The Reserve Bank of Australia (RBA) has opted to keep the official cash rate unchanged at 4.35% at its first meeting of 2024, following lower-than-expected inflation figures released in January.

This decision aligns with the predictions of most economists and major banks, offering a temporary sigh of relief to Australian borrowers on variable rates.

The announcement follows the release of the December quarter Consumer Price Index (CPI) data, showing inflation at 4.1% year-on-year, slightly below the RBA's initial forecast of 4.3%.

While inflation remains above the target range of 2-3%, this downward trend provides a flicker of hope for Australians grappling with rising interest rates and cost-of-living pressures.

In a statement, the Reserve Bank Board said, “returning inflation to target within a reasonable timeframe remains the Board’s highest priority. This is consistent with the RBA’s mandate for price stability and full employment”.

“The Board needs to be confident that inflation is moving sustainably towards the target range. To date, medium-term inflation expectations have been consistent with the inflation target and it is important that this remains the case.”

The Board acknowledged that while the data indicates that inflation easing, “it remains high”.

“The Board expects that it will be some time yet before inflation is sustainably in the target range,” the statement said.

Homeowners have reason to be cautiously optimistic that the next time the cash rate cut may come sooner than later.

In this month’s Finder RBA Cash Rate Survey, 27 experts and economists weighed in on future cash rate moves, with all correctly predicted a cash rate hold.

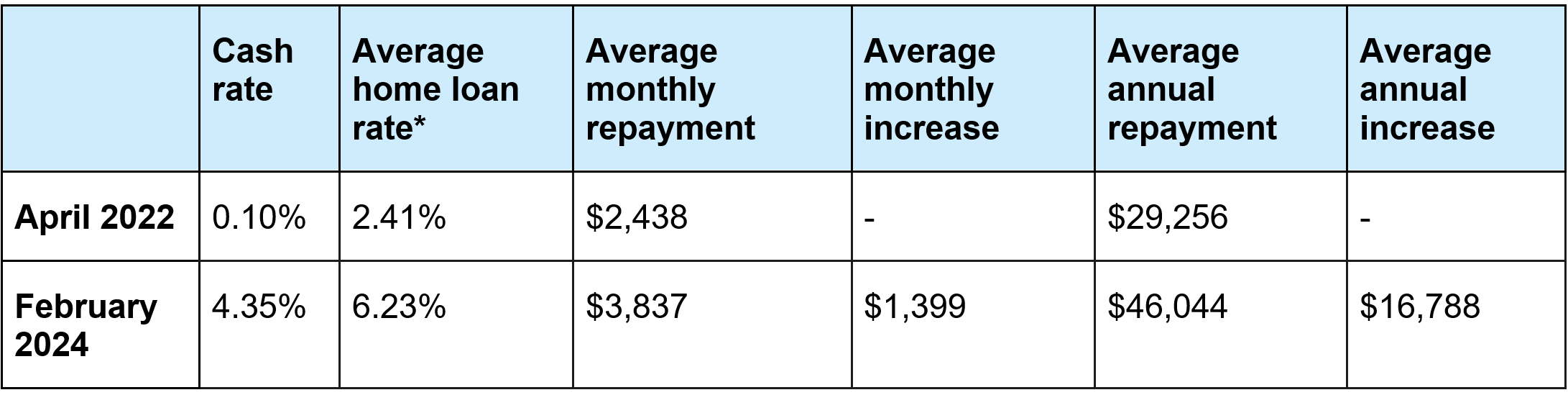

Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $624,387 (ABS data analysed by Finder).

Source: Finder, RBA. *Owner-occupier variable discounted rate. Repayments based on the average loan of $624,387 (ABS data analysed by Finder).

Pearl Tran (pictured above left), director of Lending Hub Co., agreed with the experts, saying given that inflation had slowed to its lowest level in two years while remaining above the target band, a pause was “appropriate”.

However, she doesn’t expect the pause to make much of an impact to the habits of borrowers or consumers.

“People have gotten used to interest rates increasing over the past two years. Their mentality has adapted, and discretionary spending has been cut down,” said Tran, who recently shared her experience going from banker to broker.

Blake Murray (pictured above center), director and finance broker at Blue Crane Capital, echoed Tran’s reasoning about the rate pause.

“I am not surprised at all,” Murray said. “If the RBA had any thought of one more rise, the inflation data last week would have removed that thought.”

However, Murray was more optimistic about the effect on borrowers, giving consumers more certainty and confidence to make purchasing decisions.

“Whilst rates are rising the monthly budget is constantly changing so now it is likely that rates have peaked, it can drive people to start making the big decisions if they are able to do so,” he said.

Caroline Jean-Baptiste (pictured above right), lending specialist and owner of Mortgage Choice Fortitude Valley, also agreed with the RBA’s decision to keep the cash rate steady, “although I am looking forward to seeing a rate cut”.

“The stability in the cash rate has given many borrowers time to adjust their budget and borrow with more confidence,” Jean-Baptiste said. “Becoming accustomed to a higher cost of living has already been tough on many households.”

“Borrowers are still awaiting a reprieve on the increasing rates they have accommodated in the previous year. The unchanged rate provides some predictability for borrowers.”

While the Reserve Bank of Australia (RBA) has kept the cash rate on hold for now, the question of when (or if) a cut is coming remains a hot topic. Broker opinions vary, with some expecting a late-year reprieve while others hope for an earlier move.

However, others think it could be earlier, with AMP chief economist Shane Oliver suggesting that slowing inflation might prompt the RBA to lower rates as early as June.

Jean-Baptiste was the most bullish among the brokers, agreeing with Oliver that a rate cut is expected in June given inflation is tracking down.

“Pausing the rates all year would provide stability and some certainty, but relief will only be felt with a reduction in the cash rate passed on fully by each lender,” Jean-Baptiste said.

Murray said, “the first half of year is likely to see rates unchanged with rates likely to fall at the mid-late this year.

“This will be a welcome relief to borrowers - especially those that have recently or about to move from record low fixed rates back to variable.”

Tran was more cautious with her forecast, expecting rates to hold until last quarter of 2024 then slowly lower towards 2025.

“However, everything can be changed, interest rate could go down a lot quicker and sooner than expected if inflation rate is well down towards RBA’s target.”