By

New research from LongView and PEXA has identified the key drivers behind Australia’s housing crisis, revealing that the problem is more complex than just supply and demand.

The report, which is the first in a series of three, identified a unique combination of factors driving today’s crisis, namely high population growth, urban concentration and a shortage of well-located residential land near jobs and services. It stated that the impact of interest rates and government homebuyer subsidies on the housing crisis is often overstated.

In analysing the on-going housing affordability and rental crises, LongView and PEXA found that the scarcity of well-located residential land has prevented many Australians from enjoying the benefits of city living.

According to the report, residential land now accounts for an estimated 48% of Australia's national wealth, eclipsing all other Australian asset classes, including commercial real estate, bonds and shares. As a result, house prices have grown much faster than incomes in recent decades, with prices rising at a compound annual growth rate of 7.2% since the 1960s.

The report also found that growth in real estate value, which has amounted to over $7 trillion in the last two decades, cannot be solely attributed to government policies such as the first home-buyers grant, capital gains tax exemptions, and negative gearing.

In fact, long-term interest rates cannot be considered the only factor influencing house prices over time, the report additionally revealed, as there has been consistent price growth over 50 years regardless of whether interest rates were high or low.

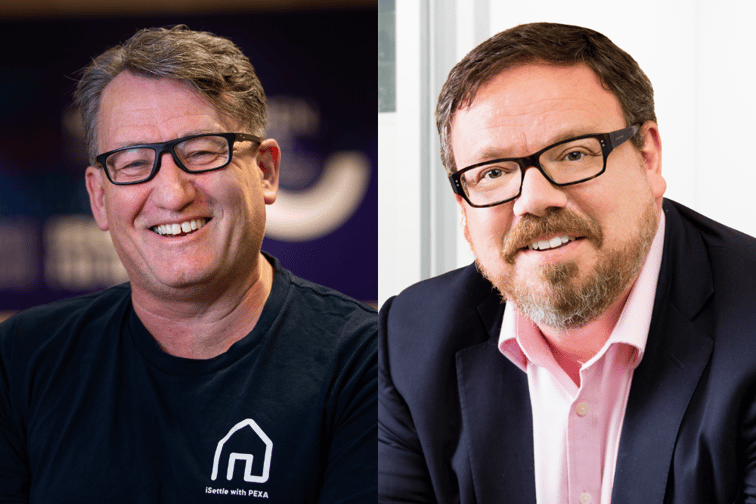

“If you reduce the analysis of our housing crisis to simple supply-and-demand arguments, you are going to get simple solutions – solutions that simply don’t work,” said PEXA CEO Glenn King (pictured above left).

“If you really want to understand house prices, you need to understand what is different about Australia,” said LongView executive chair Evan Thornley (pictured above, right). “Commentators typically focus on interest rates and tax policies. Both matter but they don’t fully explain the growth we’ve seen.”

“Nearly every developed country has had record low interest rates, supply constraints and government subsidisation for housing. What sets Australia apart is its consistently high population growth rates and urban concentration. Australian cities are unusual – they are few, they are large, and they all have dense CBDs and expansive suburbs, with not much in between.”

LongView and PEXA warned that the disparity between those benefitting from the property market and those falling behind would continue to worsen if not properly addressed, with estimates showing that it now takes Australians up to 14 years on a median salary to save for a down-payment on a mortgage, causing homeownership to fall among all age groups nationwide, particularly young people.

“Many first home buyers, who are forced to buy far from the centre of cities, are denied the opportunities that may increase their quality of life, including access to the higher paying jobs that are in the central city and employment hubs,” King said..

“They aren’t reaping the economic benefits that living in a city should bring, benefits that generations of Australian city and suburb dwellers have enjoyed. Put simply, our largest cities are now too big for this. This also has serious implications for the challenge of homelessness in Australia, which must be addressed.”

The next instalment of LongView and PEXA’s whitepaper series will focus on the challenges of renting in Australia, while the third will focus on solutions that reflect the economics of the Australian housing market.