Non-major lenders Citibank and Suncorp have both announced a series of rate changes across several mortgage products.

Citibank

Effective from 1 August, Citibank has made two rate changes:

- Reducing variable interest rates for principal and interest loans by 10 basis points for all loans settled prior to 1 May this year

- Increasing variable rates for interest only mortgages and line of credit products by 30 basis points for all loans settled prior to 1 May.

The lender has made a number of policy changes including restricting cash out loans to when a customer’s maximum borrower exposure is greater than or equal to $500,000.

Facility increases for interest only loans have also been temporarily halted, effective immediately. This feature can still be used for principal and interest loans, however the borrower is not permitted to switch to an interest only loan within 12 months of the variation.

Suncorp

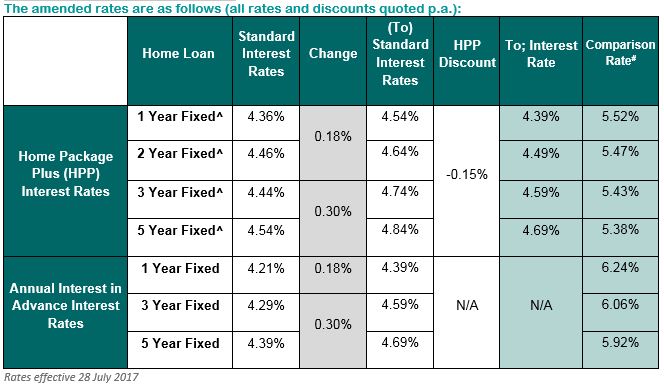

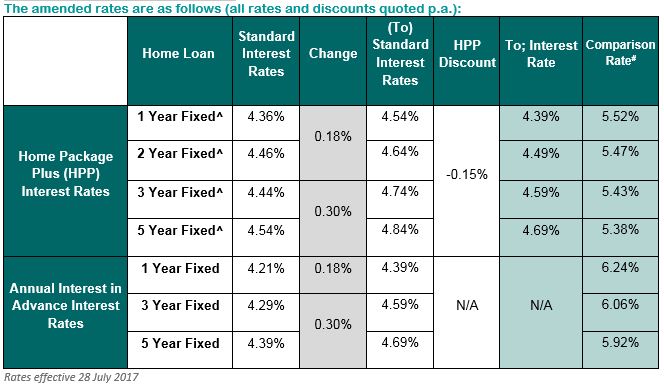

Suncorp has announced increases on all of its fixed rate investment loans for new customers and pipeline applications, effective from today (28 July).

The changes, which will impact Home Package Plus Fixed, Standard Fixed and Annual Interest in Advance Loans (AIIA) interest rates, will “ensure the bank remains compliant with regulatory caps on investor and interest only lending,” the bank wrote in a note to brokers.

Related stories:

Trail at risk from shifting investor landscape

Wholesale funder raises IO interest rates

Non-major launches new owner occupier deals

Related stories:

Trail at risk from shifting investor landscape

Wholesale funder raises IO interest rates

Non-major launches new owner occupier deals