ANZ and the Queensland government have signed an implementation agreement, marking a significant step towards the major bank’s acquisition of Suncorp Bank.

The major bank said it would establish a “tech hub” in Brisbane for specialists in digital, cloud, and data as part of the agreement, fostering the growth of Queensland's technology sector and providing promising career opportunities for residents.

The collaboration aims to empower Queenslanders and serve as a strategic foundation for ANZ to drive ongoing innovation for its customers, ANZ said.

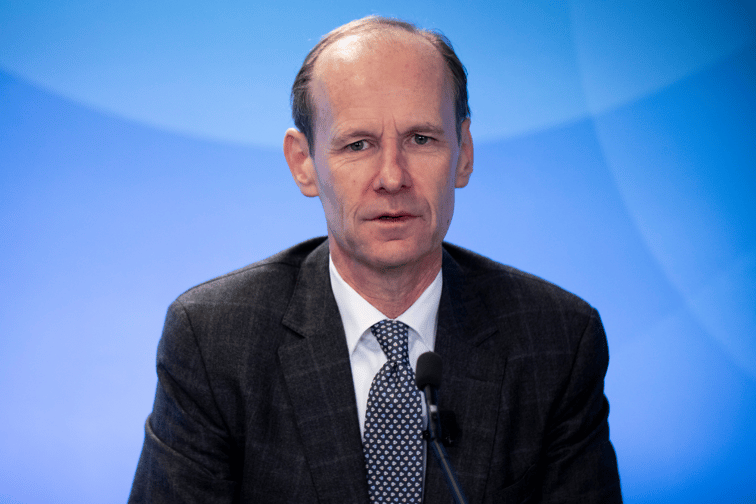

“The implementation agreement represents a significant commitment by ANZ to Queensland, and we welcome the constructive approach of the government to growing the tech sector in the state,” said ANZ CEO Shayne Elliott (pictured above).

Under the deal, ANZ has committed to hiring or placing 700 people into the tech hub over a five-year period, working with Google to deliver cloud training to tech hub employees.

ANZ has also committed to working with Queensland universities to drive research and training in technology.

“Research shows Queensland educates almost one fifth of the nation’s IT students yet has less than one seventh of the nation’s tech workers,” Elliott said. “ANZ’s tech hub will provide career opportunities to Queenslanders and will create jobs, lift wages, and boost productivity.”

“The agreement aligns with the work already underway by both the Queensland and federal governments to build the capability of Queensland’s workforce, including providing a pipeline of technology talent for the future.”

The bank’s commitments in the implementation agreement, which also include new lending commitments, are conditional on it successfully completing its $4.9 billion acquisition of Suncorp Bank.

The acquisition of Suncorp Bank is subject to conditions including authorisation by the ACCC, approval from the Federal Treasurer and Queensland legislative amendments.

Announced on July 18 last year, ANZ’s proposed acquisition of Suncorp Bank has faced many regulatory hurdles amid concerns it would lessen competition.

Earlier this month, ANZ published its response to the ACCC’s preliminary views.

“We have closely considered the ACCC’s Statement of Preliminary Views and provided the ACCC with our detailed response, including directly addressing the matters they raised,” said Elliott in a statement on June 6.

“We believe the evidence we have provided clearly demonstrates that the proposed acquisition will not substantially lessen competition and is in the public interest. Indeed, the banking sector is dynamic and competitive, and competition in the banking sector continues to increase.”

While the acquisition remains subject to regulatory conditions, ANZ said preparations for the integration of Suncorp Bank into ANZ continued, including the execution of a joint transition plan agreed with Suncorp.

ANZ expects completion of the acquisition to occur in the second half of 2023.