Mortgage arrears have increased by 25% in the 12 months prior to September 2016, according to global ratings agency, Standard & Poor’s.

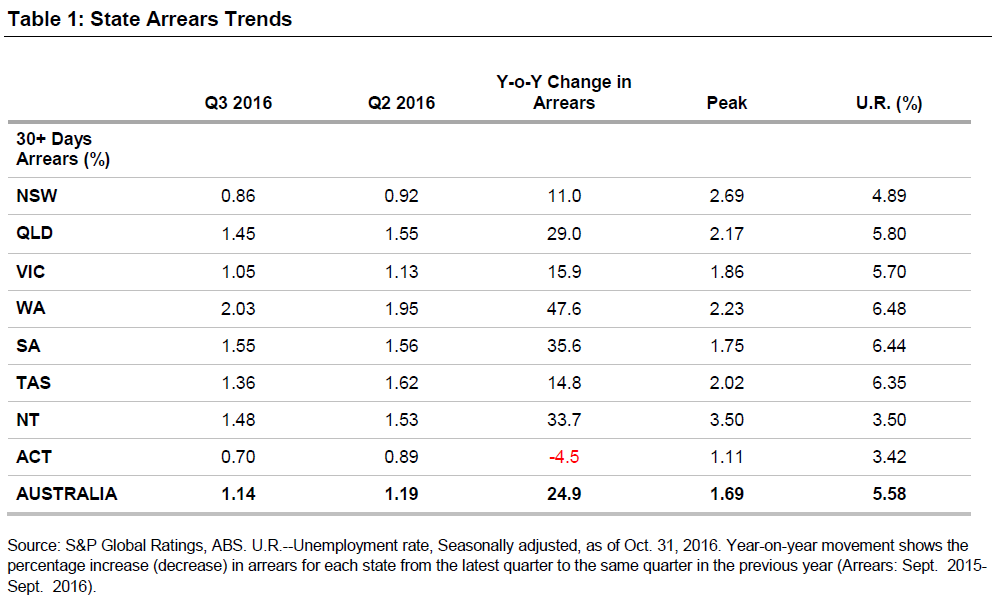

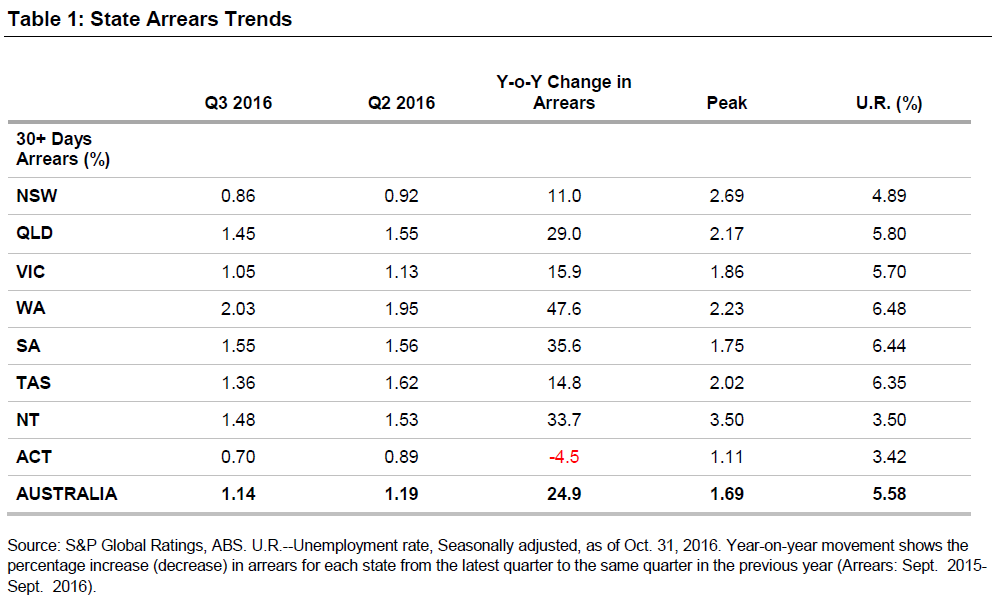

In the third quarter this year, 1.14% of all mortgages underlying Australia’s prime residential mortgage-backed securities (RMBS) were more than 30 days in arrears. Although this indicated a rise from 0.91% in the third quarter of 2015, the total percentage dropped from a peak of 1.19% in June.

Arrears at this point in the cycle have not been at this level since September 2012 when interest rates were much higher.

“While we consider arrears to be still at relatively low levels, their performance during the past 12 months suggests they have bottomed out,” the agency reported.

Looking at arrears across the states, S&P found clear differences between mining and non-mining regions.

In the third quarter of 2016, the ACT had the lowest arrears of any state or territory at 0.70% while Western Australia had the highest recorded arrears at 2.03%.

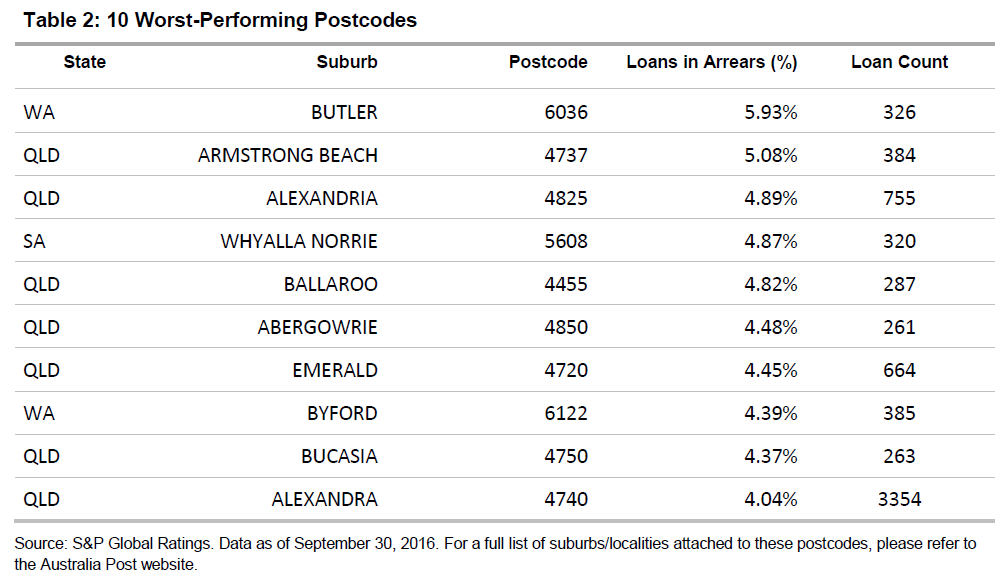

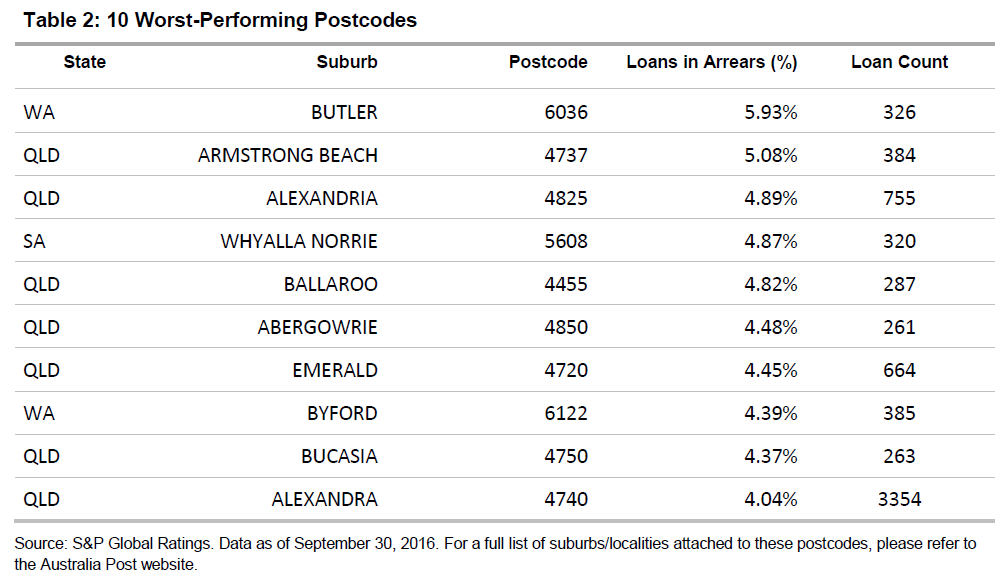

While the number of arrears fell in all states except Western Australia during the third quarter, seven of the 10 worst performing postcodes were actually in Queensland. This was an increase from the previous quarter when the state had five of worst 10 postcodes.

“This is further evidence of how the decline in the resource sector has extended to other parts of the economy in these states,” S&P reported.

Looking forward to 2017, the ratings agency expects a relatively stable arrears performance for New South Wales and Victoria while Queensland and Western Australia will continue to show a record high number of arrears.

Arrears in South Australia will increase as well due to the decline in manufacturing jobs while arrears in Tasmania will continue to remain elevated because of the state’s higher unemployment levels.

Related stories:

Home loan arrears up in regions

Major bank reports rise in loan delinquencies

Broker clients “slightly more likely to default”