Housing affordability has increased across the country with new figures pointing to lower levels of household income being spent on home loan repayments.

The latest

Housing Affordability Report by

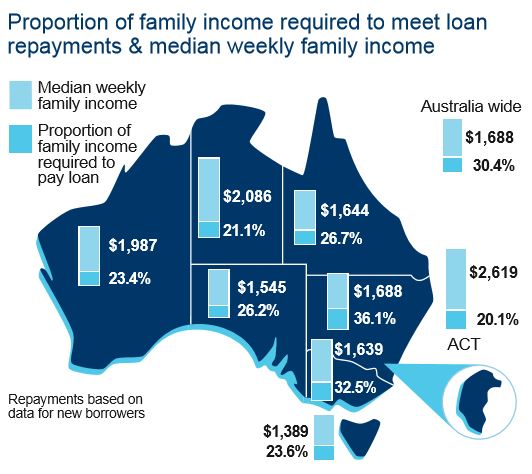

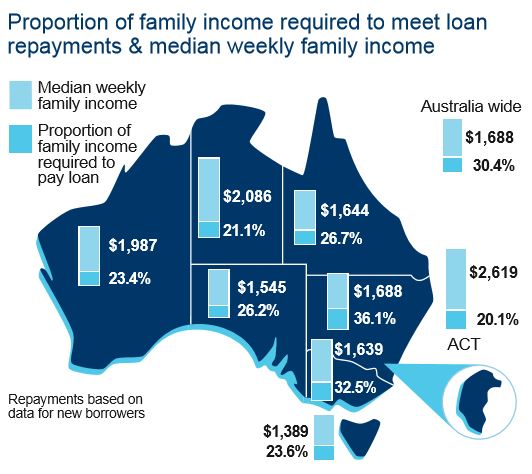

Adelaide Bank and the Real Estate Institute of Australia (REIA) showed mortgage holders were spending an average of 30.4% of their incomes paying back this debt. This was a decrease of 1.3 percentage points over the March quarter and a decrease of 1.3 percentage points in comparison with the same time period in 2016.

Housing affordability also improved across the quarter in all states and territories with individual results below:

“While the improvement in housing affordability for the March quarter is to be welcomed, we are still in the midst of a housing affordability crisis and need to treat it as such,” said Damian Percy, general manager of Adelaide Bank.

“Recent measures by governments to assist first home buyers are similarly welcomed, but the reality is that it will take years for these policy measures to wash through the system and translate into meaningful price action.”

The total number of loans (excluding refinancing) decreased by 8.2% across the March quarter to 103,193 – although this was an increase of 5.3% from the year before.

The average loan size in Australia in the first quarter this year was $372,620 which dropped by 4.3% over the quarter and rose by 2.3% compared to the previous year.

All states and territories recorded a decrease in the total loan number and average loan size during the quarter. However, only Western Australia and the Northern Territory recorded decreases in these figures compared with the same period in 2016.

Where are the FHBs?

Despite these gains, the number of first home buyers in Australia decreased by 11.2% to 20,677 during the March quarter. However, this was an increase of 1.4% from the year before.

Currently, FHBs make up 13.4% of the owner-occupier market, a figure which leaps up to 20.0% if refinancing is excluded.

“It will be interesting to see the effects that stamp duty exemptions and concessions announced in Victoria and more recently in NSW have on first home buyers,” REIA president Malcolm Gunning said.

“We anticipate that more first home buyers will be enticed to enter the market place. However, it will take time for any response to filter into our data as the changes do not come into effect until 1 July 2017 in either state.”

With the current available data, the report found the number of first home buyers went up in Victoria, Queensland, South Australia and the Northern Territory compared to a year ago.

The average loan size for FHBs decreased by 3.2% to $313,433 over the quarter and by 0.4% over the year. South Australia and Tasmania experienced growth over the March quarter while numbers in New South Wales, Victoria and South Australia rose over the year.

More work to do

Despite the uplift in affordability, Percy said that more needs to be done.

“Anything short of a national objective of, at the very least, halting house price inflation in Australia’s major population centres is underestimating the profound impact having some of the world’s most expensive houses in one of the world’s least densely populated nations means to the economic and social wellbeing of the nation.”

“For our part, Adelaide Bank strives to build strong relationships with mortgage brokers and their customers to minimise the stress and hassle – because buying a house is one of the biggest decisions people will ever make.”

Related stories:

First home buyer activity to surge in NSW

Softer housing market no confirmation of peak

How a toilet indicator can help housing affordability

.jpg)