In his first speech as governor of the Reserve Bank of Australia (

RBA),

Philip Lowe has commented on how managing household debt can work as a buffer against future economic shocks.

Although lower household debt means people can draw more on their savings in difficult economic times, failure to properly tackle this issue has led to significant effects worldwide, Lowe said on Tuesday (15 November).

“In the United States when the recession hit in 2008 some households found that they had simply borrowed too much. What followed was a period of defaults by some, less new borrowing and faster repayment of some debt. The result was a more severe downturn and a more protracted recovery than otherwise would have occurred.”

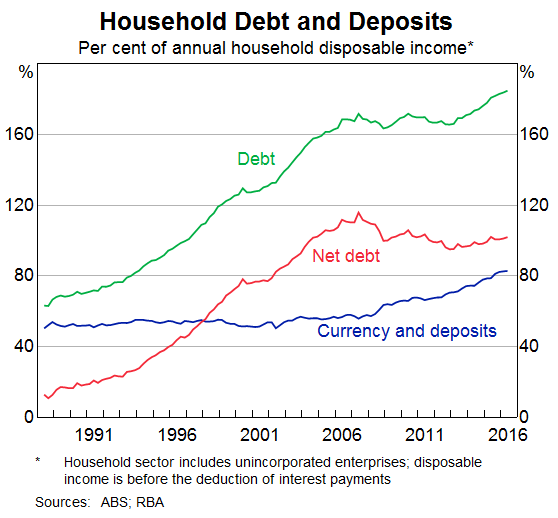

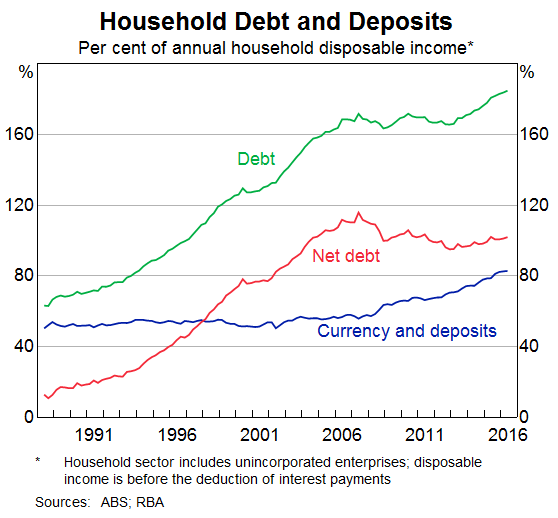

Presently, household debt is equivalent to 185% of annual household disposable income, he said, which is a record high and a dramatic increase from around 70% in the early 1990s.

“If we net off the household sector's holdings of cash and deposits the pattern looks somewhat different. It is important, though, to recognise that the households with the debt typically are not the same ones with the large deposits,” he added.

Reasons for this increased household debt include lower nominal interest rates which allow people to borrow more, Lowe said. While most households are managing these higher levels of debt, some feel they are a lot closer to their borrowing capacity than ever before and have adjusted how they behave as a result.

“Since the financial crisis, there has been a noticeable increase in the household saving rate. We are not using our houses like ATMs in the way that we were in the decade to the mid-2000s. Gone are the days when higher housing prices were a sign that we should go to the bank and borrow more to spend.”

This more prudent behaviour can be seen in the higher numbers of borrowers putting money into mortgage offset accounts or redraw facilities, he said. Balances in these accounts are equivalent to 17% of the total volume of outstanding home loans which is a buffer of two and a half years of scheduled repayments at current interest rate levels.

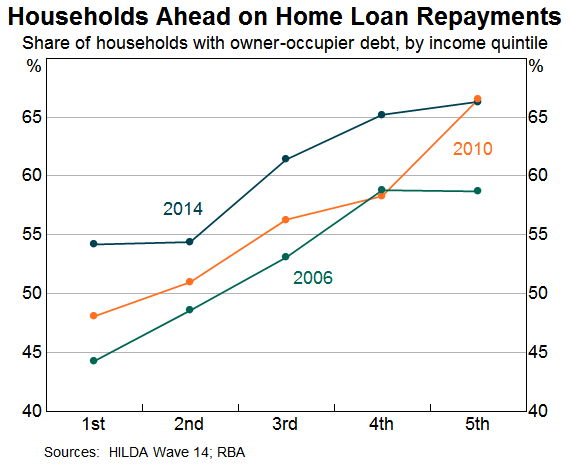

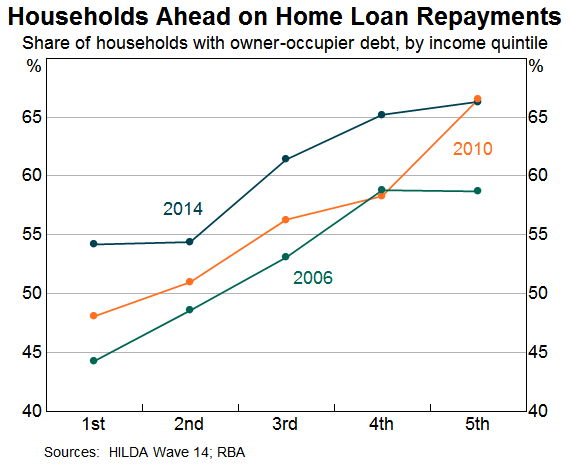

Additionally, Lowe noted that the number of Australians who are ahead with their mortgages has also increased over the past few years.

While this change in behaviour is a positive development, it is still important to keep an eye on debt levels as they are still quite high, he added.

“We can never know with certainty exactly what level of debt is sustainable. It depends on income growth, lending standards and asset prices. But it surely must be the case that the higher is the debt, the greater is the risk,” Lowe said.

Related stories:

Rising house prices mean more debt, less work: Report

Aussie households predicting debt trouble doubles

Calls for 'drastic' change as rental affordability deteriorates