the RBA started to hike interest rates.

“To put recent rate hikes in perspective, CoreLogic monthly median rent values are estimated to have increased $225 per month over the year to June,” Owen said. “However, mortgage costs of a new investment loan are estimated to have increased by $948 per month on the median Australian dwelling value.”

Investors with little to no mortgage might have also taken advantage of tight rental market conditions to increase rents.

“Irrespective of mortgage costs, rents can generally only rise substantially if the rental market is competitive, and tenants cannot find alternative accommodation to bargain with; in other words, rents rise when demand for rental accommodation is outweighing supply,” Owen said.

Why rent growth is expected to slow next year

Owen said while national rent values have never seen an annual decline in the CoreLogic series, rent growth is likely to continue moderating – here’s why:

“Canberra rent values are down -2.8% in the year to June (albeit off the back of a 17% uplift through COVID), and annual growth in regional rents has slowed to 4.9% in the year to June, down from a peak of 12.5% in the year to November 2021,” Owen said. “While conditions will vary at a granular level, the rental market as a whole is likely to loosen in 2024.”

Use the comment section below to tell us how you felt about this.