With a suite of new products and a foot in the New Zealand market, Pepper Money is helping brokers capitalise on new opportunities. CEO Australia Mario Rehayem reveals the details

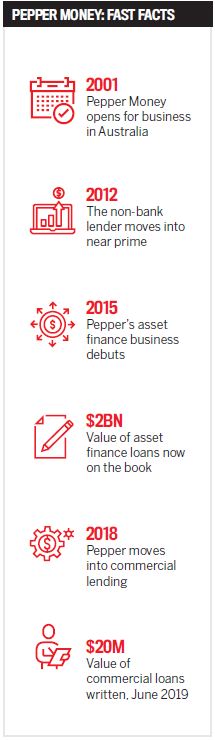

When international non-bank Pepper Money first entered the Australian market in 2001, the lender was fully focused on providing the residential lending solutions that others weren’t. Then the market started to change.

To avoid its Kodak moment, Pepper Money leveraged market reach, experience and expertise to embark on a strategic diversification drive that would see its credit solutions portfolio expand and its loan book swell.

In 2012, Pepper Money stepped into the near prime space, tactically positioned to complement its existing suite of non-conforming products. In 2013, identifying another gap in the market, the lender started to do prime mortgages differently by returning to what Mario Rehayem, Pepper Money CEO Australia, calls “old-school underwriting”.

In an age of algorithms and automated credit assessments it was a bold move, but it paid off.

Next came the 2015 launch of Pepper Money’s asset finance business, focusing on used cars, caravans and small-ticket equipment – a market that was either overlooked or mispriced by other lenders. From a standing start less than four years ago, its asset finance loan book currently stands at $2bn, with more than $110m originated every month.

Then late last year Pepper Money stepped into commercial lending, including real estate (CRE), another segment it notes is underserved in the current lending environment.

The soft launch of the new division was followed in February by the news that commercial lending veteran Malcolm Withers would lead CRE operations for the non-bank.

“The Pepper brand has a fantastic reputation of delivering on its promises. We have a strong reputation for service and for how we treat our customers” Mario Rehayem, CEO Australia, Pepper Money

“The Pepper brand has a fantastic reputation of delivering on its promises. We have a strong reputation for service and for how we treat our customers” Mario Rehayem, CEO Australia, Pepper Money“From 2015 we really started to refine our core businesses and now, with the launch of CRE, we’re going back to basics. We’re giving every mortgage broker the ability to be in a position to write a commercial loan, rather than being pigeonholed as working for a specialist commercial writer,” says Rehayem.

Early performance indicators are strong. Currently at Pepper Money, CRE is performing at 140% of its projected growth rate. In June 2019, approximately $20m in commercial loans were written and Pepper Money estimates CRE is worth in excess of $11bn a year Australia-wide.

“The Pepper brand has a fantastic reputation of delivering on its promises. We have a strong reputation for service and for how we treat our customers,” says Rehayem.

“That’s probably one of the primary reasons why every time we launch into a new asset class or launch a new product, we not only become successful but we do so in a very short period of time. We spend a lot of time in the background before the launch, refining the product and the area we want to play in.”

Core focus

While the deliberate nature of the strategy is evident, what those on the outside may not realise is that, rather than this being diversification per se, Pepper Money has actually expanded its core operations with each new launch. Today, Rehayem says brokers, too, can echo this strategy to emulate the same success.

“We are creating an experience that leverages off a mortgage broker’s core capabilities so that they can create their own strategy to reach out to their existing clients in new ways,” he adds.

Pepper Money’s loans are almost 100% originated through the third party channel, whether that be through commercial, asset finance, online or mortgage brokers. Third party skill sets are therefore crucial to the lender’s ongoing ability to deliver its solutions in the marketplace.

As a result of supporting brokers in leveraging its credit solutions, Pepper Money has seen a surge in commercial lending accreditations nationwide, with more than 2,500 brokers accredited at the time of writing. Further, Rehayem says the response from aggregators has been “overwhelming”.

Yet for all the new focus areas, he maintains that brokers should take a pick-and-mix approach to the new product solutions they adopt, in order to stay true to their brand and meet the needs of existing customers without overcomplicating things.

“The customer a broker naturally attracts will dictate the level of knowledge and skill they need. For example, a mortgage broker who deals with your everyday Australian buying a home, or a self-employed customer looking to buy their first CRE or investment property, would only really need to understand how to position a basic commercial loan with their customer base. It’s not a complex development loan for example,” Rehayem says.

“The best diversification strategy is to leverage off your own core skills, then consider your customer’s needs and you marry the two. That is why asset finance is also a fantastic extension of the natural ability of a mortgage broker.”

On that note, Rehayem advises that diversification shouldn’t be about taking on new focus areas and clients because of recent market events. Instead it should be about meeting more of an existing client’s needs and focusing on the sustainability of the broker’s business – whether that’s by advising the client on a new commercial real estate investment or assisting them with the purchase of a new car to sit in the drive of their new home.

“Diversification really should only be part of the broker’s vocabulary when they truly understand their strengths and customer base. Many people enter into diversification tactics not understanding the true reason why they are doing it, which means they struggle with the why and the how,” he says.

The same message was central to Pepper Money’s 2019 Insights Roadshow, which visited Adelaide, Perth, Sydney, Melbourne and Brisbane throughout June. Focused on solution matching, the agenda was designed to help brokers understand and develop “best in class” approaches to the regulatory, digital, customer and business experience.

New territory

In May, the lender made its first mark in New Zealand by partnering with Astute NZ under the Ascenteon brand, funding a range of loans under a white label agreement.

The portfolio initially comprised three residential products (prime, near prime and specialist) designed to meet the wide and varied needs of all types of residential borrowers.

“It’s still in its embryonic stage, but we have received an overwhelming reception,” Rehayem says.

As an unknown brand in a notably different marketplace, gains are welcome in any form. However, for Rehayem the latest development is all about leveraging Pepper Money’s distribution arm and a brand that already exists in New Zealand.

“We tend to gravitate to those particular segments of the market, and we have to make sure that when we put products together we are going to add value and really stick to our mantra of helping people succeed,” he says.

“We have been really strategic and tactical in selecting these unmet needs in the industry.”

With the backing of an international parent company and a finger firmly on the pulse of borrower demand here in Australia, when it comes to Pepper Money’s next move, nothing is off the table.

Rehayem says, “We never say never in our business! Our growth is controlled, but it has definitely been a wonderful journey to date.”