National Australia Bank (

NAB) has released its full year results for 2016 with the annual report containing some positive signs for the big four player.

In the year prior to September 2016, the bank recruited 379 brokers across its three aggregators (PLAN, Choice and

FAST). This is a 10% increase with the total number of brokers now at 4,299.

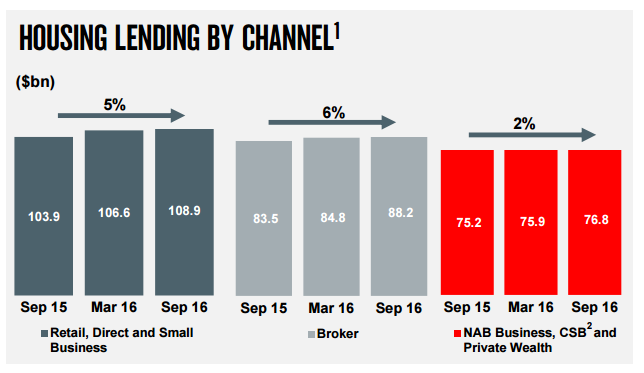

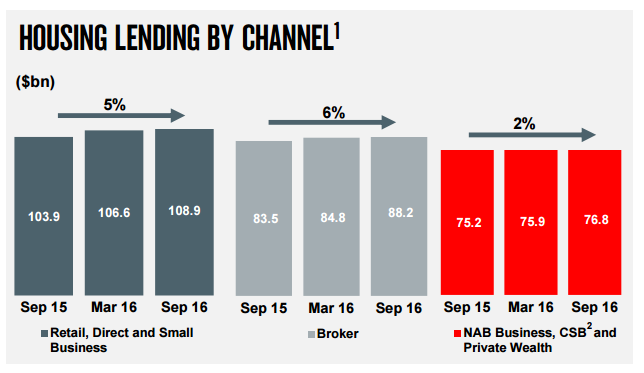

Volume of housing lending through brokers and other channels was laid out in the graph below:

House lending volumes via the broker channel increased from $83.5 billion in September 2015 to $88.5 billion in September this year. Additionally, drawdowns attributed to brokers also went up during this period, rising from 32.6% to 34.4%.

Describing its mortgage lending practices, NAB said all brokers were subject to licencing and accreditation requirements. The bank also monitored its brokers through triggers such as delinquency requirements. Finally, all broker applications are assessed centrally through verification and credit decisioning.

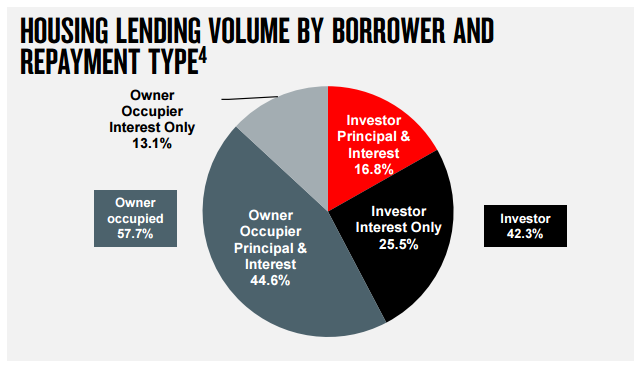

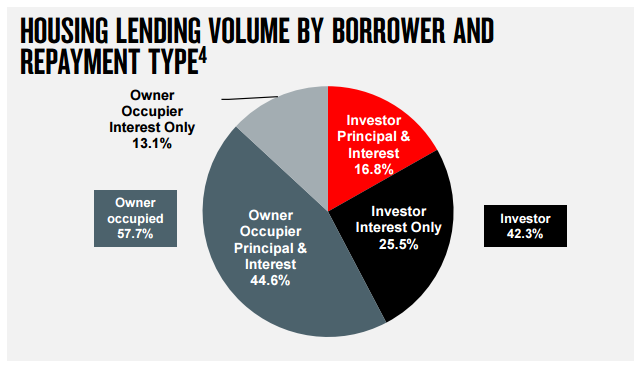

Looking at the NAB loan book, 77.5% of balances were variable rates, 13.2% fixed rates and 9.3% lines of credit as of September 2016. Of these loans, 31.9% were interest only, 57.7% were owner-occupied and 42.3% were for investment.

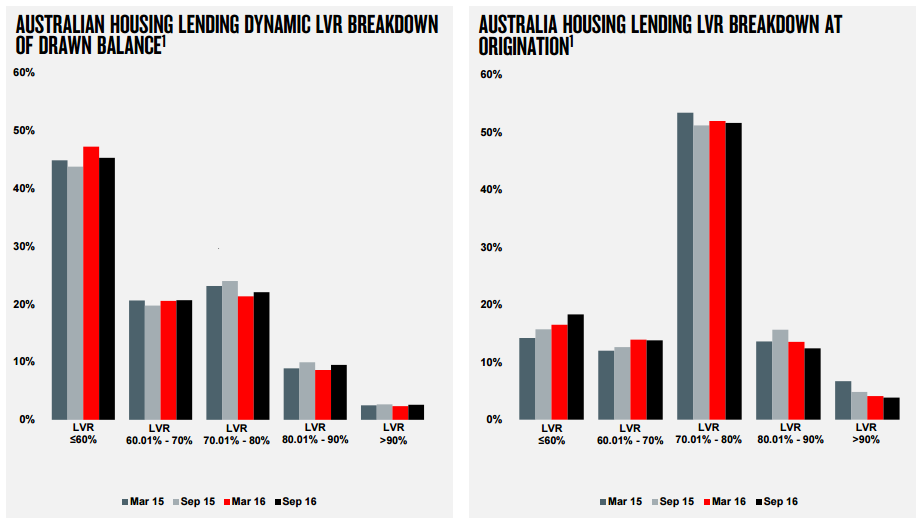

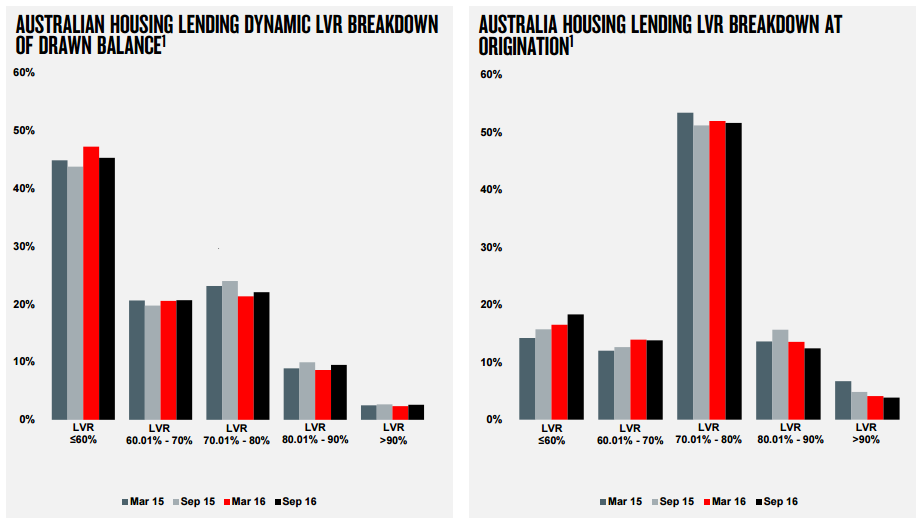

Breaking down the LVR into suitable bands, the profile for NAB is as follows:

Related stories:

National Australia Bank “paranoid” about future banking scandals

Broker market share underestimated: National Australia Bank

National Australia Bank launches overhauled broker offering

Related stories:

National Australia Bank “paranoid” about future banking scandals

Broker market share underestimated: National Australia Bank

National Australia Bank launches overhauled broker offering