New measures announced by the

Australian Prudential Regulation Authority (APRA) are credit positive for the nation’s banks, says global ratings agency Moody’s.

The limits, which were announced last Friday (31 March), constrain the flow of new interest-only mortgages by banks to 30% of total new residential lending. Banks will also be required to implement internal limits on interest-only lending volumes at LVRs of greater than 80%.

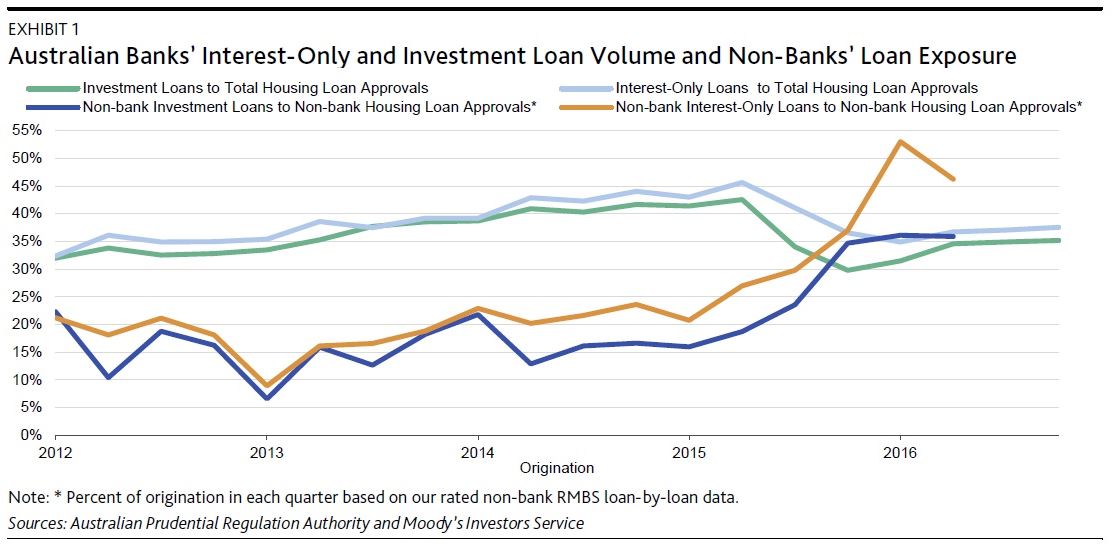

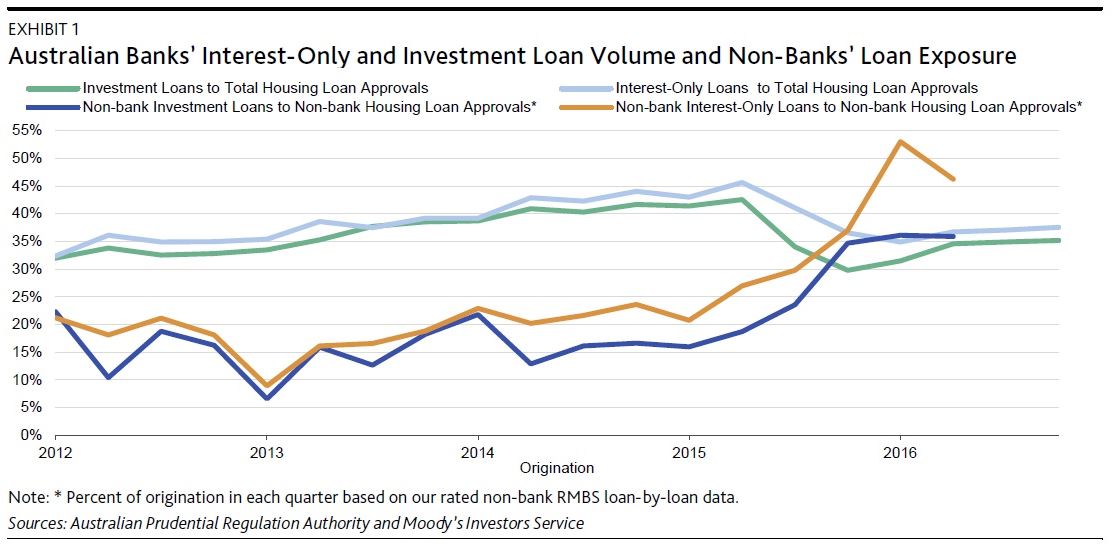

Moody’s said that interest-only lending accounted for 38% of total residential loan approvals in December 2016. This continues a monthly trend since June 2009 where over 30% of total housing loans were interest-only.

Investment loans, which are often interest-only, accounted for 35% of total housing loan approvals as of December 2016, the agency added.

Agency analysts predicted that banks further raise interest rates on interest-only loans to reduce growth in that segment and support net interest margins from increased competition.

“When APRA introduced limits on housing investment loans in December 2014, banks responded by raising interest rates on such loans.”

The additional requirement that banks remain comfortably below the previous set 10% speed limit for investment loan growth was also a shift in attitude, they wrote.

“APRA advised that banks will no longer have leeway to exceed this growth speed limit and that any breach will immediately prompt a review of the offending bank’s capital requirements. This contrasts with APRA’s original guidance, under which the 10% cap was not a hard limit.”

Moody’s also noted APRA’s announcement that it would monitor warehouse facilities that banks use to fund non-bank lenders.

“APRA does not regulate non-bank lenders, but monitoring the warehouse facilities will effectively allow the regulator to influence non-banks’ mortgage underwriting standards and promote the overall stability of the financial system.”

The amount of investment lending by the non-banks had increased since the introduction of APRA’s 10% limit, the analysts said.

While these measures added a layer of protection against a housing price correction for the banks, Moody’s said to wait and see how effective these measures actually were in moderating house price appreciation particularly in this low interest rate environment.

Related stories:

APRA to hone in on residential lending

RBA refocuses on need for strong lending standards

APRA mandates 30% limit on interest only resi lending