.jpg)

Providing the clearest indication of what could lie ahead for the broking industry, the royal commission’s interim report posed some challenging questions. Australian Broker examines its contents and impact

The finance and banking sector’s annus horribilis took another turn on 28 September when the royal commission’s interim report was released.

"Frank and scathing", in the words of Treasurer Josh Frydenberg, it focuses on four issues related to broking: confusion over roles and responsibilities; customer needs; 'unsuitable' lending; and processing errors.

Industry associations were quick to point out the gaps. MFAA CEO Mike Felton says the real debate should be around how changes to distribution would redraw the industry’s competition dynamics.

In a statement, he said, “Ignoring competition when considering further changes to the financial system could lead to unintended consequences, and risks driving customers back to bank branches.”

In its response, FBAA executive director Peter White said, “On first glance it appears the commission does not fully understand the finance broking sector.

“We expected an interim report like this and we will work through the points, but nowhere is there any suggestion that the broking sector is systemically broken.” The association also rejected claims that lenders paying value-based upfront and trail commissions could be in breach of NCCP legislation.

Noting the industry’s achievements over the last two decades, founder and principal of Astute Ability Finance Group Mhairi MacLeod says, “The whole financial services sector seems to have been tarred with the same brush.”

She adds, “From an industry perspective, I think there was a lot of food for thought, but there was also some misinformation about broking and the industry’s relationship with consumers.

“Brokers have brought real competition, and the royal commission should appreciate that and be cautious about any future findings it makes which may effectively push customers back to the banks.”

The repeated claims of misinformation and misunderstanding – not to mention the events that unfolded in the dock – have led many to believe that brokers have become scapegoats for the banks.

Kevin Lee, buyer’s agent and mentor at Smart Property Adviser, worked as a BDM and branch manager at a major bank in the late 1990s. He says, “The scapegoat may well be the broking industry.

Commissioner Hayne’s scathing attack on upfront and trail commissions would appear to be calculated towards that.

“Was the royal commission set up to deliver this outcome from the very beginning? Lots of bluster, headlines and a few scalps, but when the dust has settled, could it be, once again, a case of business as usual for the banks? With reduced competition, higher fees and higher interest rates, making even more profit than ever before – it’s not as bizarre as you might think.”

While the report asks a number of questions related to intermediaries, the biggest one is: ‘Is structural change in the industry necessary?’

MoneyQuest MD Michael Russell believes the Combined Industry Forum proposals are extensive enough to address regulator concerns, but that other changes could be useful.

“The change needs to come culturally, top down, in all financial services organisations, where people in charge lead always with ‘customers first’. Not only is this always the right way to do business, it’s the smart way to do business in the long term,” he says.

Meanwhile, Lee advises removing vertical ownership and placing a greater focus on education and training, to secure wider recognition of broking as a career path.

“Broking needs to be perceived as a genuine career path that can place individuals who hold both the qualifications and licence as trusted advisers and a cornerstone of society.”

A degree should be required, along with a minimum of two years’ industry experience, he says. To support this, incentives and greater access to education are both required.

Noting how Australia has become a benchmark for brokers in New Zealand and Canada, MacLeod agrees that education and training should be enhanced, but the future lies in the attitudes of the next generation.

Advising private businesses to address the rising demand for ethical operations and corporate social responsibility, when looking to attract customers and talent, she says, “I have pushed for our industry to place a much greater emphasis on CSR. Younger people are much more conscious of the CSR programs and ethics of the companies they work for and use. This is something the broking sector should be aware of in order to ensure the longevity and popularity of the profession.”

Profit before people

In its executive summary, the commission blamed the conduct of the banks on a culture of greed and the pursuit of profit, “at the expense of basic standards of honesty”.

The human impact of their actions was widely documented.

The commission heard from one man, Robert Regan, who was dependent on charity for food, and Nalini Thiruvangadam, who was forced to borrow from her family and sell her jewellery. Another man, David Harris, revealed that when he admitted to his bank that he had a gambling problem, they offered him more credit.

In their initial responses, the banks were remorseful; however, others didn’t hold back the punches.

The Australian Banking Association simply referred to the report as the banks’ day of shame. “We will fix these problems and make them right without delay, to earn back the trust of the Australian public,” said CEO Anna Bligh.

For Russell, the profit over people conclusion was inevitable. He says, “It all started when strategically they shifted far too quickly from being customer service organisations to product manufacturers. “The latter would have been fine but for the fact they also wanted to replace customer face-to-face interactions with technology and soon-to-be artificial intelligence. All of this adds up to staff not having enough personal interaction with customers, which in a B2C business is not a great ingredient to foster care and empathy for customers.”

In rebuilding their public images, the banks have been quick to announce changes, with leadership shake-ups and exits, new policies, public apologies and promises. But the question of whether this level of misconduct could occur again will cast a shadow for some time yet.

To prevent a repeat, Russell makes three suggestions: top-down cultural change to drive an agenda of fairness; empowerment of key management to make the right decision over the profitable one; and close collaboration with regulators, backed by a self-reporting regime.

“I’m absolutely certain this will prove to be a wonderful circuit-breaker for the banks and those now in control who are driving change with a steely focus on customers,” he says.

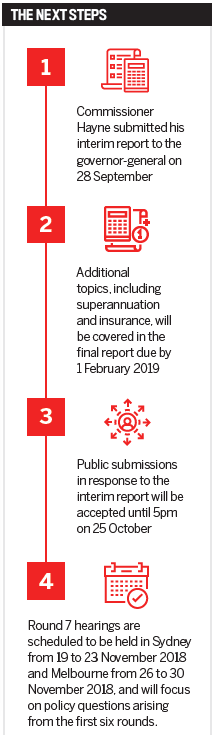

Public submissions in response to the interim report will be accepted before 25 October (see box, p16, for details). The next and final round of hearings will take place in Sydney from 19 to 23 November, and Melbourne from 26 to 30 November 2018. They will explore the questions to be considered in the final report, due to be submitted to the governor-general by 1 February 2019.