.jpg)

Marking 20 years in the market, PLAN Australia is preparing for a future in which broking is diversified, digital and indispensable. CEO Anja Pannek outlines her vision to Australian Broker

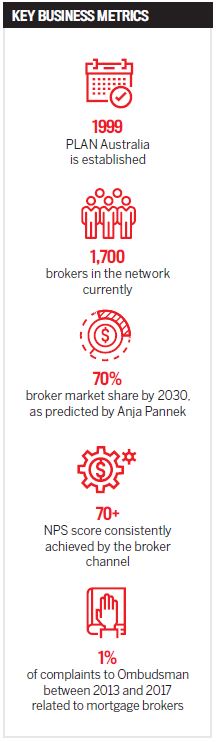

Established in 1999, PLAN Australia has witnessed many developments in the broking industry over the last 20 years. However, as the aggregator celebrates its milestone anniversary, the focus is all about the future.

Over the course of this year, PLAN Australia has been asking its network of 1,700 brokers how they feel about the future of their industry.

Fresh from the turbulence of the ASIC broker remuneration review, the Sedgwick retail banking remuneration review, the Productivity Commission’s report on competition in the Australian financial system, and a royal commission, it’s a worthwhile question.

“This year has been pivotal in determining who we are as an industry and where we’re heading. As an industry, we are continuing to demonstrate that we are doing the right thing for customers, and that is reflected in how highly customers rate brokers,” says PLAN Australia CEO Anja Pannek.

Sharing her “optimism and excitement” for the next phase, Pannek says the greatest opportunity right now isn’t simply to demonstrate the value of mortgage brokers but to demonstrate to customers, the government, Treasury and regulators that “we have the right to continue to lead and grow our fantastic mortgage broking industry”.

“I believe that we will continue to do this by delivering value and ensuring great outcomes for customers are achieved. As a result, small and medium-sized-business owners will continue to seek out brokers to help them with their business needs, and this will contribute greatly to the overall growth of the market,” she explains.

Pannek’s comments come hot off the heels of the mortgage broker best interest duty and remuneration reforms – on which the industry has until 4 October to submit responses.

While she has previously described the proposed best interest duty as “enshrining the best of broking into law”, as the CEO of a major-bank-owned aggregator and a Combined Industry Forum member, her stance remains that self-regulation is vital.

“PLAN Australia has been a member of the CIF from the beginning; we believe in self-regulation and want to ensure that a sensible and pragmatic approach is undertaken by our industry,” she says.

PLAN Australia has placed diligent focus on promoting the benefits of broking to “key decision-makers” in terms of what the industry contributes to the economy, with regard not only to competition but also customer outcomes.

While Pannek praises the industry for its progress and welcomes the government’s clarity on when and how it will implement Hayne’s recommendations, she says proactive addressing of the original 2017 ASIC review of mortgage broker remuneration has set the tone for the next wave of legislation.

“This has put us in good stead for the ongoing dialogue we will need to have with the government and regulators over the next few years. A massive positive throughout all of this has been how we have collaborated as an industry, and this is helping to guide us as we move forward,” she says.

The next steps

The next phase of growth, however, will come from continuing to cultivate a culture of “customer obsession”, and there are many ways in which PLAN Australia is helping its brokers achieve this, from promoting meaningful conversations to having a greater presence in the post-settlement phase.

“Process and technology will make this increasingly possible and seamless for brokers and customers. For brokers who are looking to move from transactional relationships to those that last the distance, we believe recognising client milestones and leveraging the power of social media will be important in the future,” she says.

Another focus area for PLAN is upskilling its brokers’ business expertise with a view to implementing new processes that help them work on their businesses, not just in them. This part of the strategy will be achieved through an education and coaching program that combines a series of face-to-face and digital development opportunities with peer-to-peer learning.

“Brokers should focus on what they can control, make the most of every business and personal development opportunity, and continue to support positive growth within our industry,” says Pannek.

Among the development opportunities on offer are the boardroom-style 100/100 program designed to transform 100 PLAN Australia businesses in 100 days; the Stanford Strategic Leadership Program, which this year sees a second cohort of brokers undertake six months of study at Stanford University; and new PD content on commercial and asset finance, an area where Pannek says members are seeing “fantastic growth”.

“We believe professional development is essential for brokers to grow their businesses, grow professionally and provide great customer outcomes. We invest heavily in world-class training and education to help our members thrive and excel,” says Pannek.

It all feeds into the continued professionalisation of the broking industry, the cultivation of which Pannek considers to be intrinsically linked to its future growth.

While customer trust in the banks has plunged to new lows since the royal commission, mortgage brokers achieve NPS scores of 70 or higher, and only 1% of complaints lodged with the Financial Ombudsman Service between 2013 and 2017 were related to mortgage brokers.

The data, quoted by the MFAA in its ‘Your Broker Behind You’ campaign, also shows that while the number of active brokers has increased over the last decade, the Credit and Investments Ombudsman says complaints against brokers have “dramatically decreased”.

“I believe that we will look back at this last 12 to 18 months as a critically defining period for our industry,” says Pannek.

“We have and continue to navigate uncertainty and change, and there is greater awareness than ever before of the broker customer proposition. Our industry has and will go from strength to strength in the coming decade.”

Supporting the transition

.jpg)

So far, PLAN’s anniversary year has been action-packed. A new, updated version of Podium has been launched, based on a human-centred design approach that prioritises customer engagement, and in July the aggregator held its annual Commercial and Asset Finance conference, attended by 50 top-performing brokers. Among them were three ‘‘rising stars” selected by the PLAN Australia leadership team.

The conference featured several keynote speakers, including CAFBA president David Gandolfo; Bob Ansett, the founder of Budget Rent a Car; and Besa Deda, chief economist at St. George Bank.

This month, the PLAN Australia National Conference will be held, during which a video montage of broker stories about their business building and customer journeys will be played to delegates.

“This anniversary is about celebrating the achievements of our members, how they have built their businesses and, most importantly, helped their customers achieve their dreams and goals,” says Pannek.

While regulatory change isn’t going away, with the new era of digital banking comes new ways for brokers to assist their clients. Pannek believes the mobile-first customer journey, and open banking in particular, will give brokers an opportunity to leverage the significant relationship of trust they have with customers.

“We remain incredibly optimistic about the future. This is a great industry built on delivering great customer outcomes, and we will continue to work hard with other industry participants to advocate for a viable and vibrant broking industry,” she says.