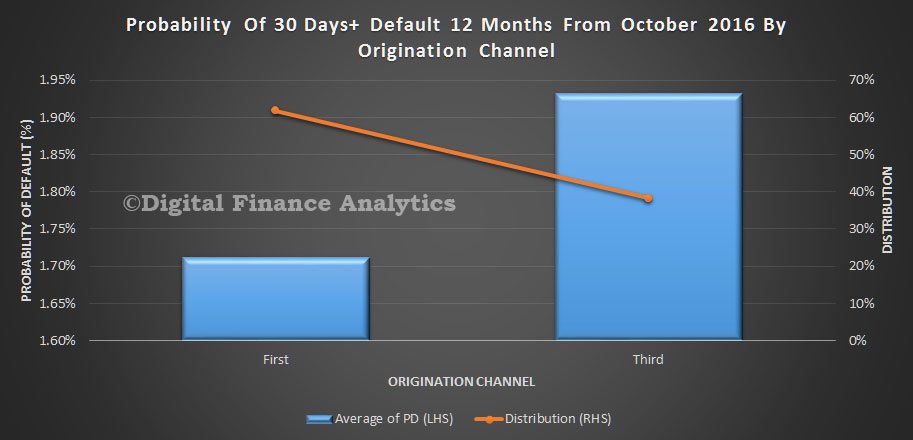

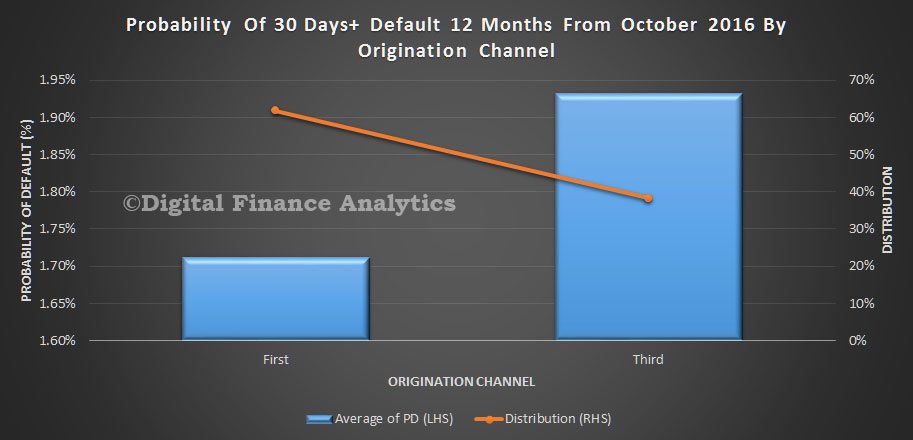

Whether a borrower uses a first or third party channel is a factor that influences the probability of mortgage default, according to the latest analysis by Digital Finance Analytics (DFA).

Following on from

his analysis on Monday (24 October), Martin North, principal and founder of DFA said that clients who use a mortgage broker are “slightly more likely to default”.

North found that 1.71% of bank clients defaulted on their loans compared with 1.93% of those opting for a broker.

“We think there are a number of factors below the waterline here which explains the differences. For example brokers know where to look for the larger loan, can help position the application for approval, and households choosing to use brokers are often after a bigger loan on the same income, compared with those via a branch.”

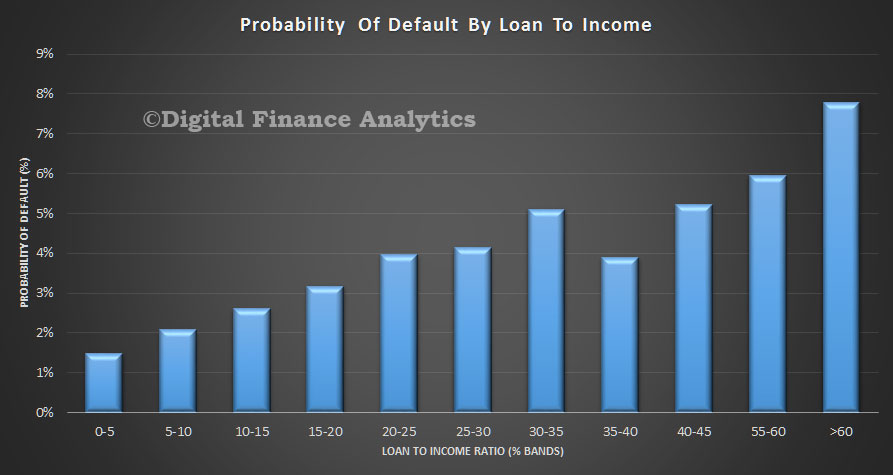

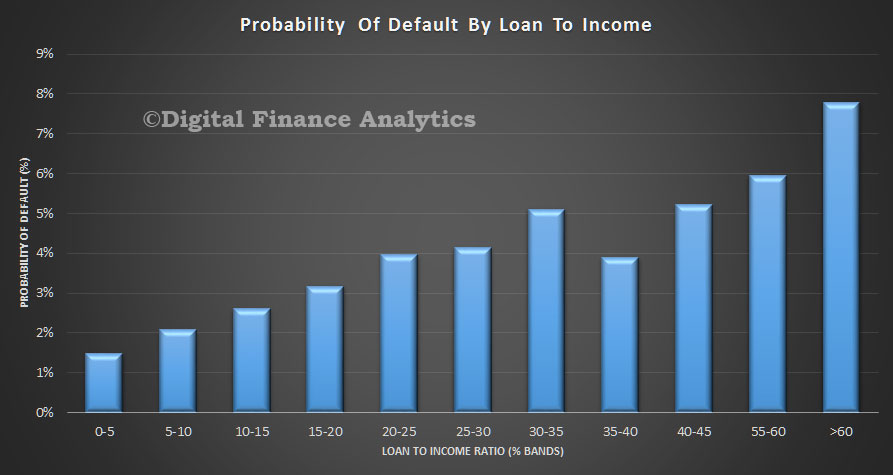

Looking at loan to income, DFA found that those putting more than 60% of their income to repay their mortgage faced the highest risk.

“As the LTI reduces, so does the risk. We think the LTI and DSR ratios should become the cornerstone of mortgage underwriting. APRA please note!” he wrote.

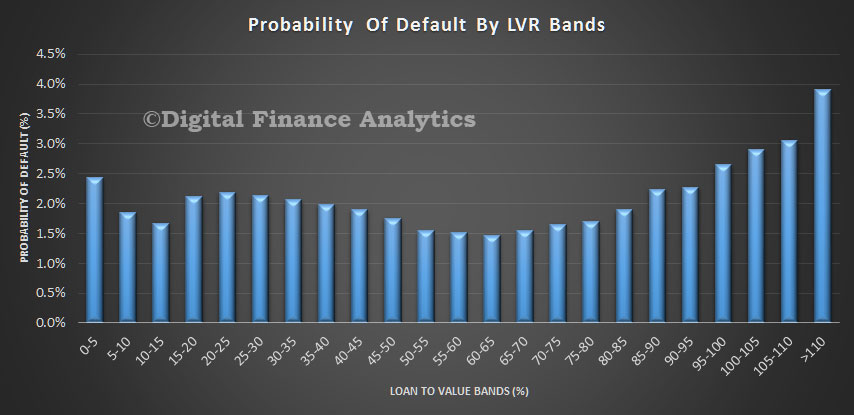

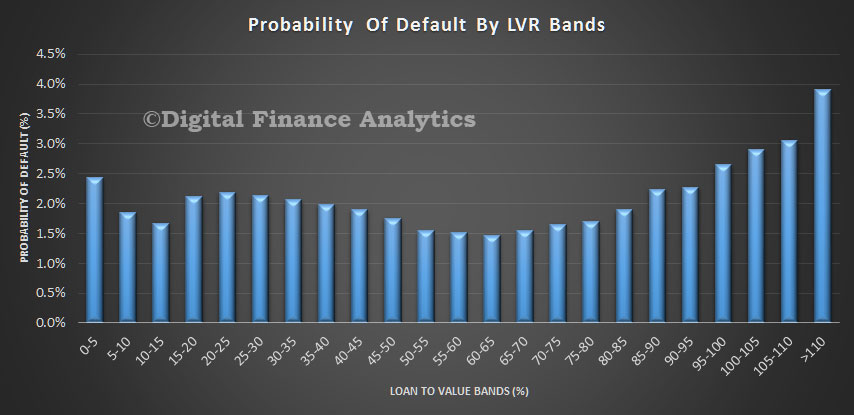

Finally, loan to value ratios also affected the risk of default although not through a straightforward relationship. Those in the 50-70% LVR bands were the least likely to default. The risk increased for the lower bands due to constrained incomes plus. Higher bands were also at risk due to larger loans relative to income as well as lower net assets held.

Other points of interest include that borrowers with interest-only loans are slightly more likely to default and that those under 30 and over 60 years old are more at risk.

Related stories:

Mortgage default rates expected to rise

Mortgage arrears at three year high: Moody’s

Risk of mortgage defaults on the rise