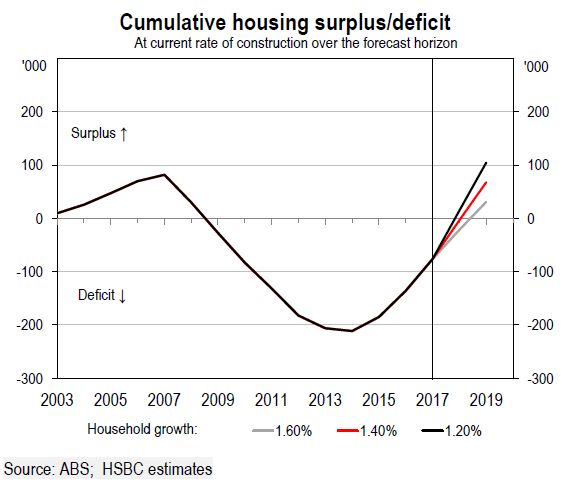

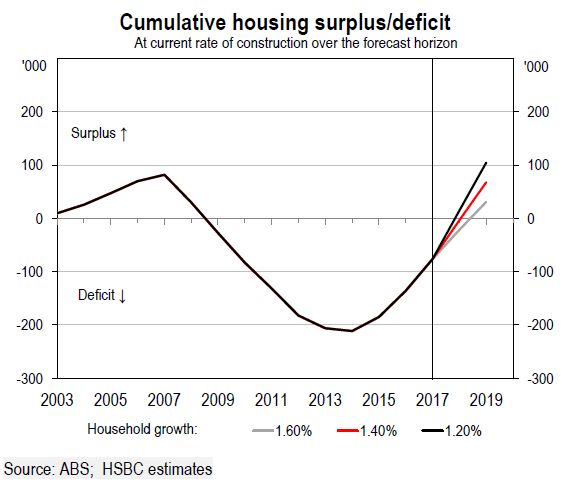

The average national level of supply/demand in the property space will eventually balance out by the end of 2017, according to new analysis by HSBC.

In the bank’s most recent

Downunder Digest, trends show that the market will reach balance after a period of deficit that has lasted since mid-2008. How quickly this can be reached can be seen in the following graph which compares the housing surplus and deficit from 2003 to 2019.

“The main message is we’ve had a long period where we’ve had an undersupply of dwellings in Australia – we haven’t built enough – and that’s what this chart clearly shows,” HSBC chief economist Paul Bloxham told

Australian Broker.

While efforts have been made to close this gap through higher levels of construction, there was still some way to go, he said.

On the positive side, without a national oversupply, this then limits the risk of a national house price decline.

Contrasts across the states

While national trends are pointing towards balance, HSBC analysis shows variations by state with different areas showing either an over or an undersupply.

Strong construction in the Sydney region has only recently matched population growth while regional NSW faced an undersupply which had yet to be matched, Bloxham said.

“In contrast, Melbourne has had stronger construction for longer, implying that the Victorian market is already close to balance.”

The markets in Queensland and Western Australia were at the other end of the spectrum with construction having outpaced population growth for quite a while.

Supply, demand & price growth

Bloxham explained that these trends explained the varying house price growth in each of the states.

“Since the national price trough in mid-2012, housing prices have risen by 69% in Sydney and are still rising at double-digit rates. In Brisbane, Adelaide and Perth, housing prices have risen by only 20%, 10% and 7% over that period, partly reflecting stronger supply relative to demand.

“The Melbourne market is a little more complicated, with detached house prices having risen by 55% over that period, but apartment prices only 19% higher.”

Related stories:

NSW property growth expected to moderate

'Two speed property market' continues

Housing a “complex picture,” says RBA