Stress tests on the impact of housing price and interest rate changes by Moody’s Investors Service have shown that the Sydney real estate market is the most sensitive nationwide.

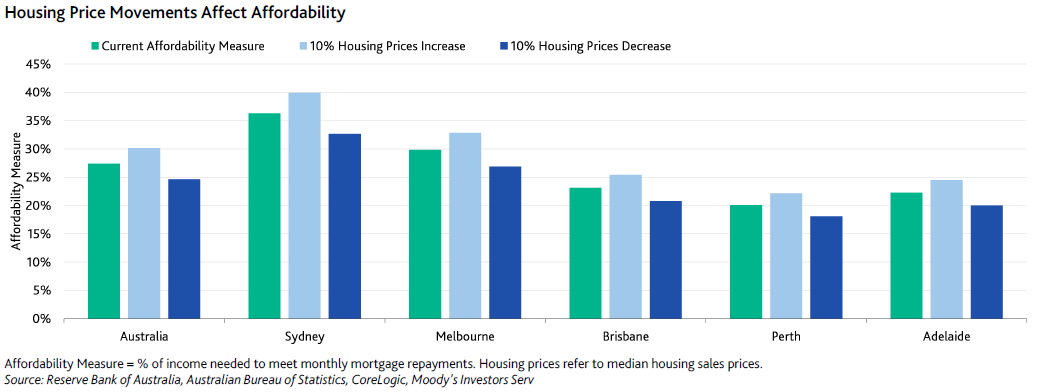

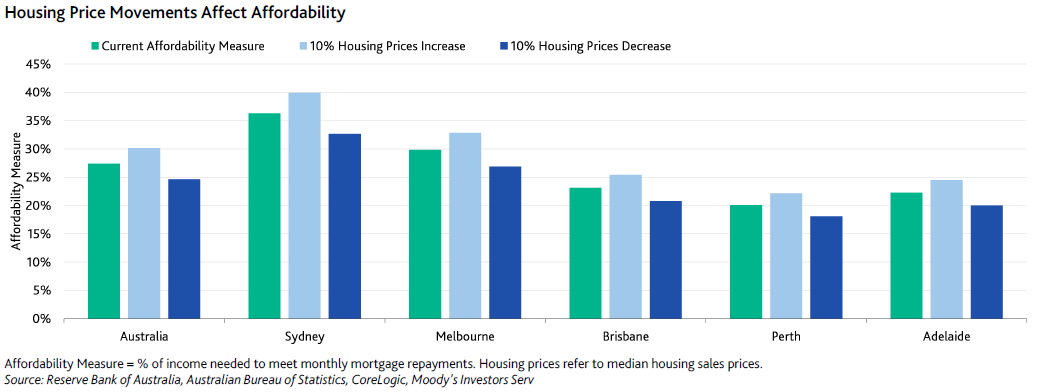

On average, a 10% change in housing price will result in 2.7% more or less household income needed to meet the adjusted mortgage repayments. This is a lower sensitivity than that found on 30 September 2015 when the resultant average change was 2.9% across the country.

In Sydney, this variance was the most pronounced with a 10% change in housing price resulting in a 3.6% change in household income needed to meet the necessary loan repayments.

In the year leading up to 30 September 2016, the average median house price has dropped by 0.9% nationwide. Prices rose in Adelaide (+3.2%), Brisbane (+2.2%) and Melbourne (+1.7%), dropped in Perth (-2.5%) and remained steady in Sydney.

How house price movement affects affordability across the nation’s capitals can be seen below. The greater the difference between the light blue and dark blue bars, the higher the sensitivity of that particular city.

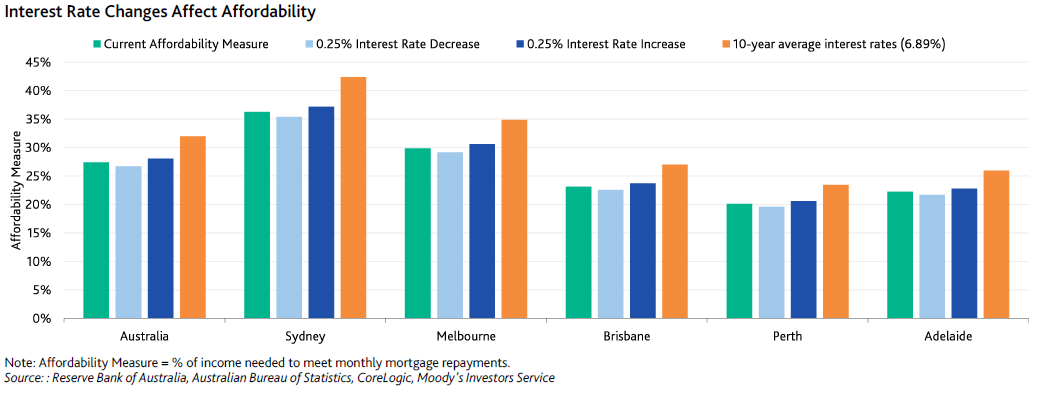

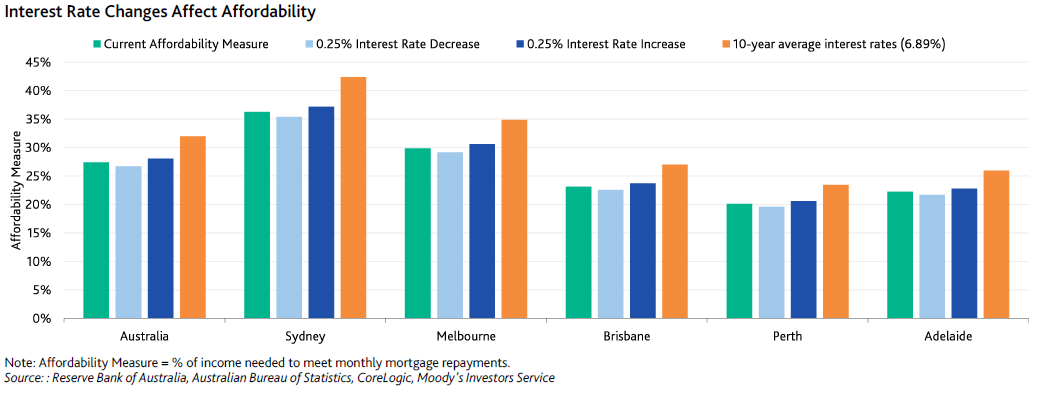

In a similar manner, Moody’s also found that mortgage holders in Sydney were more sensitive to changes in interest rates.

Across the country, a 0.25% increase or decrease in interest rates means that the household income needed to meet mortgage repayments will go up or down by an average of 0.7% respectively. This has remained unchanged in the year leading up to 30 September 2016.

For those in Sydney, the same change in interest rate means mortgage holders will be required to spend 0.9% more or less of their household income on loan repayments.

This means Sydneysiders were the worst hit over the past year with the average standard variable interest rates dropping from 5.45% to 5.25% in the 12 months prior to 30 September 2016.

The graph of how interest rate changes affect affordability in the nation’s capitals can be seen below. As before, the wider the gap between the light and dark blue bars, the more sensitive that capital city is to change.

Related stories:

Investors warned off Sydney property market

Mortgage arrears at three year high: Moody’s

Sydney office yields hit lowest levels since GFC

Related stories:

Investors warned off Sydney property market

Mortgage arrears at three year high: Moody’s

Sydney office yields hit lowest levels since GFC