In the week since the Reserve Bank of Australia (RBA) cut the country's official cash rate to a new record low, the number of lenders offering a mortgage rate under 2.0% has nearly tripled.

As of 10 November, a record 31 lenders are offering, or soon to offer, at least one home loan product with a rate below the 2.0% mark.

Effective from 19 November, 1.88% will be the lowest fixed rate on the market, made available on a two-year product from HSBC.

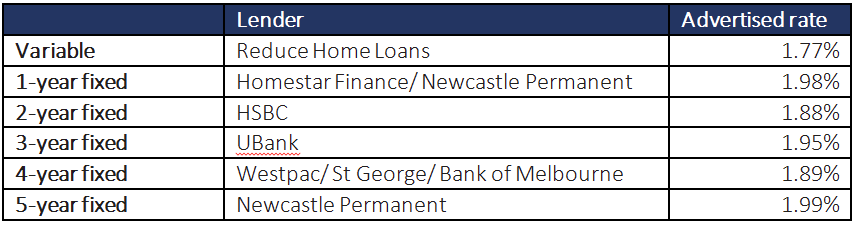

Lowest owner-occupier rates on offer as of 10 November

(Note some rates will become available later this month.)

Source: RateCity.com.au

“At the beginning of this year, no one would have predicted there would be more than 30 lenders with rates under 2.0%,” said RateCity.com.au research director Sally Tindall.

“It’s no longer just online lenders with low rates. The bigger banks are now starting to steal their thunder offering up fixed rates under 2.0%.”

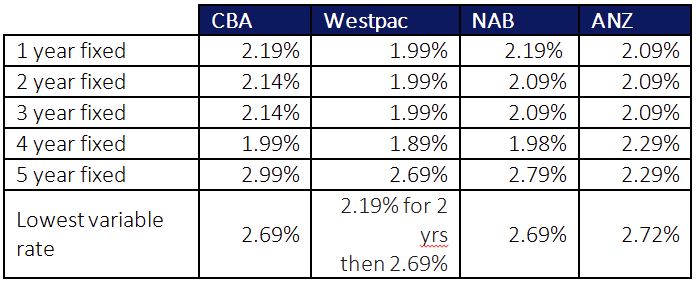

Big four banks – lowest owner-occupier rates

Source: RateCity.com.au

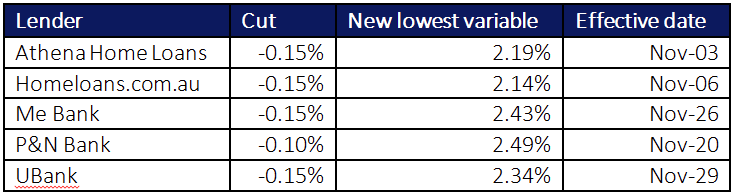

Notably, the RateCity.com.au data also showed that, of the 41 lenders who have announced rate reductions over the past week, just five passed any savings through to their existing variable customers.

Lenders passing variable rate cuts onto existing customers

Source: RateCity.com.au