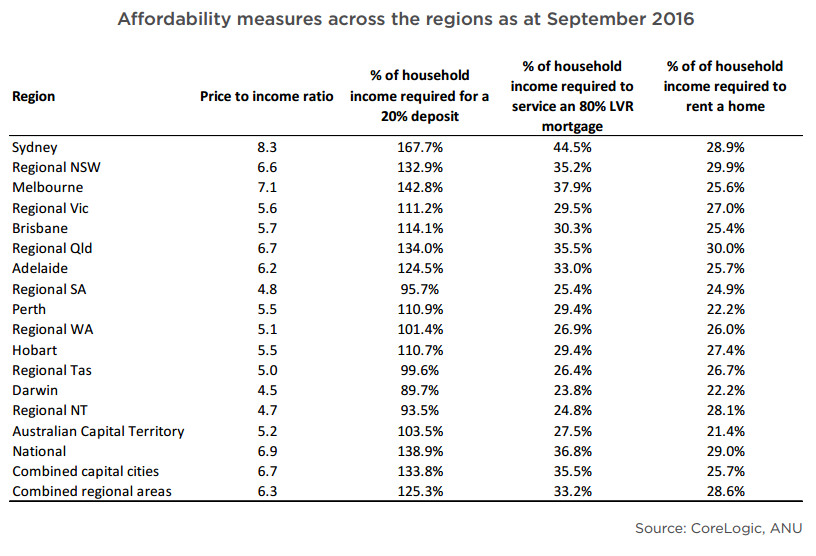

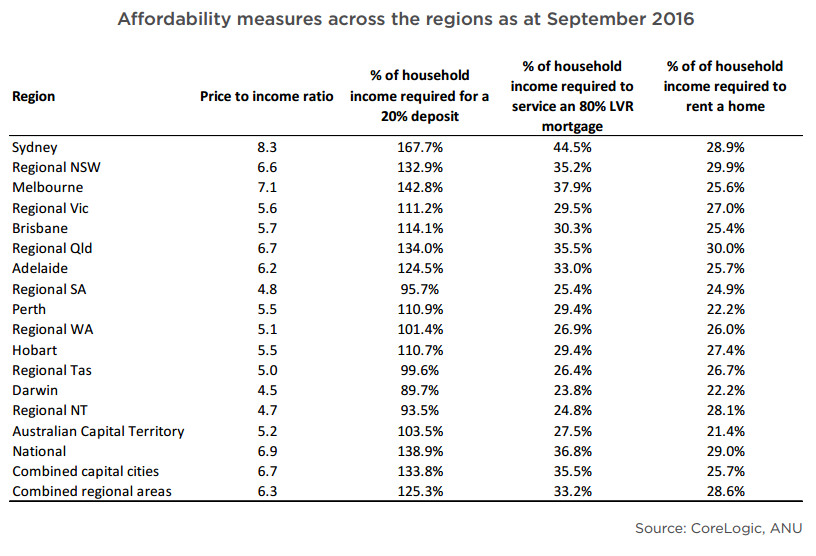

On average, Australians have to save up 138.9% of their annual household income in order to save up for a 20% deposit.

These figures come from December’s

Housing Affordability Report by

CoreLogic which examined how housing affordability is trending across the nation.

Analysing statistics up to September this year, the report found that households had to save 143.2% of their income to put a 20% deposit down on a home and 128.9% for a unit.

The price to income ratio (which compares median house, unit or dwelling prices with median annual household incomes) is also increasing, the report found.

As of September, the national ratio for dwellings was 6.9x (with 7.2x and 6.4x for houses and units respectively). This is a substantial increase from 15 years ago when the ratios were 4.3x, 4.2x and 4.8x for dwellings, houses and units respectively.

“Affordability measures which exclude the cost of debt, namely, the dwelling price to income ratio, or the proportion of household income required for a 20% deposit, are a worsening trend in housing affordability,” said

Tim Lawless, head of research at CoreLogic RP Data.

In order to service an 80% LVR mortgage, an Australian household is required to use 36.8% of its income on average. This is higher at 38.0% for houses and lower at 34.2% for units.

These figures were all higher when compared to the figures for September 2001 when a household was required to use 26.8% of its income to service the same mortgage. Broken down for houses and units, these levels equated to 26.0% and 29.8% respectively.

“Although interest rates are currently the lowest they’ve been over the past 15 years, a mortgage is consuming as much of the household income as it was in March 2004 when interest rates were 215 basis points higher,” Lawless said.

Related stories:

“Benign” property growth expected for 2017

NSW property growth expected to moderate

Affordability crisis pushing Aussies into homelessness

Related stories:

“Benign” property growth expected for 2017

NSW property growth expected to moderate

Affordability crisis pushing Aussies into homelessness